Canada’s Unsteady Path is No Deterrent to Competition in EU Exporting

Bureaucratic Restraints Constrain Cannabis as a Commodity

June 28, 2021

Flush with Cash, Cannabis Companies Jockey for Prime Market Positions Amid Rush to Scale

July 12, 2021By Noah Tomares, Research Analyst, New Frontier Data

When Canada legalized cannabis in October 2018, there was a great deal of optimism — not just for the domestic prospects of the lucrative cash crop, but for international opportunities as well. Several Canadian cannabis companies eagerly established footholds in international markets. Medical exports from Canada to Europe tripled from 2017 to 2018.

Tilray exported medical cannabis products to Ireland, Croatia, and other European nations, while Canopy Growth Corp. established subsidiaries in the United Kingdom, Spain, and Denmark. Meanwhile, Aurora began construction on two large cultivation facilities: Aurora Sky and Sun.

The Sky facility planned to produce 100,000 kilograms of cannabis annually, and cost at least $150 million CAD ($123.8 million USD). Aptly named Aurora Sky was strategically placed on Edmonton International Airport property, well situated to capitalize on its substantial export capacity. The second facility — Aurora’s Sun greenhouse — had a projected capacity for an additional 230,000 kg of cannabis annually.

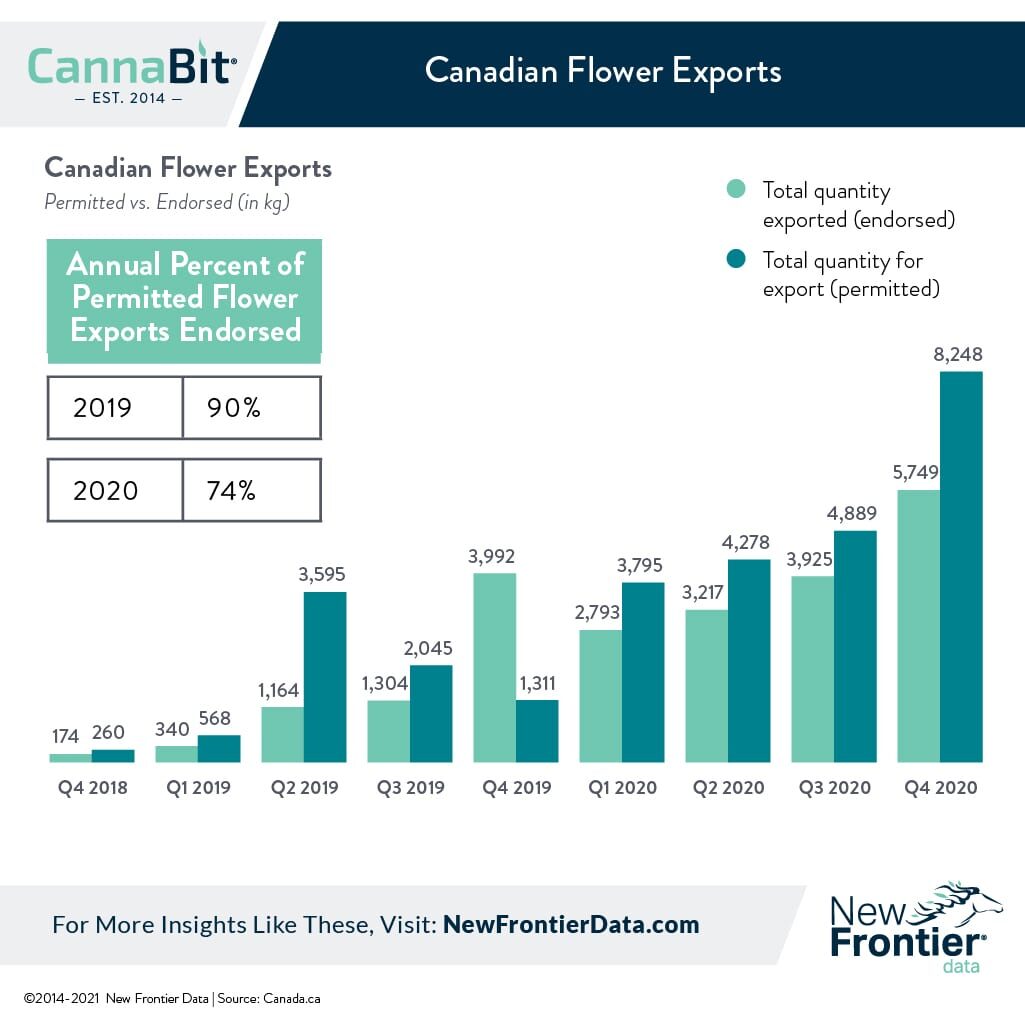

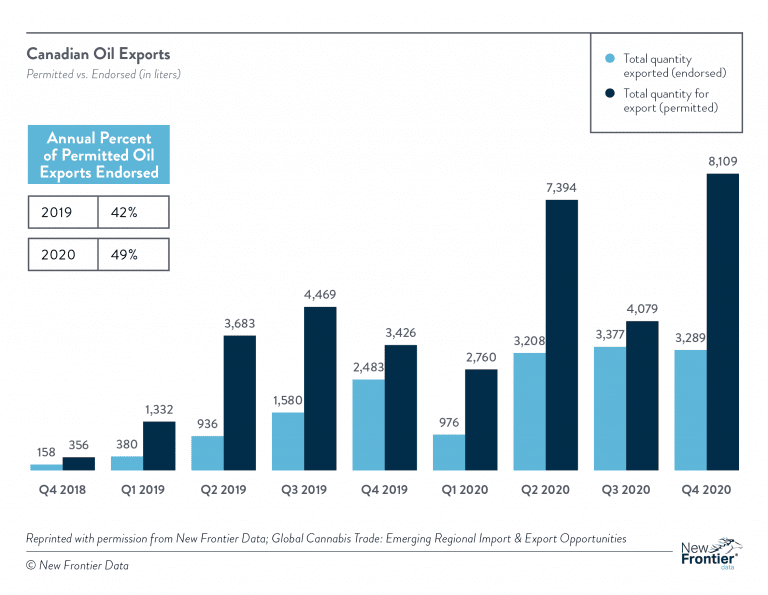

Slower-than-anticipated market activation abroad, however, left Canadian producers with more capacity than the international market could support. Permitted flower and oil exports regularly fell short of endorsed actuals. In 2019, 90% of the flower permitted for export was ultimately endorsed; in 2020, that number fell to 74%. The proportion of Canadian oil exports endorsed increased in the same period, from 42% in 2019 to 49% in 2020.

In December 2020, Aurora announced that its Sky facility was reducing activity to 25% capacity. The Sun facility remains unfinished. At the same time, some publicly traded Canadian producers have reduced exposure in Europe. For its part, Canopy Growth Corp. announced plan to wind down operations in its Denmark facility.

