Shaking the Crystal Ball for the Legal Cannabis Industry in 2021

2020 Vision: Reviewing Major Trends for Legal Cannabis

December 14, 2020

Legal Cannabis and the Three State Governors

January 19, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

As happy as people were to see it end, 2020 proved to be the most consequential year yet for the North American legal cannabis industry. Most significant was the foundation established for an aggressive period of growth poised to continue throughout 2021 and beyond.

Despite massive socioeconomic disruptions caused by the COVID-19 pandemic, a variety of dynamics compelled more cannabis consumers to rely on legal sources. State governments coping with various levels of shutdowns were led to deem activity in the legal cannabis industry as essential business whether for providing to medical or adult-use markets, and such operations continue to allow it as exception to general state and local shutdown orders.

In the United States’ fall elections, though the Democratic Party’s touted “blue wave” failed to gain full swell, the Democrats did win the presidency and managed to pull out an overtime upset to gain a razor-thin Senate majority for the first time in a decade. Vice President-elect Kamala Harris – the Senate’s chief sponsor of the MORE Act – has pledged “no incrementalism” in decriminalizing the plant. Though President-elect Joe Biden’s putative nominee for U.S. attorney general, Merrick Garland, once sided in court with the DEA regarding cannabis, industry advocates appreciated that he gave great weight to the scientific evidence presented. They praised Garland his respect for science as positive for the industry. Five years ago, Jeffrey M. Zucker, president of the Denver-based Green Lion Partners, told Vice.com that “Garland appears to be a safe choice from the cannabis industry perspective. Although he hasn’t been a champion of the issue, it’s good to know that he has an open mind to listen to the scientists that actually understand how the plant’s chemical compounds interact with the human body.”

Thus, the Democratic Party’s securing control of the White House and both chambers of Congress increases the likelihood of historic reform to U.S. federal cannabis laws within the next two years. While descheduling or decriminalizing cannabis may not be a Year 1 priority for the Biden administration, there would seem a significant imperative to get it done before the 2022 midterm Congressional elections, especially since a new Gallup poll found that 68% of Americans—including half of Republicans—support the full legalization of marijuana, the highest support ever recorded.

On the state level, each Arizona, Montana, New Jersey and South Dakota passed adult-use measures (with South Dakota simultaneously voting in a medical program). New Jersey’s adult-use measure is fueling a new urgency to adopt a program in New York, Pennsylvania, Connecticut, and Virginia, creating new long-term opportunities along the entire Eastern seaboard. Traditionally conservative Oklahoma now features the country’s biggest medical cannabis market on a per capita basis, as nearly 10% percent of its population have acquired patient cards since 2018.

As John Kagia, New Frontier Data’s chief knowledge officer, explains, “the positive market signals in the aftermath look to support a strong influx of capital investment into the cannabis sector, and provide catalysts for increased merger and acquisition activity over the next 12 months. Investors are looking at profitability and stable balance sheets. In turn, impacts from accelerating consolidation should fuel a further rise of strategically positioned multistate operators and increase confidence and public market activity. With the likelihood for federal reform and continued state market growth, the industry is expected to see its best year for new capital investment in the space since 2017, with investors bullish on both domestic and international growth opportunities. Investments in multistate operators, and into companies with strong differential or competitive advantages, will make it more challenging for smaller, undifferentiated companies to compete.”

Strong consumer demand stimulated by COVID-19 will expectedly endure well into 2021, as the social and economic disruptions caused by the pandemic will likely continue through much of the year. Business disruptions caused by the pandemic have forced brands to urgently focus on technology. Online ordering and curbside pick-up have resulted in consumers’ spending far less time in dispensaries, eliminating interaction with budtenders who have historically played a critical role both in educating consumers and shaping their purchase decisions. Losing that key touchpoint has created new challenges for brands to engage directly with consumers (especially since they are unable to use conventional social channels), if meanwhile fostering opportunities to leverage novel technologies to identify and engage consumers. Among specific trends to anticipate:

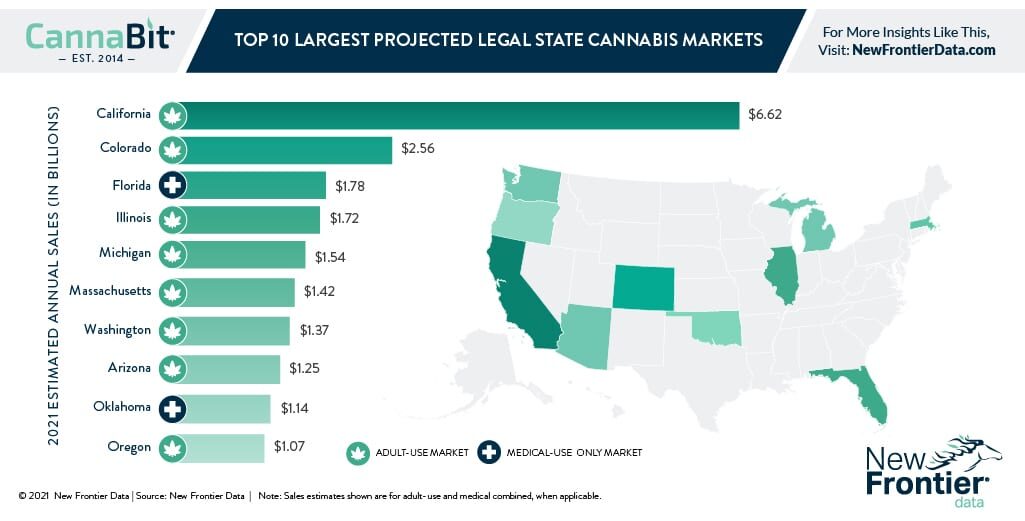

Increases in average consumption and levels of spending per capita levels (fueled by disruptions caused by COVID-19), along with the expansion of key adult-use markets will fuel total legal cannabis sales to $25.9 billion for calendar year 2021. California, Colorado, Florida, and Illinois, respectively, are projected to lead the industry as the four largest legal state markets.

Further diversification of product forms as manufacturers get more sophisticated and as consumers get more discerning.

Similar to California’s requiring health warning labels on all cannabis products sold in the state, an emphasis on standardization should continue to evolve.

In the race for competitive positioning, New Frontier Data expects a renewed focus on acquiring (and protecting) IP, with the recent suit by Canopy Growth against GW Pharmaceuticals over CBD processing techniques being a telling example of the coming patent race.

Though cannabis-oriented legislation will not be an initial priority for the new Biden administration (given ongoing issues of the pandemic, economic relief, and continuing civil unrest continuing to take precedence), an evolving national debate on cannabis prohibition enforcement should include analysis of disparities in policing and civil asset forfeiture, with discussion about federal action on cannabis. The method of federal action, specifically the means and degree by which cannabis is decriminalized, will be of great consequence to the existing industry and its operators.

Meanwhile, as votes on cannabis-related legislation transition from symbolic gestures to practical governance, the politics surrounding legislation will become more complicated. The industry can similarly expect more vigorous lobbying from interested parties both within the industry and from other interested actors, whether in support or opposition to federal liberalization. While the prospects for cannabis appear bright in 2021, the industry should continue to expect a tumultuous year.