2020 Vision: Reviewing Major Trends for Legal Cannabis

Cannabis in 2020

December 14, 2020

Shaking the Crystal Ball for the Legal Cannabis Industry in 2021

January 11, 2021By New Frontier Data staff

For the legal cannabis industry, 2020 marks an inflection point to presage the breakout of the global market and economy. The number of international, national, and state-level developments that advanced the liberalization of cannabis policies made it a truly historic year. To recap, New Frontier Data analysts have identified the most significant developments leading into 2021.

Landmark Legislation and Policy Initiatives

After years of delay, the United Nations (UN) in December voted to reschedule cannabis from the list of the world’s most dangerous drugs. It was the most significant change to the body’s cannabis policy in 60 years. The vote followed medical cannabis legalization in Lebanon, Ghana, Rwanda, and Malawi – countries which highlighted the pace of international acceptance of cannabis.

Meantime, Europe’s hemp and CBD industry faced an existential threat following the proposal by the European Commission (EC) to regulate CBD as a narcotic, a move which likely would have collapsed the continent’s plant-based CBD environment. However, the EC’s high court rejected the proposed reclassification, confirming that CBD is not a narcotic, and eliminating the most consequential threat faced by any emerging cannabinoid market to date.

Across North America’s legal markets, the COVID-19 pandemic not only fueled record-shattering demand (with retail sales rising as much as 35% above forecast), but in the U.S. it led to cannabis businesses being declared “essential” in virtually every legal market. With most of the brick-and-mortar retail economy shuttered, cannabis businesses were among the few continuing to operate. The essential designation also highlighted the sharp contrast between the importance states put on the industry, and the federal government’s punitive cannabis laws.

The 2020 election laid the foundation for historic U.S. cannabis policy reform, with the election of Democratic President-Elect Joe Biden who committed to descheduling cannabis during the campaign. While the timing of federal changes remains uncertain, expansion among states continued apace. Of the six ballot initiatives passed in 2020, the approval of adult use measures in New Jersey and South Dakota could prove most consequential – with the former kicking off a legalization race on the east coast (with New York, Connecticut, Pennsylvania, and Virginia all committing to follow suit) and the latter becoming the most historically conservative state to approve an adult use measure, and the first state ever to do so without first approving medical use.

Any one of these developments may have been noteworthy, but taken together, they affirm the broad momentum building toward liberalization of cannabis policies globally. And while the outcome of developments may take time to fully materialize, 2020 will be remembered as the year that changed the arc of the cannabis industry’s trajectory. — by John Kagia, Chief Knowledge Officer

