Cannabis Consumption Reflects Dramatic Changes Amid COVID-19 Pandemic

Cannabis Consumers Coping With COVID-19

November 22, 2020

Cannabis Consumers & COVID-19

November 29, 2020Dr. Molly McCann, Ed.D., Director of Industry Analytics, New Frontier Data

The number of COVID-19 infections in the United States surged beyond 11 million last week, with American deaths from the disease exceeding 250,000 and increasing at a rate of more than 1,000 daily.

As new cases increase, states and local jurisdictions have been pausing or reversing their previous reopening measures, and in some cases issued second rounds of stay-at-home advisories or orders.

Despite such setbacks, recent events have also included some promising news in vaccine development — testing trials conducted by both Pfizer’s and Moderna’s, respectively, have reportedly shown over 90% efficacy in early analysis. While some vaccine doses may be ready as early as December, significant logistical hurdles remain to be overcome, and mission experts anticipate that vaccines will not be available to the public at large until mid-2021 at earliest.

Ten months after the World Health Organization declared a public health emergency of international concern, and amid arguably the most dramatic and sudden widespread shift in behavior of the last century, New Frontier Data is revisiting the topic of consumer behavior amid the pandemic in an upcoming report with new survey data involving more than 4,600 U.S. cannabis consumers.

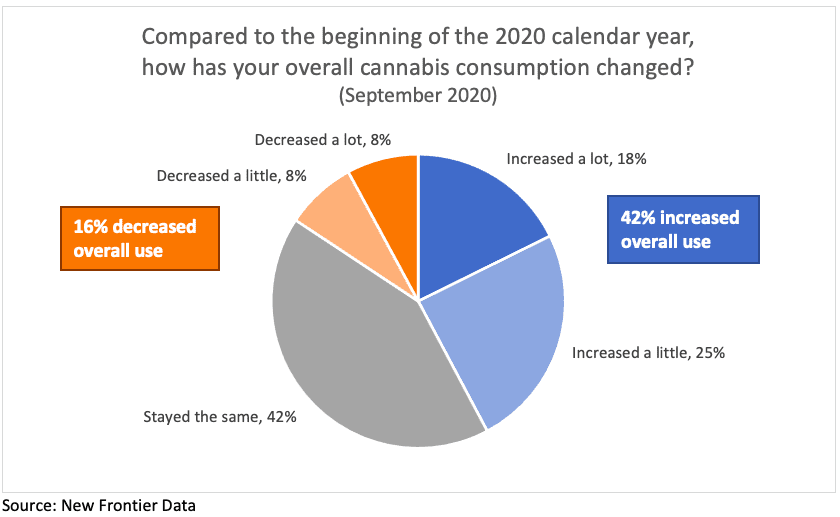

Broad Increase in Consumption

More than 4 in 10 (42%) among current* cannabis consumers report having increased their overall cannabis use during the pandemic — one-quarter (25%) of respondents reported a small increase, and nearly one-fifth (18%) reported a large increase in consumption. An additional 42% of consumers said that their use remained steady, with 16% reporting that their overall use declined since the beginning of 2020.

