One More Time: New York Governor Makes Third Try to Adopt Adult-Use Cannabis

Legal Cannabis and the Three State Governors

January 19, 2021

A New Year and Gathering Momentum Offer Expanding Legal Markets

February 1, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

Last week, New York Governor Andrew Cuomo presented a budget outline to legalize and tax adult-use cannabis in the nation’s fourth-largest state, with its cultural centers and tourist meccas. Despite a slight post-COVID-19 decline in population, the Empire State has an estimated 19.3 million residents, and in 2021 marks its sixth year of legal medical cannabis sales. A convergence of cultural and demographic factors manifested in New York stands to make it one of the legal cannabis industry’s most influential markets, both domestically and internationally.

Having twice previously proposed an adult-use program, the governor has repeatedly maintained that a tax-and-regulate stance for recreational cannabis would help fill the state’s historic, $15 billion budget deficit. He asserts that a projected $350 million in annual revenue from cannabis taxes represents an opportunity to aid an economy that has suffered amid the coronavirus pandemic. Cuomo said that the state would divide the revenues, with $100 million dedicated for a social equity fund but “$250 million towards the budget and our needs.”

Overcoming some implementational issues during its medical program’s rollout and first few years of operation, the Empire State adopted some important regulatory changes to improve patient access and participation. As of the past November, New York had 131,736 certified patients participating in its medical program, which had been projected (lacking an adult-use program) to exceed $500 million in annual sales by 2025.

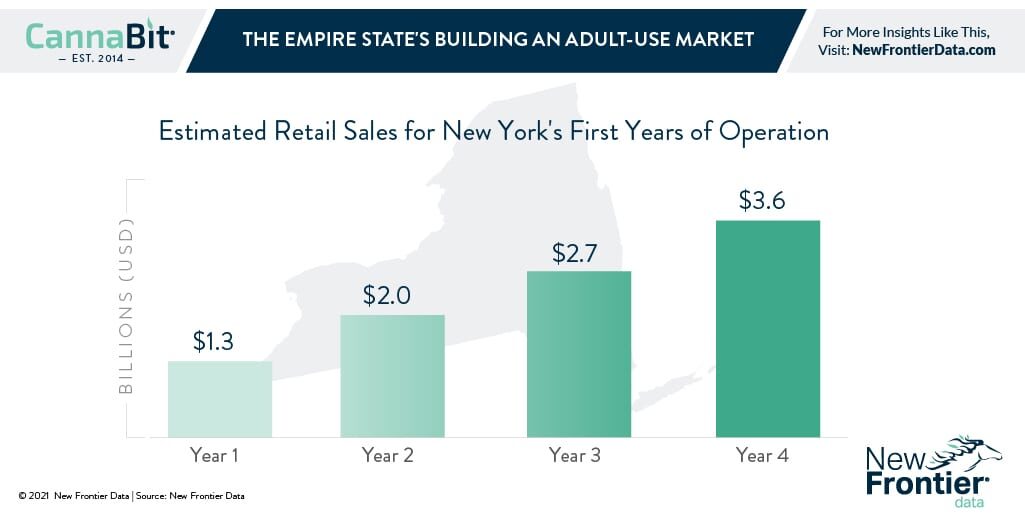

Now, New Frontier Data’s initial projections for New York’s adult-use cannabis market calls for it to reach $1.26 billion in the first year of sales, reaching $3.59 billion by its fourth year. Those Y1-4 estimates assume a tax rate resulting in retail prices competitive versus those in the existing illicit market; the specific final regulatory details (i.e., the chosen tax rate and any product form restrictions) will have significant bearing on the market potential.

Outside of New York’s existing legal medical cannabis program, the state in 2020 had an estimated 1.6 million people who consumed cannabis at least once a month, with about 2.4 million consuming some at least once per year. Before the pandemic, the cultural epicenter of New York City was drawing an estimated 65.2 million visitors annually.

As Kacey Morrissey, New Frontier Data’s senior director of industry analytics explains, Cuomo’s most recent proposal calls for cannabis products be taxed at 10.25% (well below a previous plan which called for a 20% statewide tax), but with local and state taxes would still translate into a total retail tax of around 18% at the counter. Under that proposal, New Jersey’s effective tax rate could potentially establish itself for price competition for regular cannabis consumers among neighboring New Yorkers. Though it has been plagued by some bureaucratic obstacles since voters adopted an adult-use program this past November, the Garden State’s estimated 1 million cannabis consumers and heavy tourism potential from New York City and Philadelphia, et al, figured into New Frontier Data’s estimates that annual sales of legal adult-use cannabis in New Jersey could reach $1.8 billion by year four of an operational market.

Conversely, by Morrissey’s estimates, New York’s annual sales of adult-use cannabis will surpass $1.26 billion in its first year, $2.02 billion in its second year, $2.73 billion in its third, and $3.59 billion in its fourth.

New York lawmakers have previously failed to reach consensus about issues including managing revenue, supporting minority communities, and maintaining public safety.

Cuomo has also aspired for “regional symmetry” with bordering states’ legalized programs in order to avoid a patchwork of competing cannabis markets with broadly different regulations and prices across state lines. Cuomo previously organized a regional cannabis summit with state executives from neighboring Connecticut and New Jersey, before it passed legalization.