Oklahoma’s Open Medical Market Offers Surprises

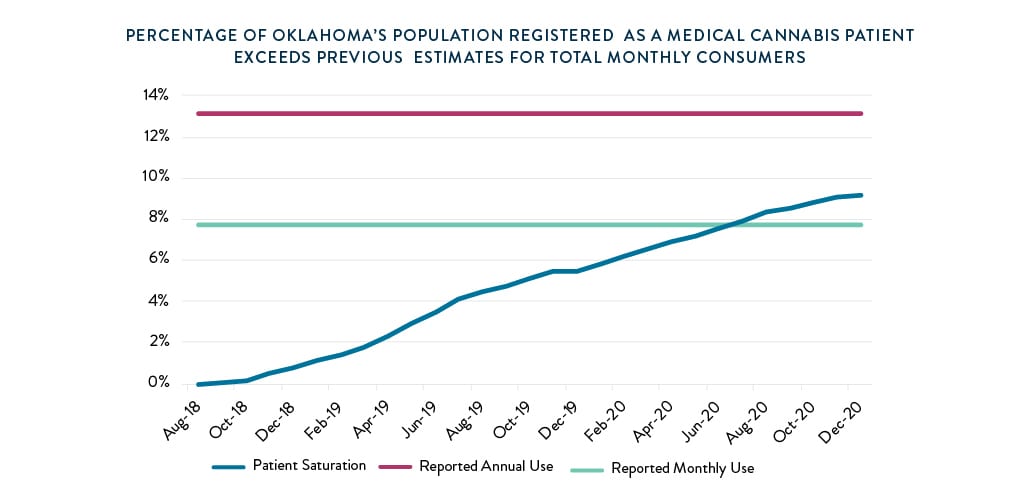

Oklahoma’s medical cannabis market features the highest patient saturation of any state in the U.S., with more than 9% of residents registered (as of Dec. 7). That rate is more than 2x that of all other state medical cannabis markets, and was achieved in but two years of program operation. Oklahoma has more licensed cannabis retailers per resident than any other state (including those with both active medical and adult-use markets); the state’s surging number of cannabis business licenses is a function both of its having no statewide cap, and charging a relatively low licensing fee.

Conversely, Oklahomans’ sky-high patient participation is encouraged through lax regulations: The Sooner State does not require qualifying conditions for medical recommendations, which effectively permits any board-certified physician in good standing to recommend cannabis to a patient for any reason according to “accepted standards a reasonable and prudent physician would follow when recommending or approving any medication.” Given the broad range of conditions for which cannabis has reportedly been therapeutic, and the profusion of licensed retailers providing product access, unprecedented participation rates nearly match the state’s total cannabis consumer population. In fact, the number of Oklahoma’s patients had already exceeded its estimated heavy cannabis consumers (i.e., cannabis consumers using it at least once monthly).

Across the U.S., legal adult-use state markets currently stand as the most open among legalized cannabis markets, allowing access for all adults, residents, or tourists. But participation rates cannot be tracked across resident populations in those markets, since it is total sales (not consumers themselves), which are tracked. However, medical markets provide those data points through patient registration requirements: Oklahoma’s open-access medical market provides a unique case for testing the true consumer population; in fact, the level of participation seen casts uncertainty on estimations (based on survey-reported usage rates) for the total U.S. cannabis consumer population overall.

Oklahoma illustrates complications which often arise from measuring cannabis use though self-reported surveys (e.g., SAMHSA’s National Survey on Drug Use and Health), which characteristically under-report. With survey-reported, past-month usage rates at 7.8%, Oklahoma had the nation’s 8th-lowest reported rate of cannabis use, half that of nearly a dozen states (e.g., Vermont, Oregon, Maine, Colorado, etc.). Given rapid expansion of national public acceptance toward cannabis (with a dramatic rise in aggregate usage rates nationwide), low reported numbers in Oklahoma and other historically, deeply conservative states raise questions of possible self-censoring (i.e., artificial suppression of reported usage rates), and underestimations of existing cannabis consumer populations in the U.S., and projections going forward. — by Kacey Morrissey, Senior Director of Industry Analytics

Edibles Become Consumers’ New Favorite Products

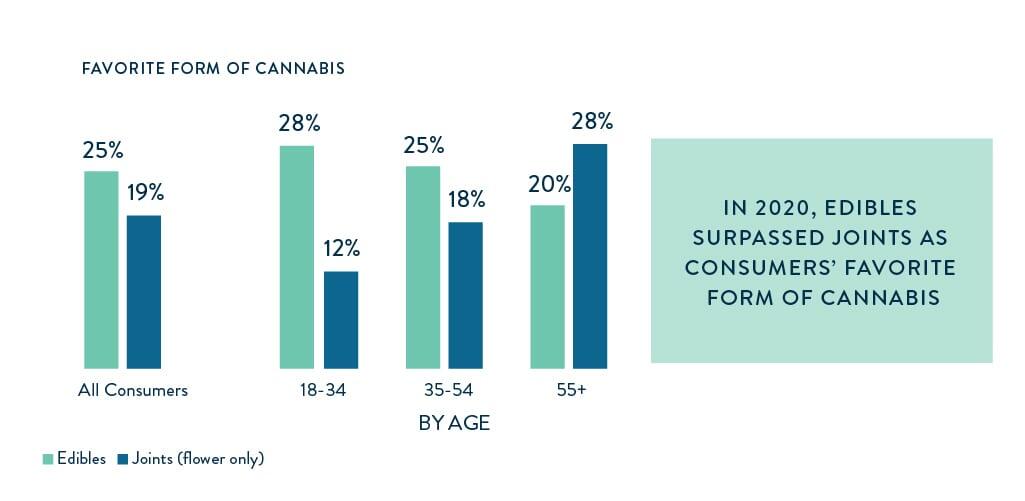

In 2020 (for the first time), more consumers named edibles instead of classic, flower-only joints as their preferred form of cannabis, marking a milestone in the product landscape and heralding rapid diversification of product forms and formulations.

