Key Global Cannabis Use Trends – 2019 Mid-Year Review

Potential Zimbabwe Healthcare Savings

June 23, 2019

U.S. Cannabis Usage

June 30, 2019By John Kagia, Chief Knowledge Officer, New Frontier Data

New Frontier Data’s latest growth forecast for the legal cannabis industry is the most robust and comprehensively developed outlook that our research has produced. By leveraging accumulated intelligence collected over five years, the model accounts for significant differences emerging across legal markets, rapidly evolving consumer behavior, preferences now reshaping legal demand, and unique local market forces that are either accelerating or constraining growth.

Ahead of the new forecast slated for release next month, it seems useful to explore some of the foundational inputs for the model, and to examine how trends detected in the data are impacting the broader market.

One of the key inputs for the modeling is the Substance Abuse & Mental Health Administration (SAMSHA)’s National Survey on Drug Use and Health (NSDUH), the government’s largest drug-use study. The NSDUH covers illicit drugs, alcohol and tobacco use, prescription drug abuse, and mental health issues — providing rich insights to trends in cannabis use at the national and state levels, along with the interplay between cannabis and other oft-used substances.

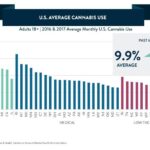

Two important observations from the NSDUH as tracked across a decade include:

States with the highest rates of use have been the most progressive in advancing legalization: The trend is clear: Historically, markets, where cannabis use is highest, are the earliest adopters of cannabis reform. However, in the U.S. and internationally, as medical cannabis has become more entrenched and support for legalization has risen, usage rates have become less reliable legalization predictors, in part due to local complexities and political, social, and cultural factors which all shape government actions. This local variance is an increasingly important consideration as investors and business owners pursue opportunities in increasingly diverse international markets.

