August Numbers Show Sustained Post-COVID Sales Increase

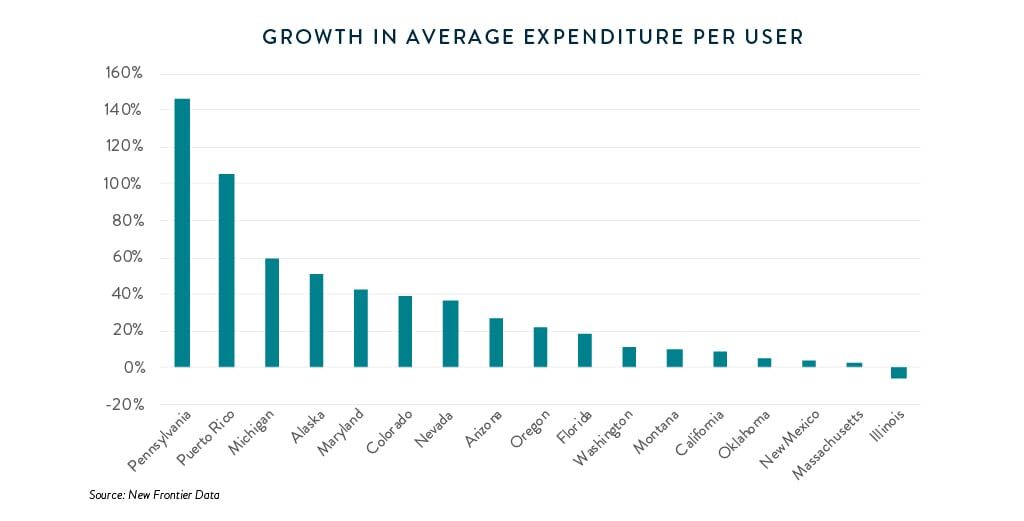

Annual Growth in Average Cannabis Spending

September 8, 2020

California’s Revised Cannabis Sales Tax Revenues Lift Gloom of Market’s Early Performance

September 13, 2020By Trevor Yahn-Grode, Data Analyst, New Frontier Data

Post-COVID Sales Increases Continue

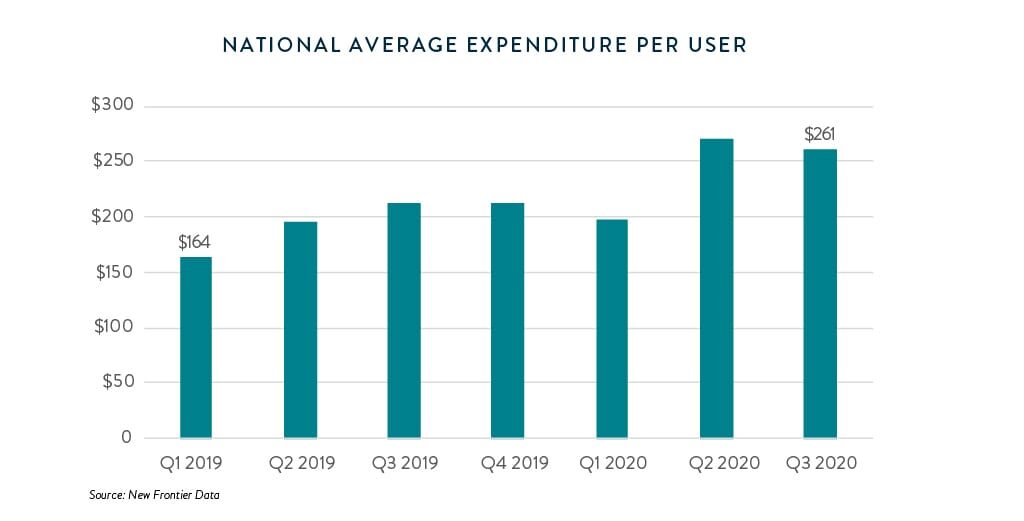

The spike in cannabis sales, which extended from the start of COVID-19 lockdowns, seems poised to continue, with legal states seeing an average increase in spending per consumer of 23% since the beginning of 2020. Despite a slight drop from the initial spike in Q2, August expenditures per user were 17% higher on average than they were a year ago.

Average overall spending per month has increased among all cannabis product categories by an average of 25%, but average spending per dispensary visit has decreased 3% over the same period. Contrary to industry fears that the post-COVID sales spike was the result of consumers’ stocking up on products to avoid frequent trips to dispensaries, this data point indicates that consumers are actually visiting stores more often, without significant changes in amounts purchased per trip.

Nonuniform Growth in Spending Across Product Categories

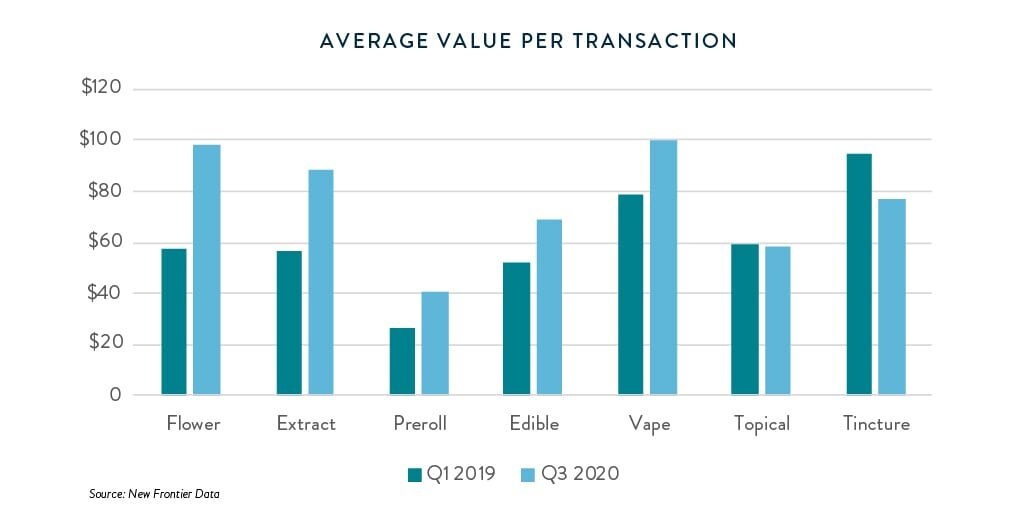

The growth in average user expenditures has not been uniformly distributed among product categories. Flower and edibles have seen respective increases in average transaction value per user of 71% and 56% since Q1 2019, capturing an additional 5% and 3% of market share, respectively.

Despite an increase in average purchase value per user of 28% since Q1 2019, vape products have lost nearly 2% of market share, perhaps indicating that users are stocking up on products in response to nationwide crackdowns or public response to vaping, or that consumer preferences are changing in response to the ongoing global pandemic.

The popularity of tinctures has also waned significantly, with a decrease in average purchase value per user of 19% from Q1 2019, and a loss of market share of 2%.

Explosive State Growth Even in Established Markets

In the first three quarters of 2020, states have seen an average year-over-year increase in average spending per user of 34%. That growth was not limited to emerging markets, with the four oldest recreational markets (i.e., Colorado, Washington, Alaska, and Oregon) alone seeing a 30% average increase in per user expenditures. Adult-use states saw an average increase in spending per user of 28%, while medical-only states saw an increase of 39%.

Whether COVID-19 has resulted in a temporary surge in cannabis use, or is a catalyst for long-term, sustained growth in per-capita consumption is yet unclear. In the near term, however, New Frontier Data expects to continue seeing elevated levels of consumer spending, throughout the duration of the pandemic, and perhaps beyond.