Anticipating the Impacts on Canada’s Market Under Cannabis 2.0

Humboldt’s Iconic Cannabis Industry Faces Difficult Transition to Fully Regulated Market

October 13, 2019

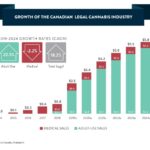

Growth of the Canadian Legal Cannabis Industry

October 20, 2019By New Frontier Data

To mark Canada’s rollout of Cannabis 2.0 value-added legal cannabis products last week, the Ontario Cannabis Store (the province’s government-run online cannabis retailer) organized a two-day conference for producers, processors, and retailers. The event highlighted the complex dynamics emerging in the Great White North’s increasingly complex and competitive regulated cannabis market, with companies revealing increasingly sophisticated product roadmaps and brand strategies even as many grapple with complicated regulations, supply-chain challenges, and fierce competition for limited retail shelf space.

Despite limited integration of data across the supply chain, producers have clear visibility into the wholesale market; yet, little retail data is publicly available, limiting brands’ ability to track and plan their sell-through.

Despite strong demand, access remains a challenge with limited retail licenses in the country’s most populous province. Retail sales have been constricted by consumers’ lack of access, while challenges with online order fulfillment and comparatively higher prices than in the illicit market discouraged many consumers.

With the Cannabis 2.0 products officially legal, the first of them are expected to hit the market in December, though many retailers are targeting early 2020. To the extent that product selections will be initially limited, brands have already planned extensively, with beverages being a major category for expansion. Seltzers, juices, teas, and kombucha are among the new products aimed to significantly impact the retail environment, yet with product and branding development cycles, required regulatory approvals, and complex retail buyer negotiations, hurdles remain before reaching the market.

Three key factors should dramatically shift Canada’s retail dynamics for 2020:

- Additional retail licenses will considerably expand access: and lead to more strategic consumer engagement with lower retail prices.

- Technological developments are streamlining on- and offline service delivery. Significant investments made by OCS for improving the retail platform based on consumer feedback marks but one illustration of the interest in leveraging technology to enhance consumers’ retail experiences.

- Product diversity will close the pricing gap with the illicit market: Larger brands are tiering products based on price and quality, with some companies offering nearly 100% cost difference between their lowest and highest SKUS. Cost-conscious shoppers will find products competitively priced against the illicit market, without dilution to premium pricing for top-shelf brands.

New Frontier Data’s forthcoming Canada Cannabis Report: 2019 Industry Update and Outlook examines a host of other dynamics in detail:

How retail layouts will quickly evolve as new products and brands emerge, though merchandising regulations will constrain design options;

How a patchwork of provincial regulations will continue to challenge brands in getting products to market;

How in racing to acquire market share, some companies are spending unsustainably on marketing relative to revenue earned;

How despite heightened concerns about vapes, brands anticipate robust consumer demand upon launch;

How while budtenders play vital roles in informing consumers’ decision, limited product familiarity will limit the effectiveness of their recommendations;

How novel strain names will lead many consumers to base their flower purchase decision on two attributes: THC potency and designations of sativa/hybrid/indica;

How acute contraction of investment capital will force many investment-driven companies to revisit and overhaul their strategies;

How recruiting and retaining top-flight talent will become increasingly difficult as companies have less capital and equity to offer; and

How limited access to retail sales data will keep materially impacting business efficiency.