An Industry in ‘Bloom’: New Frontier Data Analysts Discuss What’s Coming in 2022

Cannabis vs. COVID Study Illustrates U.S. Need for Key Research

January 24, 2022

Normalization of Cannabis Yields Accuracy in Self-Reporting

February 7, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

As the legal cannabis industry settles into a new year, it is primed for yet another year of dynamic changes despite continued Congressional inaction around U.S. federal prohibition. Last week, New Frontier Data hosted an online industry briefing, 2022 in Bloom: A “Flower” Side Chat with the New Frontier Data Research Team, discussing key issues, trends, and their likeliest outcomes in the coming year.

The conversation covered topics including global legal market expansion; U.S. regulation and state dynamics; cannabis policy and governance development; finance, investment, and M&A trends; the evolution of consumer behavior; and the future of hemp.

The six themes discussed were drawn from trends identified in 22 for 2022: Cannabis Industry Assertions & Predictions, which is available for download at NewFrontierData.com/22for22. “Economic headwinds are gathering,” said John Kagia, New Frontier Data’s Chief Knowledge Officer. “While consumer demand remains essentially recession-proof, a decreased flow of capital influx to the cannabis market looks to slow the pace of industry expansion, and fuel M&A activity around cash-strapped assets.”

Topics included:

- Global Expansion: With Germany’s intent to legalize adult-use cannabis, New Frontier Data expects several U.S. companies to announce partnerships, investments, and M&A to establish footholds across the country’s estimated $14.5 billion cannabis market opportunity. “Having Germany fully legalized for adult-use cannabis,” noted Kacey Morrissey, Senior Director of Industry Analytics, “becomes a really interesting story to watch in 2022, because momentum is really the name of the game when it comes to legalization in a new region.”

- U.S. Market: Three major East Coast markets, namely New York, New Jersey, and Virginia, are preparing to launch legal adult-use markets that should generate nearly $11 billion in sales by 2025, accounting for nearly one-quarter of all legal U.S. sales. Yet, rhetoric is expected to outpace action on the national level. “Given the Congressional midterm elections in the fall, politicians are leveraging legalization as a campaign issue to run on, [but] I don’t know how optimistic we are that we’re going to see a lot of progress, at least at the federal level this year,” Senior Industry Analyst Josh Adams explained.

- Policy and Governance: “As the industry grows, the actors that are becoming engaged – particularly leveraging either some lobbying or political weight – are not necessarily tied to the industry,” said Adams. “Whether it’s multinational corporations like Altria or Amazon, whether it’s labor organizations, or trade associations here in D.C. – all of these actors have an interest in the industry while not necessarily being industry players, and they are going to begin engaging as well.”

“Another thing to keep in mind,” noted VP of Public Policy Research Amanda Reiman, Ph.D., MSW, “is that even if Capitol Hill were to take unexpected action this year, it would not guarantee buy-in from resistant states. Federal legalization does not necessarily mean that every state will jump on board and most likely, states will still have the opportunity to opt out of legalization, even when things change on the federal level.” For instance, Mississippi – the last state to repeal its alcohol prohibition laws – remained legally dry until 1966.

Fundamental questions and advanced research about consumer impairment will also continue to frustrate blanket enforcement efforts. “Patchwork regulation across the United States creates unique complications for each existing market, but at the same time [also] some interesting opportunities for new markets that are coming online to take advantage of the lessons that have been learned,” explained Research Analyst Noah Tomares. “Without a clear understanding of the differences between the laws of each state, that is going to confuse the consumers, that is going to confuse law enforcement that has to enact it [and] enforce it. Ultimately, it makes it more challenging for larger-scale adoption.”

- Finance and Investments: Despite last year’s industry turns in the stock market, Morrissey reports that the pace of total industry investment has been back on track to roughly pre-pandemic levels. We’ve seen capital raised across both public and private sectors reach nearly $13 billion for calendar year 2021, compared to about $4 billion in 2020. And the strong uptick in M&A transactions, over 300 in 2021 compared to less than 120 in 2020, indicates large M&A owners and operators across the U.S. are continuing to aggressively pursue these acquisitions.”

