California’s Revised Cannabis Sales Tax Revenues Lift Gloom of Market’s Early Performance

August Numbers Show Sustained Post-COVID Sales Increase

September 8, 2020

California’s Revised Cannabis Retail Sales Tax Revenues

September 14, 2020By John Kagia, Chief Knowledge Officer, New Frontier Data

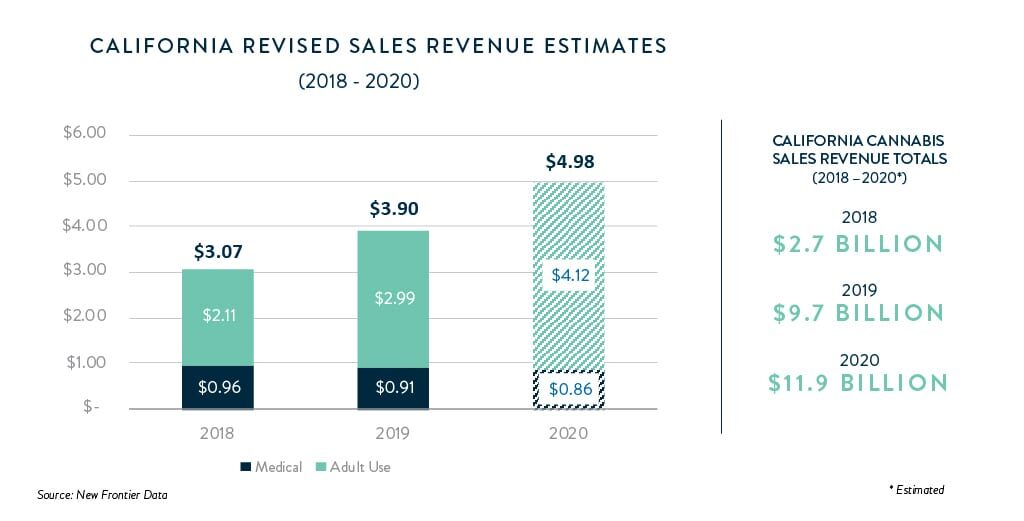

California recently released revised cannabis tax revenues which showed significantly higher revenues earned by the state’s legal cannabis industry. The revised numbers indicate that the market performed much better than expected, especially in 2018 – the first year of operation – when the consensus deemed the market’s performance as far below expectations.

The revised figures saw 2018’s sales tax revenues up 36% (from $125 million to $169 million); 2019’s revised numbers were up 14% (from $209 million to $239 million), and the first two quarters of 2020 increased by 16% (from $134 million to $155 million).

Over the two-and-a-half-year period, the state now reports sales tax revenues of $563 million, up 20% from the initially reported $468 million.

The revisions are welcome news to an industry that has faced major challenges getting operational. The state and local governments’ licensing approval process was complex and under-resourced, leaving many applicants waiting months for approvals, while the nation’s-highest cannabis sales tax rate (at nearly 50%) kept many consumers from transitioning away from illicit sources to patronize the newly legal market.

While the revised numbers do not completely eliminate concerns that the regulatory environment is acting as a drogue to market growth, the fact that the cannabis businesses earned approximately $9.2 billion in adult-use sales during the first 2.5 years of operations suggests that a burgeoning market is underway for those allowed to get licensed and operational.

The stronger-than-expected sales performance may complicate current debate about potential changes to cannabis policy. Industry advocates continue to champion lower taxes to spur demand. New Frontier Data’s analysis has shown that high taxes serve as a deterrent for price-sensitive consumers, and that with a large, well-established illicit market in the state, there remains less incentive for consumers to pay the premium for legal cannabis when high-quality, unregulated options abound.

State lawmakers — already facing an acute budget crunch even before the economic shock of COVID-19 decimated local government revenues — have been resistant to making the change. And with COVID-19 stimulating a dramatic increase in legal cannabis demand (nationally, revenue increases of up to 30% over baseline figures are being seen since the pandemic began), there may be less incentive to lower taxes on the industry during such surging growth.

Lawmakers should bear in mind, however, that the longer the state maintains the country’s highest cannabis sales tax rate, the more entrenched the illicit cannabis market will become. While the state has become more aggressive in pursuing and prosecuting unregulated operators, the competitively priced, easily accessible legal market remains the most efficient way to disrupt illicit markets.

With local autonomy allowing counties the authority to regulate which cannabis businesses operate in their jurisdictions, more than two dozen California counties have opted to ban legal retail operations. The inability for consumers in large swaths of the state to buy from the legal market is as important a factor in the entrenchment of California’s illicit market as the state’s high taxes, since it provides a strong incentive for unlicensed operators to serve those lacking legal options.

With a total addressable market (legal + illicit) of nearly $13 billion in 2020, California’s expected legal sales of $5 billion for 2020 reminds that there remains a long way to go before the legal market fully cannibalizes the state’s illicit ones. However, the revised sales tax revenues show that the market’s start was not as slow as had been feared, and the COVID-19 pandemic has served as a timely boost to legal sales as shelter-in-place orders have driven higher-than-normal demand. But even amidst those positive developments, the impacts of the state’s high cannabis tax rate and the widespread bans on legal retail dispensaries will likely continue to constrain growth in the country’s largest cannabis economy.