Source: New Frontier Data

Throughout modern history, joints had been the uncontested, dominant mode of cannabis consumption. But as noted in New Frontier Data’s 2020-2021 Cannabis Consumer Survey, 2020 marked the first time among total cannabis users that edibles (25%) were preferred over classic, flower-only joints (19%).

Joints remain what consumers report using most frequently (21%), though edibles (18%) have tightened the margin among consumers’ most frequently used forms. Flower—which —is still consumers’ favorite when considering all its forms combined (including joints, blunts, pipes, bongs, and spliffs), though by only a slight majority—53%, down from 68% of consumers in New Frontier Data’s 2018-2019 survey.

Edibles’ 2020 leap to prominence promises to trigger a rapid diversification of product forms and formulations, driven by a symbiotic relationship between increasingly discerning and sophisticated consumers and innovative brands’ product technology and market segmentation.

Consumers—particularly younger ones—will continue to embrace increasingly nuanced preferences for specific formulations and concentrations of cannabinoids, terpenes, and other non-cannabis ingredients. They will keep tailoring their use of various forms and formulations to specific contexts: 71% of regular cannabis purchasers who use multiple forms say they choose different forms for different situations, i.e., to engage in different activities, create different moods, at different times of day, in different locations, or in the company of different people.

That degree of intentionality is only possible with a mature product market. With the mainstreaming of cannabis (e.g., expansion of legal markets, lessened stigma, influx of investment capital), manufacturers will produce ever-wider varieties of high-quality products to meet rapidly emerging consumer niches. Innovations in technology will allow for increasingly stable and reliable formulations, resulting in more consistent user experiences and thereby increasing consumer confidence. Brands will continue to pinpoint their target audiences and the nuances of their use cases and preferences. — Dr. Molly McCann, Ed.D., Director of Industry Analytics

Mainstream Social Acceptance

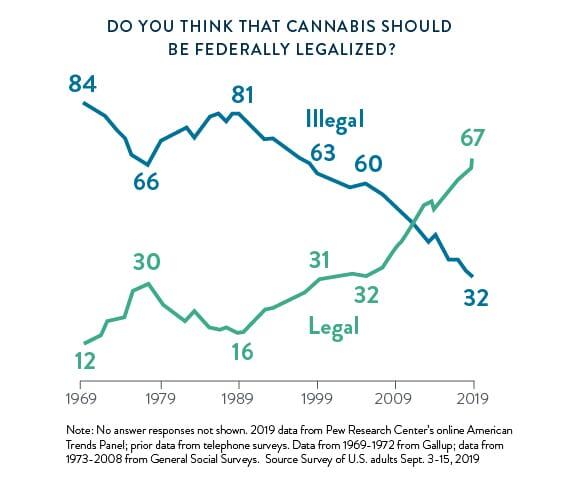

In 2019, Pew Research found that 67% of Americans supported legalizing cannabis, which had been a majority position since 2013, when public support (52%) for the first time broke above even in the U.S. Nevertheless, national legalization has meanwhile been incremental. Amid the tumult of 2020, much of America has reshaped how it thinks about cannabis.

By March, stay-at-home orders designed to combat the spread of COVID-19 led to a nationwide avalanche of business closures and job losses. Almost immediately, states began officially declaring cannabis businesses as “essential”, allowing them to remain open throughout the pandemic. In so doing, states tacitly endorsed cannabis businesses’ value in providing jobs and tax revenue beyond the services provided to consumers within their communities.

