An Update on Canada’s Legal Cannabis Industry

No Slacking: How Cannabis Consumers Are Pursuing Health and Wellness

October 18, 2021

New Frontier Data to Acquire the Medical Cannabis Businesses of Skylight Health Group Inc.

October 29, 2021By Noah Tomares, Research Analyst, New Frontier Data

With this month occasioning the third anniversary of Canada’s nationwide legalization of adult-use cannabis, the Great White North in many ways maintains the mantle among global cannabis markets. As the first G-7 nation to fully legalize cannabis (five years after Uruguay became the world’s first country to do so, the Canadian cannabis industry has illustrated both the potential profits and practical pitfalls in developing an international cannabis marketplace.

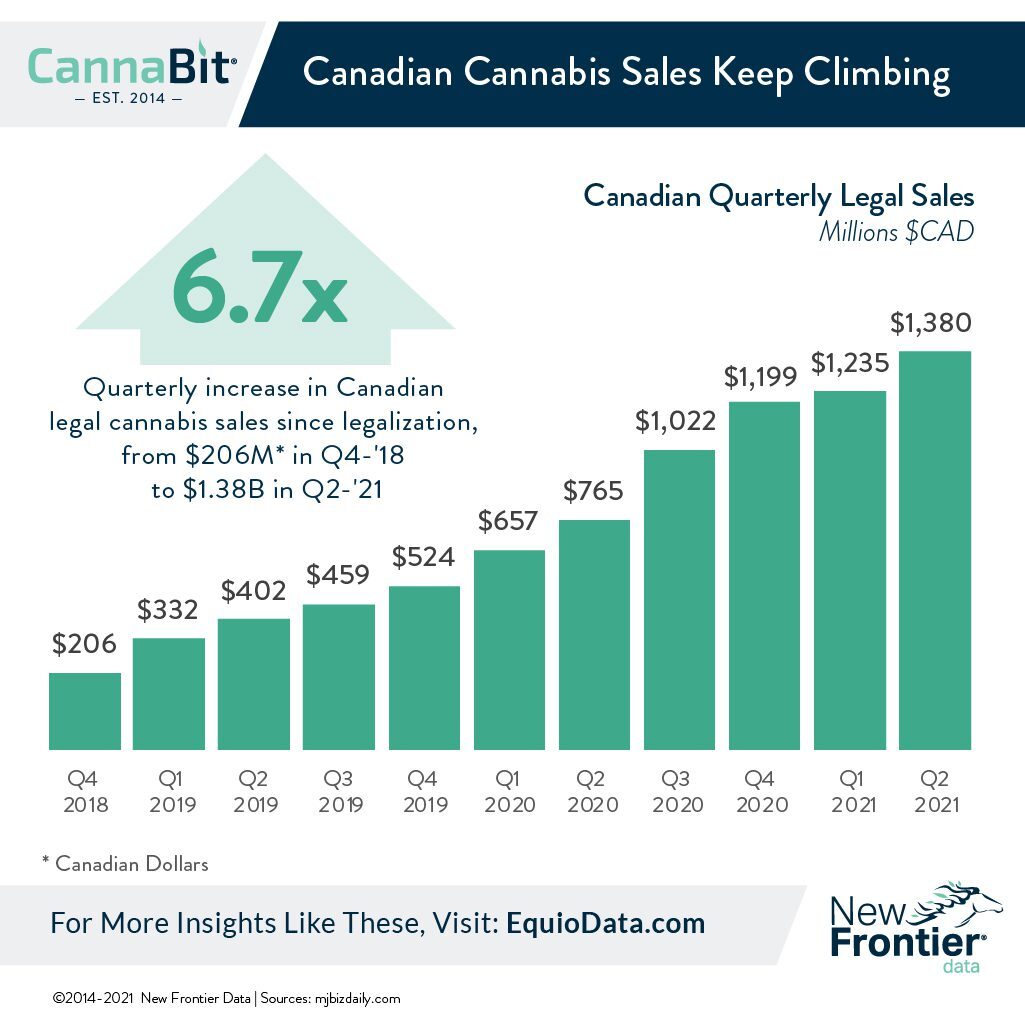

Since legal sales began in October 2018, legal cannabis sales have steadily risen. More than CAD $1.3 billion of cannabis products were sold in Q2-2021 for non-medical use, marking nearly 12% growth from the previous quarter. New Frontier Data projects that by 2025, that number will grow to $5.2 billion.

Sales growth has been supported by the introduction of edible and topical products in late 2019. While dried flower still dominates the market, accounting for a reported 73% of spending in all categories in Q2-’21, that margin is shrinking.

Comparatively, in more mature cannabis markets like Colorado’s, the share of flower has fallen to 50% of sales while value-added products (e.g., vapes and edibles, in particular), have become widely available to drive strong consumer interest.

Prevalence of cannabis use has also increased. According to a Statistics Canada national survey, as of Q4-’20 a reported 20% of those ages 15 and older had consumed cannabis in the previous three months. Preceding legalization (i.e., Q1-’18), the reported rate was 14%.

Canadian licensed producers (LPs) have agreements to export to more than 20 countries. The agreements represent a significant head start compared to other nations eager to engage in the global cannabis market.

However, rapid expansion and over–estimation of international markets’ readiness to absorb imported cannabis products have resulted in bloated inventories. At the end of 2020, inventories of federal license-holders, provincial wholesalers, and retailers were left holding approximately 1,141,092 kilograms of dried cannabis.

Some major Canadian producers have been forced to scale back, shuttering cultivation facilities and paring back production volumes until the market stabilizes. In June, Canopy Growth sold its GMP medical cannabis cultivation and manufacturing facility in Demark to Little Green Pharma, Ltd. More recently, Aurora announced that it will be shutting down its Edmonton facility, laying off approximately 8% of its staff.

Such anecdotes are hardly indicative of organizations cooling on international cannabis; rather, they represent a pivot towards short-term profitability. According to New Frontier Data’s new Global Cannabis Report, 96.8% of high-THC legal cannabis sales in 2020 were had in North America. The United States alone accounted for $20.3 billion (86%) of the $23.7 billion legal market.

Canopy Growth Corp. recently paid $297.5 million to acquire Wana Brands, which currently sells its gummies throughout 12 states. Tilray, also eyeing expansion into the United States, acquired convertible bonds issued by MedMen Enterprises, a Los Angeles-based cannabis retailer, in a deal to allow Tilray’s taking a 21% ownership interest. For both producers, action is contingent on federal legalization of cannabis in the United States.

New Frontier Data projects that global legal sales will grow to an estimated $51 billion by 2025. For those eager to secure their respective slices of the legal cannabis sector, Canada yet serves both as an established market capable of monumental growth, and as a cautionary tale about assuming that a first-mover advantage will protect aspiring producers from unpredictable politics and overly ambitious sales projections.