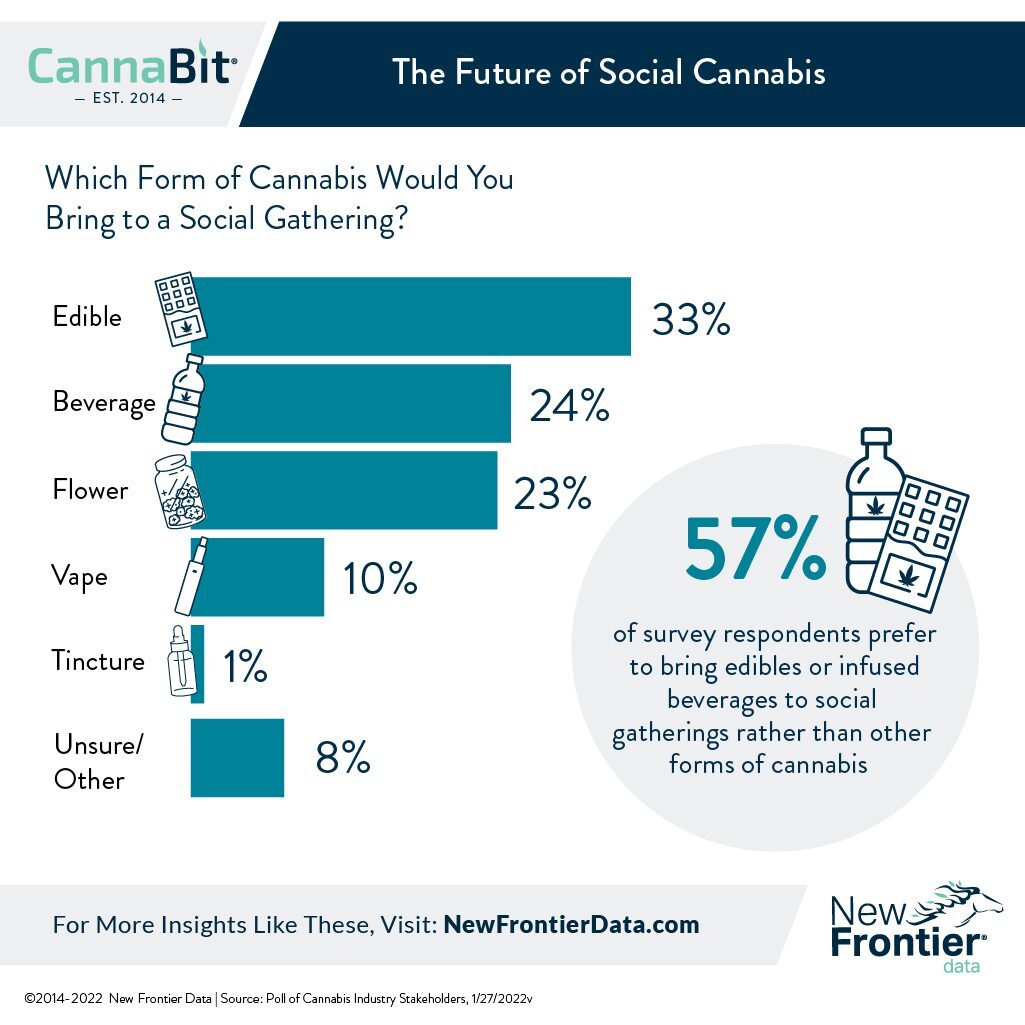

As to how consumers will behave in 2022, Morrissey reminded that while inflation affects consumers to some degree, “I don’t think we’re going to see a slowdown in the growth of legal cannabis sales because of it.” - Consumer Behavior: Reiman explained how a diversifying product landscape is giving consumers new and novel ways to integrate cannabis into their lives, stimulating new categories of demand. “As we see cannabis more normalized, I think we’re going to see celebrities getting more engaged, and not necessarily celebrities that already have cannabis as part of their persona. In addition to that, we will see cannabis brands starting to partner with edgy non-cannabis brands from the food and fashion industries, who now feel that coming into cannabis is not as much of a risk in alienating their main consumer base, and in fact, may be a draw.”

- Hemp: Based on the increasing demand for ESG products and rising costs for building materials, New Frontier Data expects the markets for hemp hurd-based building materials and bioplastics to grow dramatically in 2022. As Eric Singular, Director of the Hemp Business Journal, recalled, “Last October, McKinsey and company reported that the world must close a $4 trillion financing gap by 2050 to meet climate change, biodiversity, and land-restoration targets. Further, they predicted that nature-based solutions could account for 65% to 85% of the total supply of carbon credits by 2030. This, I think, is probably the single-biggest thing that folks in the in the hemp sector should really be looking toward.”

As the analysts’ various takeaways suggest, tracking trends and negotiating the flow of market activity will remain essential endeavors for industry stakeholders. Those seeking more specific, comprehensive information for keeping tabs on the latest consumer trends can find benefits in Equio®, New Frontier Data’s business intelligence platform providing insights, data, consumer and demographic profiles, updated news, and analysis on the rapidly evolving cannabis industry.

The fundamental elements of the industry remain strong, and New Frontier Data confidently predicts another breakthrough year for the legal cannabis industry. Understanding the nuances of regulations, global expansion, and consumer demand will remain primary determinants for success.