Cannabis Jobs, Growth, and Tax Revenue After the Trump Tax Reform

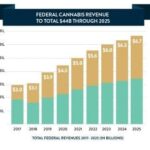

Federal Cannabis Revenue to Total $44B Through 2025

March 4, 2018

Federal Cannabis Revenue to Total $44B Through 2025

March 11, 2018By J.J. McCoy, Senior Managing Editor for New Frontier Data

Now that President Trump signed the Republican tax reform bill into effect, there are more than 115 provisions in place, making advantageous discernment of the new tax structure a convoluted process. Cannabis business operators need good, solid, professional tax advice – including whether to change one’s business structure.

While the full impacts of the new tax law are still being analyzed by tax and accounting professionals at large, the implications for the cannabis industry, its investment community, and individual businesses alike will not be fully ascertained until later in the year. Cannabis in the U.S. Economy: Jobs, Growth & Tax Revenue (2018 Edition) reflects not only the tax changes, but also the most up-to-date assessment of current demand in the industry.

Current total projected revenue for legalized cannabis through 2017–2025 is $44 billion. The difference between current cannabis business taxes (subject to 280E), and those if taxed like “normal” businesses is $12.4 billion (2017 –2025 cumulative). The effective tax rate that had been nearly 85% is now substantially lower, closer to the 50% or 60% range

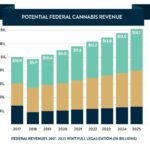

The report examines three aspects of how national legalization would look in contrast to today’s state-by-state patchwork of legalized environments, along with anticipated impacts seen by the U.S. Treasury’s coffers through full legalization. Such aspects include federal business taxes on cannabis businesses, federal payroll withholdings, and revenue generated from a federal cannabis sales tax of 15%.

Business Structures: Business structures are not tracked for cannabis businesses at the federal level, so fully understanding the proportion of businesses in the industry that are LLCs versus C-corporations, for example, is limited. Therefore, the new analysis assumes all businesses being C-corporations.

Pass-Through Deductions:

Redistribution of Profits: In some circumstances, distribution of profits to shareholders is now subject to a 20% federal tax. With limited visibility into corporate structures and those impacted by distributed dividends, the updated analysis assumes either that profits will be reinvested into existing businesses, used to invest in other businesses, or distributed outside of the 2017-2025 window analyzed within the updated report.

It is not a simple task to assess the significant tax changes that this represents. However, given the complexity of these changes this is exactly why NFD teamed up with experts from CohnReznick and the Hoban Law Group to put out the 2018 update. As with the dynamic nature of the industry, taxes and their impact on cannabis businesses remain just as complex and dynamic as ever – and one cannot reach the top of the industry without staying on top of the issues.

J.J. McCoy

J.J. McCoy is Senior Managing Editor for New Frontier Data. A former staff writer for The Washington Post, he is a career journalist having covered emerging technologies among industries including aviation, satellites, transportation, law enforcement, the Smart Grid and professional sports. He has reported from the White House, the U.S. Senate, three continents and counting.