A New Year and Gathering Momentum Offer Expanding Legal Markets

One More Time: New York Governor Makes Third Try to Adopt Adult-Use Cannabis

January 25, 2021

Proficiency Testing Is Key to the Health of the Legal Cannabis Industry

February 8, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

At the start of 2020, prior to the wave of disruptions from the COVID-19 pandemic, there were about 15 states drawing focus on New Frontier Data’s radar for potential legalization in 2020. The pandemic and subsequent shutdowns derailed the timelines and process for most of them, though the 2020 elections nevertheless yielded five new states voting to adopt legalized medical or adult-use cannabis – New Jersey, Arizona, Montana, South Dakota (respectively backing adult-use measures), and Mississippi (approving a medical program). Those states falling short of the ballot last year are now regaining momentum in 2021 – with a few new ones making notable developments. Now, an estimated 75.5 million Americans are living in states that may yet legalize medical or adult-use cannabis (or, in Texas’ case, significantly expand its medical cannabis program) this year. If all the states advancing medical legalization measures pass, they would raise to 86% the amount of the U.S. population respectively residing in a state having legal access to high-THC legal cannabis in some form. Under that scenario, the exaggerated disconnect with federal policy is likely to add additional pressure on the Biden administration for federal action on cannabis reform.

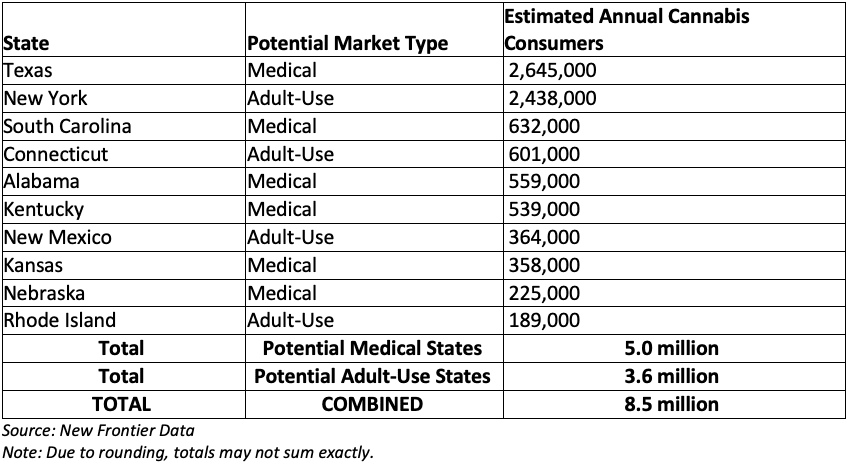

The geographic locations of states expected in the near term to legalize medical cannabis reflect some changing tides of public opinions about cannabis in the South (with Mississippi’s passage offering the most recent evidence)). Each among Alabama, Kansas, Kentucky, Nebraska, and South Carolina are entertaining motions to continue efforts toward medical legalization this calendar year. Additionally, Texas could expand its fledging medical cannabis program to create a more fully functioning market by loosening current restrictions on products, patient eligibility, and THC caps. Right now, those six states are home to an estimated 5 million cannabis consumers without access to legal cannabis.

Following New Jersey voters’ mandate for an adult-use market, there has been mounting pressure among its neighbors in the Northeast to likewise enact adult-use reforms, nowhere with more demographic and cultural significance than in nearby New York. Along with the population and prestige of the Empire State and its Big Apple, Connecticut and Rhode Island could also join the ranks of U.S. states with legalized adult-use cannabis, and collectively kick-start a period of enormous growth in such markets along the Eastern Seaboard. While the Northeast region has already demonstrated willingness among its political leaders to work cooperatively across state lines to collectively effect cannabis regulatory policies, a cursory look at a map suggests how many major metropolitan areas could be engaged.

For its part, if about 1,800 miles to the west, New Mexico may also decide to adopt adult-use expansion to its long-standing medical cannabis market.

All told if ultimately passed, the 10 states deciding whether to advance cannabis legalization this year could collectively add a combined $8 billion in annual legal sales their fourth years of operation. For comprehensive, in-depth analysis of New Frontier Data’s latest, post-election U.S. market projections, download our latest report, Cannabis in America for 2021 & Beyond: A New Normal in Consumption & Demand.