While several Canadian companies are reducing their international exposure, other players are entering the fray. Curaleaf announced an international foray, acquiring European cannabis distributor EMMAC Life Sciences. Canopy Growth Corp.’s Denmark facility is being acquired by Australian cannabis producer Little Green Pharma Ltd. for $20 million CAD ($16.2 million USD).

As the legal market expands globally, other key trends emerge:

- Medical use as the prevailing form of liberalization: While a few countries like Canada, Uruguay, and South Africa have legalized adult-use cannabis, much of the world will be focused exclusively on the plant’s therapeutic applications, with significant implications for the product types permitted in each market, any regulations governing the industry, and engagement of whichever consumers will participate in the market.

- EU GACP and GMP will form the basis for global import/export standards: In Europe, good agricultural and collection practices (GACP) provide a baseline for industry standards which agricultural producers must meet when cultivating plants used as medicine. Similarly, good manufacturing practices (GMP) serve to govern the production of medicines for the European market, Accordingly, the standards have raised the proverbial bar for cannabis production globally as growers and manufacturers seek entry to Europe’s fast-growing and lucrative markets. As countries beyond the EU begin importing medical cannabis, most are expected to adopt similar standards for the products which they import. Consequently, companies seeking to participate in the global market should expect stricter product standards (rather than any laxity) as markets expand.

- Regulatory variance creates transcontinental complexity and risk: While adult-use markets have opened in several countries, the global cannabis industry remains primarily engaged in medical markets. Consequently, countries tend to have strict regulations governing cannabis imports, though rules vary widely across markets. While nations considering the import or export of cannabis tend to share many of the same guiding principles, variations in the letters of laws across countries can result in some negative externalities, introducing further complexity and risks for the international cannabis trade.

For additional insights into the complicated interplay of international regulations and market forces, check out New Frontier Data’s most recent report: Global Cannabis Trade: Emerging Regional Import & Export Opportunities.