Cannabis Consumers’ Decreased Spending Is Balanced by Enthusiasm

Marijuana by Municipality

July 19, 2022

As U.S. Legal Cannabis Market Expands, Annual Consumer Spending on Homegrowing Could Near $4B by 2030

July 27, 2022By John Kagia, Chief Knowledge Officer, New Frontier Data

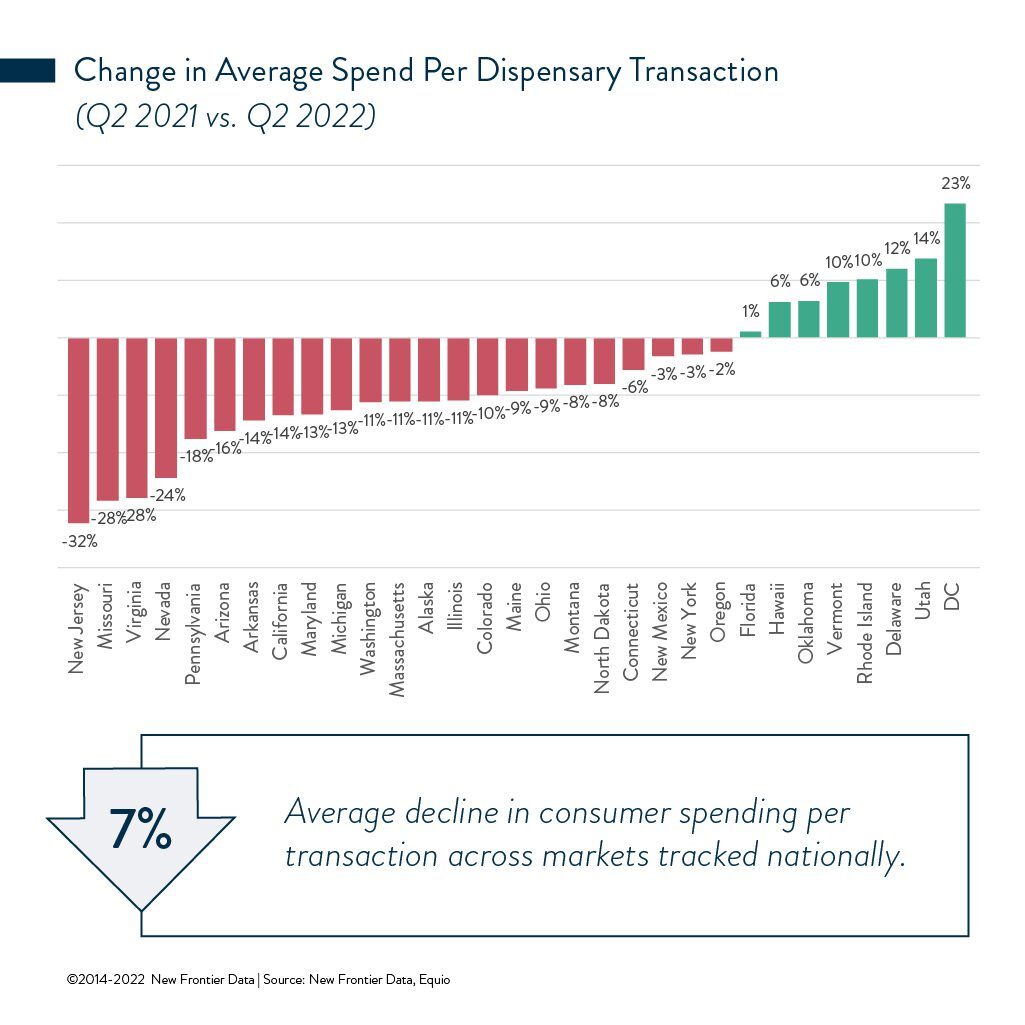

Through the first half of this year, U.S. consumers’ average spend per transaction is down significantly across most legal cannabis markets, indicating that tightening economic conditions are impacting consumer spending.

Some of the spending shifts are not solely driven by the changing economy, however. New Jersey — which saw the greatest decline in spending between the first two quarters — launched its adult-use sales in late April. Historically, average spending per transaction in medical markets is higher than in adult-use markets (though typically the number of transactions is significantly higher in adult-use markets), so the significant declines seen in the Garden State are likely more attributable to the regulatory shift than due to any acute shift in consumers’ purchasing power.

Investors Are Uncertain

In May, several large cannabis companies revealed considerable YOY rises in revenues among their first-quarter earnings. Nevertheless, some of those lowered their 2022 forecasts, citing expectations for rising costs and the potential for a recession. Given that the inflationary pressure seems probable to extend into the second half of the year, it is likely that cannabis consumer spending will contract further as consumers adopt increasingly aggressive cost-saving measures.

July began with leading cannabis stock prices at new lows for 2022. Long-term investment is becoming more cautiously speculative in a market situation characterized by brief rallies preceding further losses.

Congress Considering Federal Legalization

Last week, an update about Sen. Chuck Schumer (D-NY)’s proposed federal cannabis legalization bill buoyed the industry’s collective spirits, though further action in the Senate seems remote. Prior attempts to pass federal cannabis reforms have been supported by the cannabis industry, and some investors are depending on short-term tactics to generate money this year since many investors remain hesitant to make long-term investments given the current conditions.

The legislation has been a long time coming — Schumer, with Sens. Ron Wyden (D-Ore.) and Cory Booker (D-N.J.) proposed a discussion draft more than a year ago — but its odds for passage remain slim.

That said, the bill includes both Democratic and Republican priorities going into the midterm elections, so the legislation will prompt discussions about cannabis legalization going forward, and portions of it seem likely to be included among other bills that could pass before the year’s end.

Prioritized elements include expungement of federal cannabis-related records, earmarking law-enforcement funding to combat illicit cultivation, establishing grant programs to include small-business owners from communities disproportionately hurt by past drug laws, requiring the Department of Transportation to research and devise a nationwide standard for cannabis-impaired driving, and restricting the marketing of cannabis products to minors.

The increasingly serious debate in Congress over federal cannabis policy may not spare the industry from near-term turbulence caused by macro conditions, but they represent strongly positive signs for the market’s long-term prospects as the current patchwork of state regulations transition to a more unified national framework.

Canna-Tourism Gaining Cache

The economic downturn may also have an outsized effect on retailers in jurisdictions where tourist demand has been a major source of revenue. Operators in major destination cities with adult-use sales (e.g., Las Vegas, Boston, and sections of Los Angeles and San Francisco, or ski resort towns in Colorado and California) may see progressively lower demand should tourism begin to contract again following the early rebound after the travel crash due to the COVID-19 pandemic.

However, even with those declines, the industry will continue to see strong growth as more consumers transition from illicit to legal markets, with new adult-use markets being particularly likely to continue to perform well despite lowered spending per transaction nationally.

Cannabis legalization has been rapidly adopted across the U.S. during the past decade, and 19 states now allow anyone past the age of 21 to possess and use the drug; all told, 37 states have established medical-use cannabis programs. Public support for legalization remains solid among approximately two-thirds of Americans, and still higher among younger voters.

Given the market’s evolving dynamics, it remains critically important for retailers to know who their customers are, and how their target audience behavior is changing. Using New Frontier Data’s newly launched Retail Suite, on our Equio® business intelligence platform, retailers can curate a retail strategy based on an understanding of their dispensary customers’ preferences and attributes by state markets and product types.