Throughout the summer, protests against George Floyd’s murder, other instances of police brutality, and racial inequality broke out nationwide. Against the backdrop of an ongoing pandemic, protests quickly expanded, with disparate enforcement of cannabis laws and disproportionate arrests in communities of color seen among broader social justice issues. Whether within the industry, or in examining practices within law enforcement writ large, cannabis become intricately woven throughout the summer into the fabric of social justice and equity.

Before year’s end, the November election provided more historic developments for the industry. With five states voting about six separate measures, Election Day provided a clean sweep for legal cannabis. In all those states (including conservative stalwarts Mississippi and South Dakota), the social and political momentum are set to continue expanding the nation’s regulated cannabis marketplaces. — Josh Adams, Ph.D., Senior Industry Analyst

Booming Business

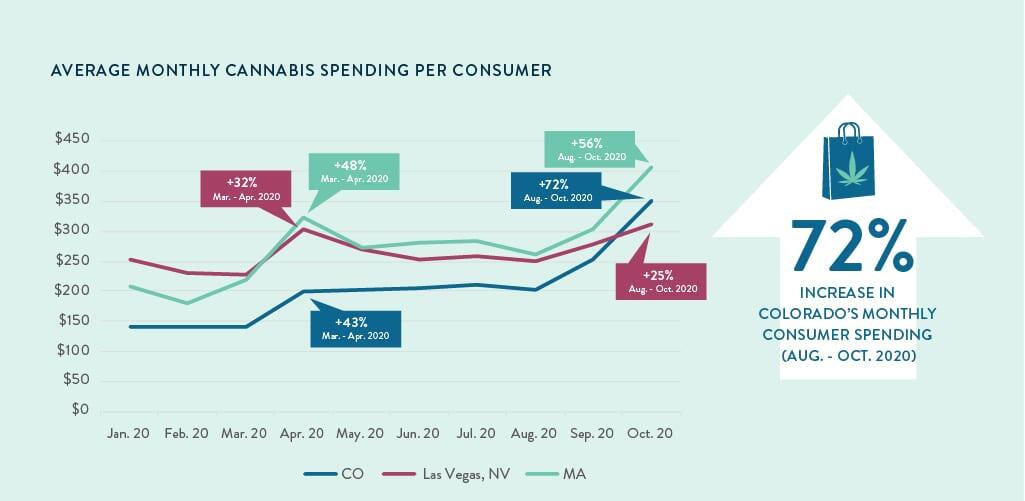

As states began imposing lockdown measures in early March, consumers took to stockpiling cannabis. While most states with legal markets declared legal cannabis as essential business, concerns about supply chain disruptions and potential business closures compelled consumers to purchase larger quantities of cannabis. In Colorado after Gov. Polis announced that dispensaries were a critical retail industry, they subsequently saw a 43% spike in average monthly customer spending from March to April 2020.

In the same period, Massachusetts (where only medical cannabis was declared essential) reported 48% sales growth. Its Commonwealth Dispensary Association (CSA)—disappointed by Gov. Baker’s decision—was quick to point out that the adult-use cannabis industry was a significant boon to the state, having generated $120 million in revenue and created more than 8,000 jobs since sales began in 2018. Once recreational sales were allowed to resume, Massachusetts joined other states in expanding dispensaries’ reach by allowing for curb-side pickup and delivery.

The expansion represented a significant shift in how the average consumer could acquire their therapeutic or recreational products, and the newfound legitimacy extended to policy changes. In California (the nation’s largest cannabis market), Governor Gavin Newsom signed a series of bills aiming to provide relief for the state’s legal cannabis businesses. Several of the measures aimed to reduce the financial burden facing the industry, including freezing state cannabis cultivation and excise taxes for 2021, and removing state penalties against banks that work with cannabis clients. Bills addressing finance and taxation at the federal level have passed through the House. While the fate of those bills is uncertain, the genie is essentially out of the bottle for legitimization of legalization. — Noah Tomares, Research Analyst