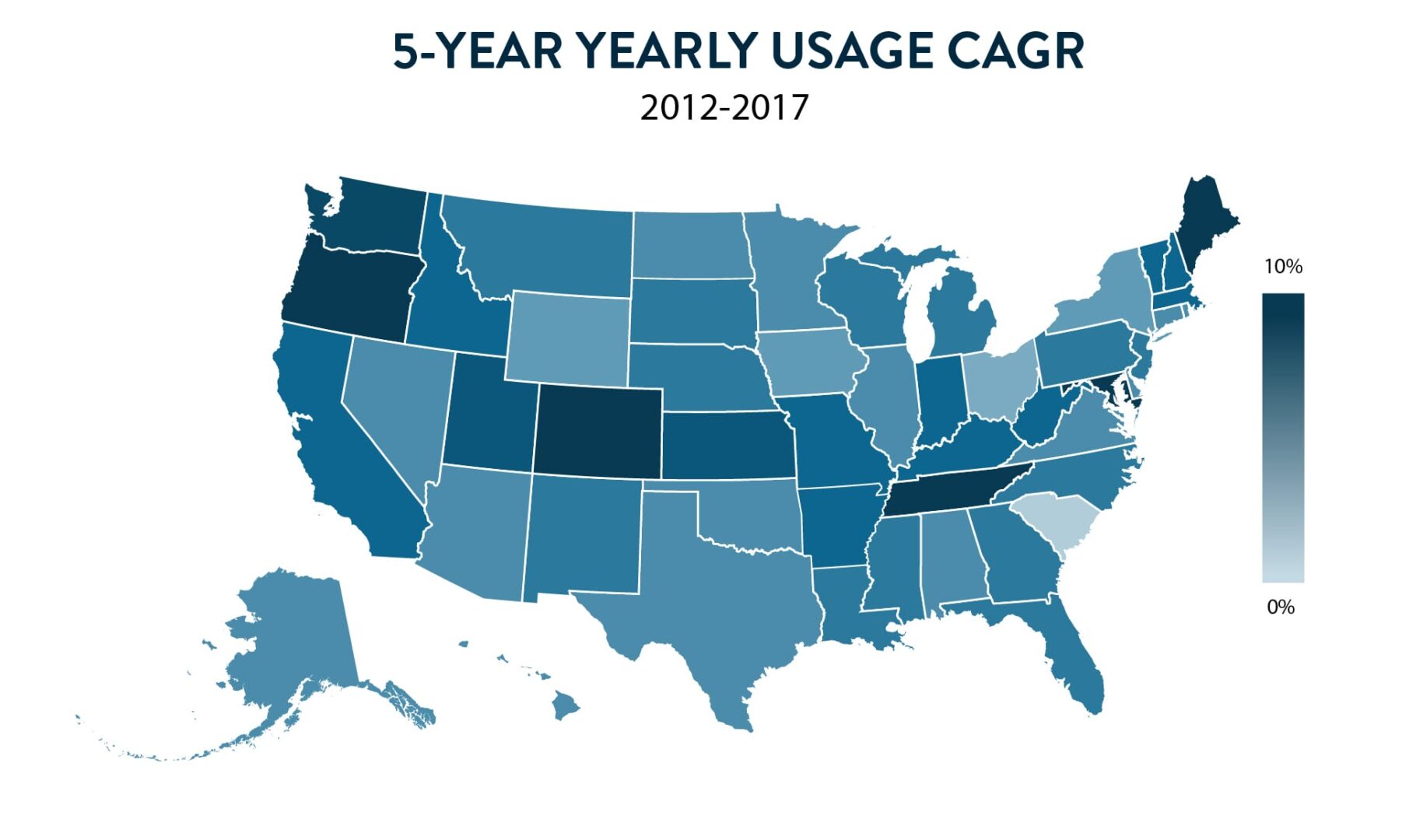

Usage is rising at vastly different rates within states: Nationally, usage rates grew at a compound annual growth rate (CAGR) of 6% between 2012 and 2017, though the rate of change varied widely across states. Markets seeing the highest growth, including Maine (14% CAGR), Maryland (14%), and Kansas (12%) saw double-digit increases while Hawaii (2%), Iowa (2%), and South Carolina (-1%) respectively saw the lowest changes in use. Such differences in statewide consumption influence each total addressable market (i.e., the number of consumers in each state), and could offer new insights about how public perceptions and social acceptance at the state level are influencing adoption, usage, and growth trends in legal markets.

Usage rate data also hint at important trends with implications for both domestic and international markets which are exploring legalization:

Normalization of Cannabis Attitudes is Leading to Higher Use.

Nationally, self-reported regular cannabis use (i.e., at least once in the past month) has risen 50% in eight years, from 6.6% in 2009 to 9.9% in 2017. In two decades since California legalized medical cannabis, nearly all Americans now live in states which have adopted some degree of cannabis law reform, driven by a combination of increasingly universal support for medical cannabis, acute concerns about inequities in prohibition enforcement, and the appeal of economic opportunities created by legal cannabis. As the stigma surrounding cannabis has eroded, and the risk of prosecution has decreased, both former and new consumers become increasingly comfortable with cannabis, resulting in higher use even among low-frequency consumers.

Affirmation of cannabis’ medical properties is attracting a new segment of consumers.

Among leading health agencies including each the World Health Organization, National Institutes of Health, and U.S. National Academies of Science, the medical potential for cannabis has been increasingly confirmed. While much research remains to be done regarding conditions and dosages for cannabis’ medicinal efficacy, and which ingestion methods may yield optimal outcomes, a growing number of medical patients (many of whom are new to cannabis) are integrating cannabis into treatments. Globally, the endorsement of the scientific community will accelerate medical cannabis adoption by allaying concerns in socially conservative nations, while providing a scientific basis for legalization among data-driven nations.

Acceptance of cannabis-appropriate social situations increases consumption opportunities for infrequent consumers.

New product forms affording discretion and convenience promote cannabis consumption in places where smoking flower products would be inappropriate or disruptive. Thus, infrequent consumers are increasingly encountering cannabis products in social situations, i.e., dinner parties or backyard barbecues. While such infrequent consumers may not be motivated to patronize dispensaries to purchase cannabis, they are more broadly partaking in socially appropriate situations. Trends toward increased social exposure will expectedly continue as novel products expand the social ranges for experiences, and cultural acceptance widens.

Taken collectively, national use rates will continue to increase. Conversely, the country’s current patchwork model of cannabis laws will drive continued variability in individual state usage trends.

Rising U.S. rates of cannabis use were mirrored in New Frontier Data’s global analysis of cannabis demand, as reported in the Global Cannabis Report: 2019 Industry Outlook. Consequently, even as cannabis data collection enhances understanding of the U.S. market, it also offers valuable insight for expectations regarding emerging international markets and their maturation.