Necessity vs. Nicety: Adult-use and medical patient spending during tough economic times

Providing a Prescription for Meeting the Needs of Medical Cannabis Patients

December 20, 2022

Want to grow the industry? Start local

February 7, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

During economically lean times, consumer spending trends towards non-discretionary purchases. When faced with limited resources, people tend to choose necessities over niceties. Where does that leave cannabis? For some people, cannabis is a nice to have, for others, it is necessary for daily functioning. High taxes on cannabis in many states already create a barrier for low-income consumers, especially patients. How is the current economic landscape of inflation and rising interest rates related to how much consumers are spending on cannabis, and does this differ between adult-use and medical consumers? According to the New Frontier Data Consumer Survey, 47% of consumers are using cannabis at least once a day, which makes it a routine part of many people’s lives, and 40% of consumers say their use is primarily or only medical. Nearly half of consumers say they are using cannabis for pain relief and 56% report using to quell anxiety. 57% percent of medical consumers rely on cannabis as a substitute for other prescription medications, with 43% saying they choose cannabis because it is cheaper than their prescription medications. So, how are these choices impacted by greater economic conditions?

Medical vs. Adult-use spending

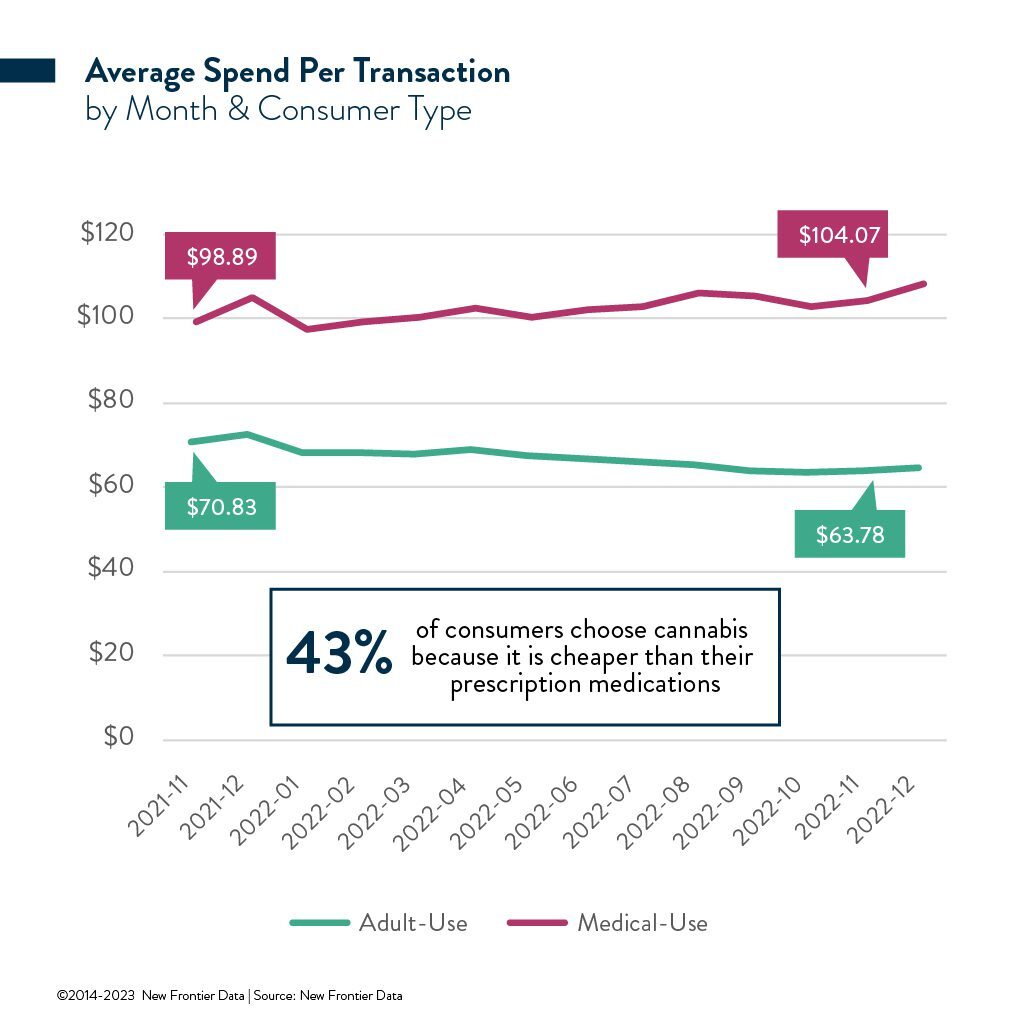

Because cannabis is a necessity for those using it for medical purposes, we looked at the differences in spending per transaction for adult-use consumers vs. those with a medical cannabis card between January 2020 and October 2022. It might be assumed that spending by medical consumers is not as vulnerable to economic conditions due to medicine acting as a non-discretionary item, and that is indeed what we found.

Looking at average spend over the past year, for adult-use consumers it was just under $71 in November 2021. By November 2022 that has fallen to $63, a decrease of 10%. For medical patients, $98 was the average spend in November 2021. In November 2022, it was $104, an increase of 5%. This shows that while adult-use consumers have been impacted by the overall economic conditions when it comes to cannabis spending, those with a medical cannabis card were not, and their spending remained fairly stable with a slight increase, while adult-use spending fell during the same time period.

During tough economic times, the general public spends less on discretionary items like alcohol and recreation, and more on non-discretionary items like gas and groceries. Cannabis has the potential to be both a discretionary and non-discretionary item depending on the motivation of the consumer. Discretionary products like alcohol have seen a decline in spending. Overall, cannabis spending saw a similar fate between November 2021 and November 2022, falling 11%. However, unlike alcohol, cannabis is a non-discretionary item for the thousands of people who rely on it as a medicine or view it as integral to their wellness. And, unlike alcohol, the cannabis industry is nascent, and prices have not stabilized, nor have most consumers fallen into a stable consumption pattern. Brands and retailers can use this information to better understand the needs and purchasing patterns of adult-use vs. medical consumers. This is also further evidence of the differences that exist among the cannabis consumer population and the importance of understanding not only purchasing patterns, but the motivations behind them related to personal need.

Stop guessing and start making informed decisions for your cannabusiness. Learn more about cannabis consumers, product trends and market analytics with Equio, our cannabis intelligence platform.