Identifying the Relative Value of a Cultivator License, By State

Cannabis Jobs and Revenue Potential for Native Americans

August 30, 2018

DEA Plant Eradication Decline, as Processed Cannabis Seizures Hit a Record High

September 9, 2018By Beau Whitney, Senior Economist for New Frontier Data

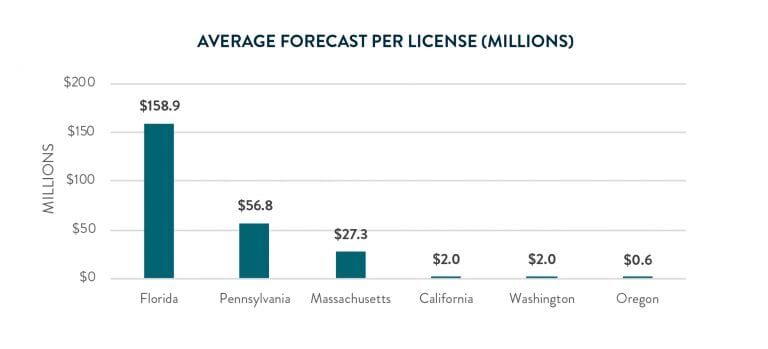

With investors seeking data about how to ascertain the value of a license, or at least identify and contrast opportunities, New Frontier Data recently compared the respective Total Addressable Market (TAM) in each of six states to the number of licenses they have respectively proposed or issued. The differences can be exponentially stark.

In states where licenses are restricted, there is more TAM per license than in states where licenses are unlimited. While on the surface that makes sense, the analysis reveals some striking gaps in the existing delta between those states.

Using Florida, for example: With its limited cultivation licenses (14 total), the Sunshine State has one license for every $159 million worth of total market forecast; meanwhile Oregon, with more than 2,000 licenses either issued or in the queue, has issued one license per every $563 thousand in total forecast (or roughly 1/282 the net value by comparison).

Such analysis creates more questions than it answers, but the data demonstrates the range of advantages and opportunities associated within limited-license markets. To borrow from the real estate industry, much depends on location, location, location.

Beau Whitney

Beau Whitney is the Senior Economist for New Frontier Data. Whitney has a unique blend of high tech business operations skills, economics and pollical analysis, as well as cannabis industry experiences.

While at Intel and TriQuint Semiconductor, Whitney honed his business operations skills associated with quickly ramping products from low volume to high volume. This is a skill he has since transferred to the cannabis industry. He is the former chief operations officer and compliance officer of one of the largest vertically integrated, publicly traded cannabis company in North America. His experiences incorporated growing, extraction, edible manufacturing and wholesale and retail distribution operations.

As an economic and policy analyst, his Whitney Economics white papers analyzing the cannabis market have been referenced in Forbes Magazine, USA Today, as well as in cannabis industry publications and across the Associated Press wire. Whitney has provided policy recommendations at the state and national levels and is considered an authority on cannabis economics.