How Cannabis Industry Participants Would Benefit if 280E is Rolled Back

April 28, 2018Canadian Consumer Behavior

May 6, 2018

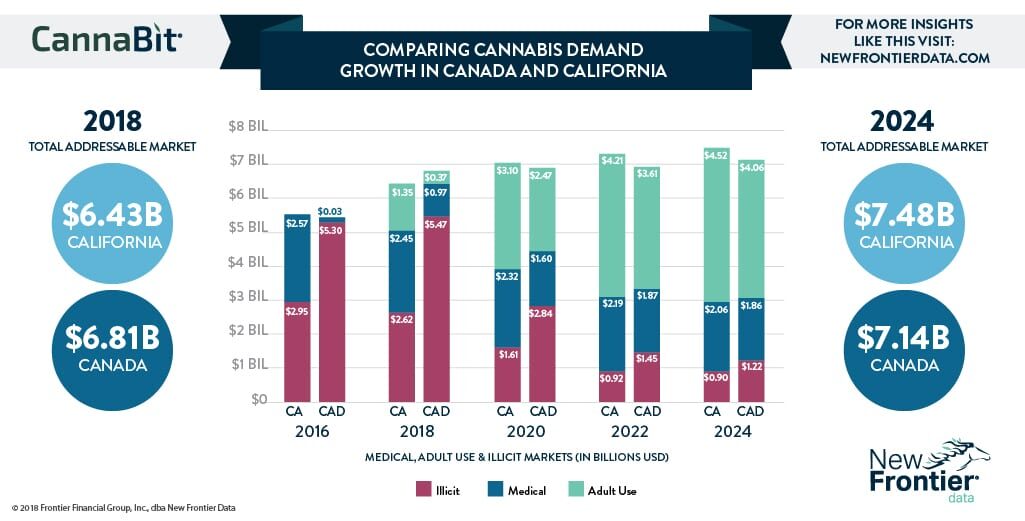

- Total cannabis demand in legal markets is expected to grow year over year through 2025, with sales through legal medical and adult use channels quickly cannibalizing the share of the illicit market.

- While in 2017 the illicit markets topped at an estimated $3.29 billion in California and $5.76 billion in Canada, strong growth of legal sales will respectively reduce the illicit market to an estimated $2.62 billion (-20.4%) and $5.47 billion (-5.0%) in 2018, and $1.96 billion (-25.2%) and $3.84 billion (-29.8%) in 2019.

- Meanwhile, the medical cannabis markets were worth $2.52 billion in California and $470 million in Canada in 2017. While activation of adult-use sales will lead to a contraction of medical demand in California to $2.45 billion (-$2.8%), strong continued growth is expected in Canada, where medical sales will increase to $970 million (+106%).

- Legal adult-use markets are expected to open this year at $1.35 billion in California and $370 million in Canada, and respectively expand to $2.51 billion (+85.9%) and $1.68 billion (+354%) in 2019.

- Overall, the total cannabis markets worth $4.63 billion in California and $4.13 billion in Canada during 2014 were then respectively worth $5.81 billion (+25.5%) and $6.23 billion (+50.8%) in 2017, and a projected $6.86 billion (+18.1%) and $6.88 billion (+10.4%) 2019.