The SAFE Banking Act Would Be a Giant Leap for Legal Cannabis

By Maier N. Rosenberg, CohnReznick

The Secure and Fair Enforcement (SAFE) Banking Act, which, in March, passed the U.S. House Committee on Financial Services by a significant bipartisan margin, represents a promising step forward for banks and cannabis companies that want to take sales out of the cash-based market and into the mainstream. Although the ultimate passage of the bill remains uncertain, it’s vital for business owners to educate themselves so they can seize the chance to put the cannabis industry on firmer financial and legal ground.

What would the SAFE Banking Act do?

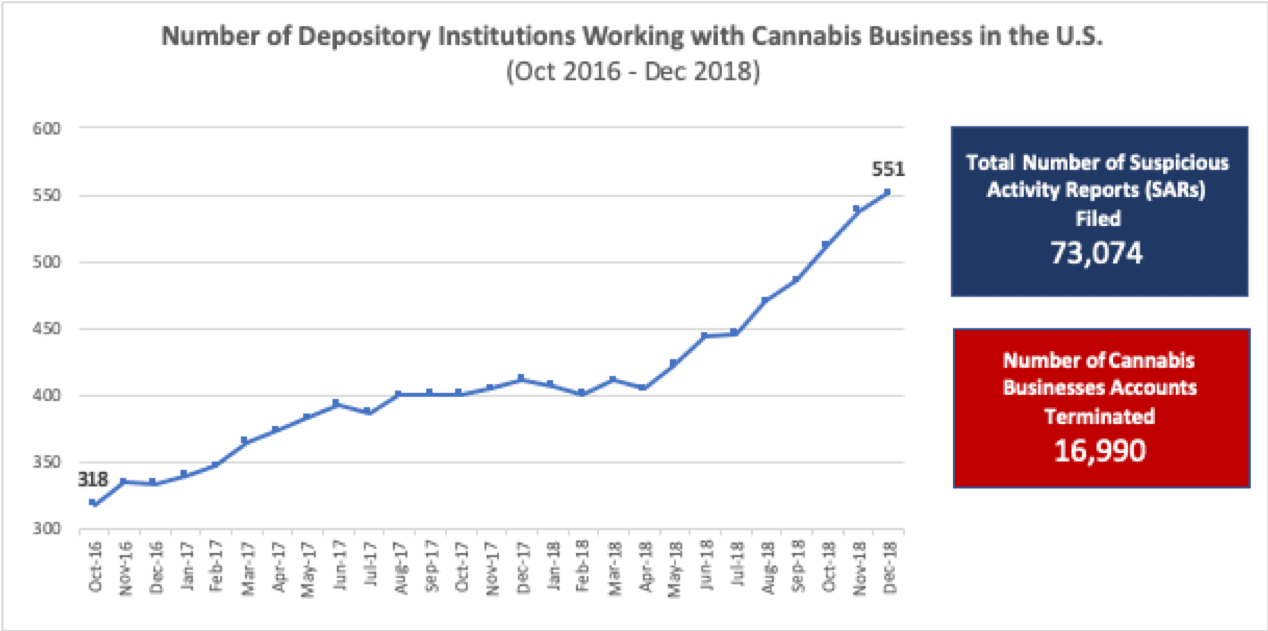

The SAFE Banking Act is designed to shield banks and credit unions that work with cannabis companies from legal penalties. Specifically, it would bar federal regulators from terminating a bank’s FDIC deposit insurance, a threat that has thus far prevented most banks from accepting cannabis business.

With the bill’s passage, it’s likely that more banks would open their doors to cannabis businesses. In turn, cannabis business owners would be able to open checking accounts and credit cards, and otherwise operate as normal businesses. Banks could even provide other services, such as payroll, creating a much-needed layer of accountability, transparency, and stability within the industry.

However, these changes wouldn’t happen overnight. Before accepting cannabis accounts, banks would need to meet certain compliance and reporting requirements, a process that could take several months.

How would legal banking change the cannabis industry?

If the SAFE Banking Act is passed, it would likely drive down the costs of cannabis financial services. Currently, the few credit unions that handle cannabis accounts charge significant premiums to compensate for the elevated risk and compliance costs these accounts represent. With increased competition from banks, premiums will inevitably decrease, reducing financial pressure on cannabis companies.

A second consideration is public safety. Today, most growers, dispensaries, and related companies are forced to do all their business in cash, putting them at risk on various levels. Giving businesses access to basic banking tools could reduce the costs of securing and transporting large amounts of cash.

Aside from the safety risk, the current cash-based system makes it more difficult for cannabis businesses to keep accurate, verifiable financial records. Establishing bank accounts will create more accountability, putting small businesses on the right track of recording and reporting their financial transactions.

One thing the SAFE Banking Act is unlikely to improve is access to loans. Cannabis companies still won’t have federal bankruptcy protection, and their product will remain a Schedule I narcotic. We’ll likely see a continuation of today’s environment, where private debt funds will lend against cannabis companies’ property (usually real estate and equipment) but not their inventory or other assets.

Will the SAFE Banking Act actually pass?

While most observers are confident the SAFE Banking Act will pass in the House of Representatives, its fate in the Senate is less certain. However, there is reason to be optimistic. The Safe Banking Act has 152 cosponsors, 12 of whom are Republicans – putting it far ahead of past attempts.

How can cannabis companies prepare?

Even if the SAFE Banking Act is never signed into law, it’s a harbinger of inevitable reforms. Cannabis professionals should start asking their local banks if they plan to take on cannabis accounts. Even if the law does pass, the acceptance process will still be arduous. Cannabis companies will likely need to answer more than a thousand questions throughout a process that could take one to two months. It’s crucial for companies to prepare relevant information ahead of time, so they’re first in line when the floodgates open.

For more information, contact CohnReznick.com.

This content has been prepared for informational purposes, is general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without first obtaining professional advice specific to, among other things, your individual facts, circumstances, and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick LLP, its partners, employees, and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.