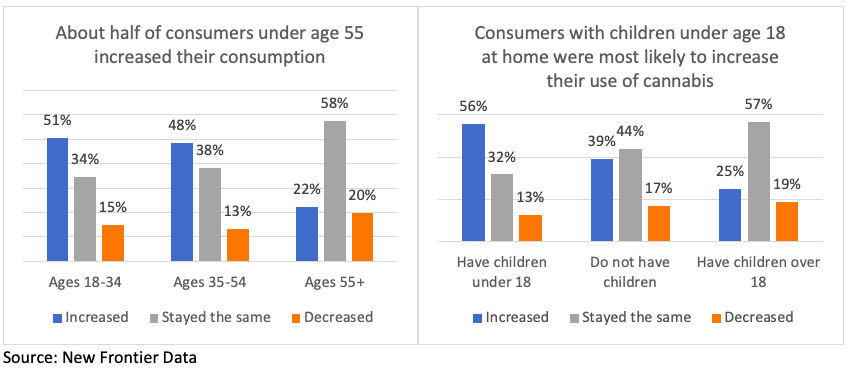

Age and Parenthood Related to Increases in Use

Changes in overall consumption varied significantly across certain consumer segments. Half (49%) of consumers under 55 years old reported an increase in use, compared to less than one-quarter (22%) among consumers 55 and older. The likeliest consumer segment to report an increase in consumption were parents living with children under age 18: 56% of them reported increasing their use, compared to 39% of consumers without children, and 25% of those with adult children.

Perhaps predictably, heavier-use consumers were considerably more likely than were lighter-use consumers to increase their consumption, and conversely less frequent consumers were more likely than were very frequent consumers to report a decrease in consumption. A similar pattern of divergence has been observed in Europe during the pandemic.

While some variables like age and parenthood were strongly related to changes in consumption, other variables notably lacked correlation. Broad changes in use were remarkably consistent across states with adult-use, medical, and illicit markets, indicating that state regulation frameworks do not shape those core aspects of consumption behavior. A consumer’s gender was also found unrelated to changes in overall use.

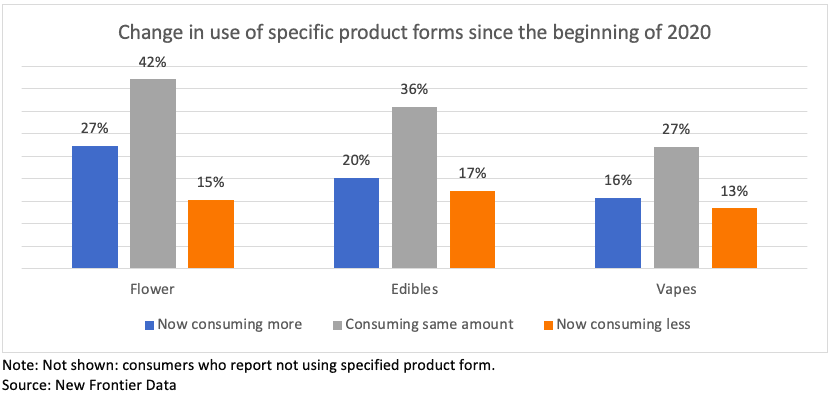

Flower Gains Share Over Vapes

Flower was the product form that saw the largest increases in use and share of sales during the first six months of the pandemic. More than one-quarter (27%) of consumers reported an increase in use of flower, while 15% reported a decrease. Edibles and vapes saw roughly equal numbers of consumers either increasing or decreasing uses of each form.

Flower is a staple product for many regular consumers, and it is typically a more cost-effective option when compared to other product forms. With 55% of consumers reporting having self-isolated at home during the pandemic, consumers are less likely to opt for vapes over flower as a less-conspicuous option for consuming outside the home.

Consumers Will Continue to Adapt Over the Holidays

The changing seasons, dropping temperatures, and shortening days are again causing consumers to adapt to new pandemic routines, and the next six weeks will see necessary modifications to holiday traditions, and perhaps creation of new ones.

In the last few years, the holidays have seen strong cannabis sales, with sales on Green Wednesday and Black Friday — the days flanking Thanksgiving — typically outperforming all other days of the year aside from 4/20.

Thanksgiving weekend’s strong sales have been attributed to the social aspect of the holiday, which for many will be limited or avoided this year. It remains to be seen whether consumers’ overall increase in consumption during the pandemic might play into holiday sales.

The exploration of changes in cannabis consumer behavior in the time of COVID-19 will continue in an upcoming Cannabit, as well as The Impact of COVID-19: A Supplement to the 2020-2021 U.S. Cannabis Report, due for release in December.

*Note: current cannabis consumers are defined in this study as those who consume at least annually.

Share on FacebookShare on Twitter