2019 U.S. Cannabis Outlook

January 8, 2019CBD, Still A Restricted Substance

January 22, 2019

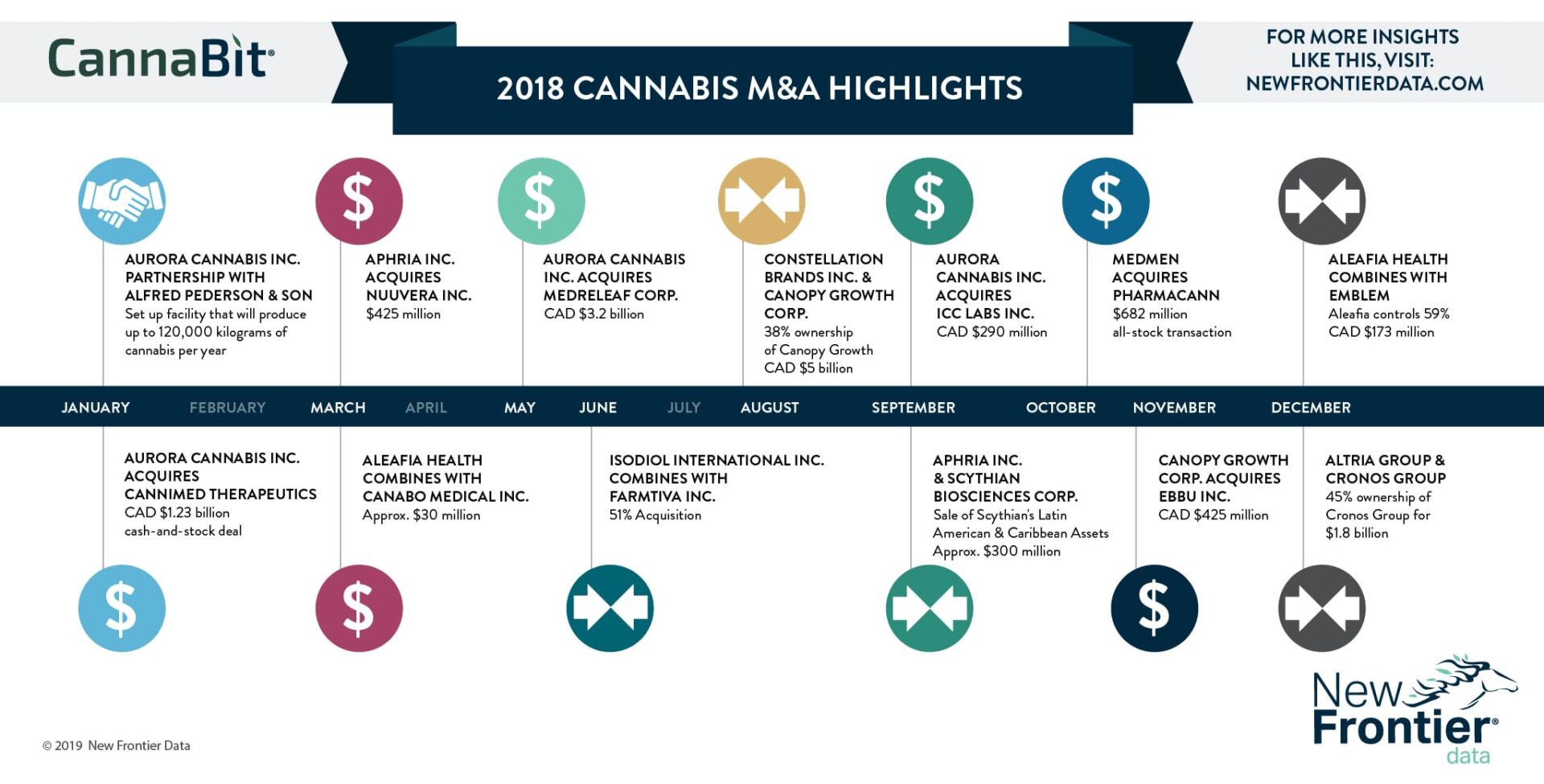

- The North American cannabis sector established market legitimacy in 2018 with word of outside interests like Constellation Brands (maker of beer, wine, and spirits) investing heavily in the space.

- Likewise, a USD $1.8 billion buy-in by Altria group (owner of Marlboro) for a 45% stake in cannabinoid company, Cronos Group, marked bullish involvement by a Big Tobacco company with cannabis.

- Constellation Brands increased its original 9.9% stake in producer Canopy Growth Corp., to 38% for CAD $5 billion

- Aurora Cannabis’ acquisitions of CanniMed Therapeutics (for CAD $1.23 billion) and MedReleaf Corp. (CAD $3.2 billion), respectively, were two more of the year’s largest deals.

- Among the 11 largest transactions highlighted in Canada or the U.S., the average cost of investment was USD $1.0 billion.

- As competition increases for market share and cannabis production heats up to meet domestic and international market demands, investors can expect more major M&A activity in 2019.