Cannabis consumers in 2022 vs. 2023: The evolution of mainstreaming

Access to New Products Changing Cannabis Consumer Behavior and Archetypes

September 13, 2023

Unique challenges for the medical side of cannabis

October 3, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

Remember when you turned 21? A whole new world of alcohol socialization opened up. Now, if you are like me, you tried alcohol prior to legal age, but the ability to freely choose your drinks and the environments in which to enjoy them came with that 21st birthday. And, if you’re like me, the first few years of that freedom brought experimentation. Fruity cocktails, bitter-tasting spirits, a cold brewski…there was a process of trial and error with a little bit of shiny ball syndrome. After a few years, my circle of alcohol trials narrowed, and I settled into a pattern of drinking that would stay with me for decades to come. We are seeing a similar pattern among cannabis consumers in the new age of legal access, which is reflected in the data from New Frontier’s consumer survey and demonstrated in our newly released Consumer Report Part 2. As legalization continues to spread throughout the US, those who did not participate in the illicit market are coming into the legal fold, those who were forced into illicit market participation due to their state laws are joining the regulated market as those laws change, and consumers who wanted to try everything and were driven by the newness of the legal market are settling into regular consumption and product patterns.

New Consumers Entering the Legal Market

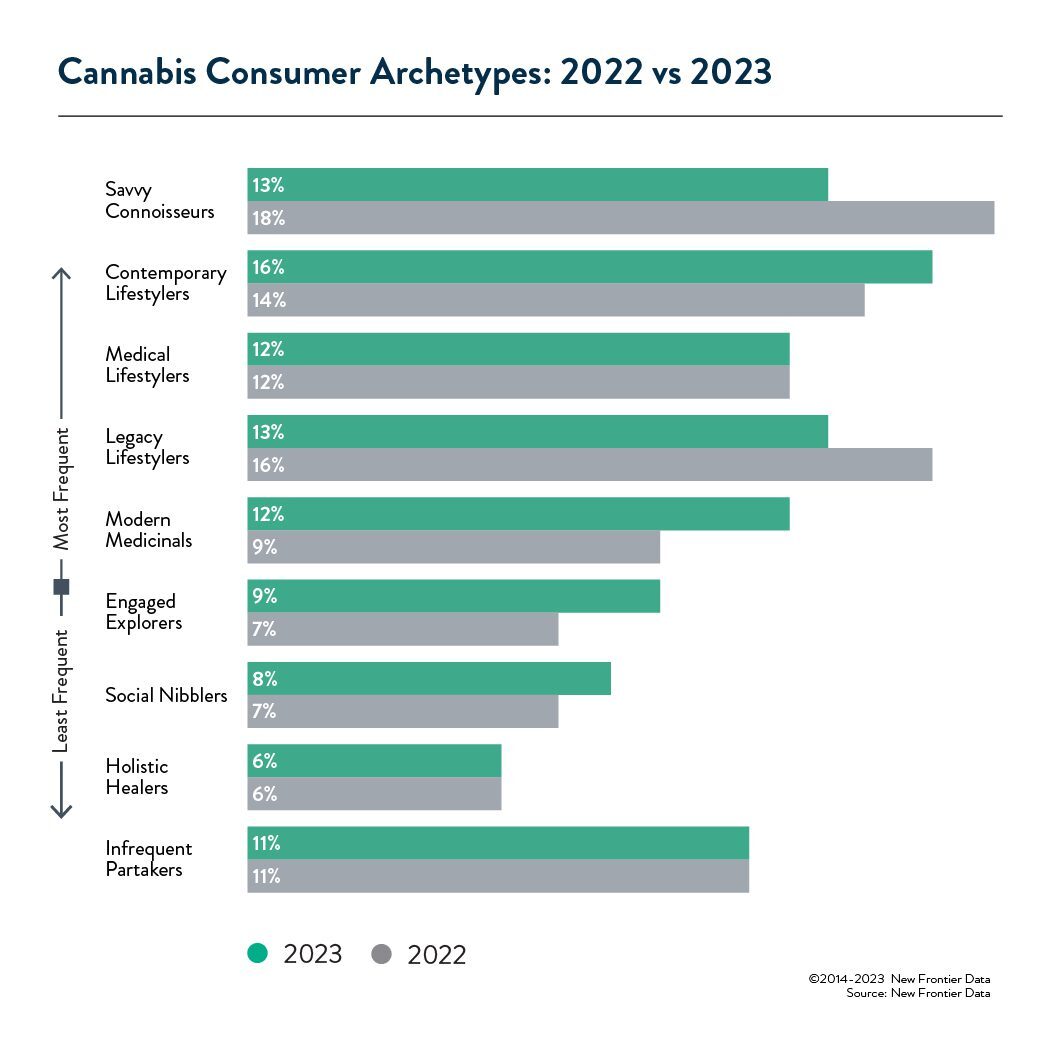

While many people who currently participate in the regulated market were obtaining cannabis prior to legalization, there is a group of low to moderate consumers who chose not to participate in the illicit market but are open to legal access. These consumers fall into archetypes such as Modern Medicinals, Engaged Explorers, and Social Nibblers. They are entering the legal market to address a medical issue (Modern Medicinals), and to try various products as an infrequent consumer (Engaged Explorers and Social Nibblers). In 2022, Modern Medicinals made up 9% of consumers. This rose to 12% in 2023. Engaged Explorers and Social Nibblers made up 7% of consumers in 2022 and saw a slight increase in 2023 to 9% and 8% respectively.

Illicit Market Consumers Gaining Legal Access

Another observed change was the movement of those who only had access to illicit markets into the realm of legal access. Legacy Lifestylers, defined as consumers who live in illicit markets, are becoming a smaller group as legal access increases. Newer markets like Maryland, New Jersey, and New York are giving those who previously only had access to adult-use cannabis through the unregulated market a chance to finally participate in legal cannabis commerce. In 2022, Legacy Lifestylers made up 16% of consumers. That fell to 13% in 2023. As more state markets come online, this number will continue to decrease. However, it should be noted that just because a state introduces a regulated market option does not mean that all consumers in that state will participate. States like California and New York have struggled to get consumers to adopt the regulated market and those states still have a great number of consumers who obtain cannabis outside of the legal framework.

Regular Consumers Finding Their Groove

Savvy Connoisseurs, the archetype that typically spends the most on cannabis, are the most frequent purchasers and like to try a variety of products has been the most prolific archetype observed previously. However, that has changed. Many consumers, having tried the vast number of cannabis products on the regulated market, are settling into more regular use patterns. They are finding which products they prefer and developing brand loyalty. In 2022, this archetype made up 18% of consumers, and in 2023, accounted for 13% of consumers. Contemporary Lifestylers, also frequent consumers, increased from 14% of the consumer base in 2022 to 16% in 2023. Contemporary Lifestylers are like Savvy Connoisseurs but have more defined patterns of use and product preferences. If a Savvy Connoisseur is a 21-year-old just getting legal access to alcohol, a Contemporary Lifestyler is a 30-year-old who has decided that they are a wine drinker.

Adapting to the Evolving Consumer

So, what does this mean for cannabis businesses? First, while there has been much focus on high potency products, the entre of low and moderate consumers into the mix means a higher demand for lower dose products, especially since these archetypes trend older. This is also an opportunity for brands to develop loyalty among those who were shopping around but are settling into their patterns as frequent consumers. Most of all, it is important for those seeking customers to stay on top of this evolution as it is far from over. You can download the most recent Consumer Report from New Frontier Data and dive deeper into all the archetypes here.