Cannabis Reforms Worldwide Aim to Expand Legal Sales Beyond $50 Billion in 2025

New Frontier Data Projects Doubling of Global Legal Cannabis Sales to USD $51B by 2025

September 15, 2021

Catching Up for Lost Time: Legal Cannabis Markets Project to Top $51 Billion Globally by 2025

September 27, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

The emerging global cannabis economy is primed with opportunities, but complex regulations, immature supply chains, nascent consumer markets, and disruptive emerging trends will significantly increase risk and time to market over the coming years. Explosive growth seen in North American legal markets is a compelling indicator for growth potential internationally as more countries legalize cannabis.

However, given nascent but immature markets and how many foundational regulatory and supply chain structures need to be established, realizing the market’s full potential will be a high-risk, resource-intensive, and time-consuming enterprise. Investors and entrepreneurs interested in capitalizing on it must prepare for a challenging path to profitability, but those who proceed with clear understanding of the markets in which they operate, agile structures that can adapt to the evolving market, sufficient capital to weather longer-than-anticipated returns on investment, and innovative strategies to differentiate themselves in an increasingly competitive market will be best positioned for future success.

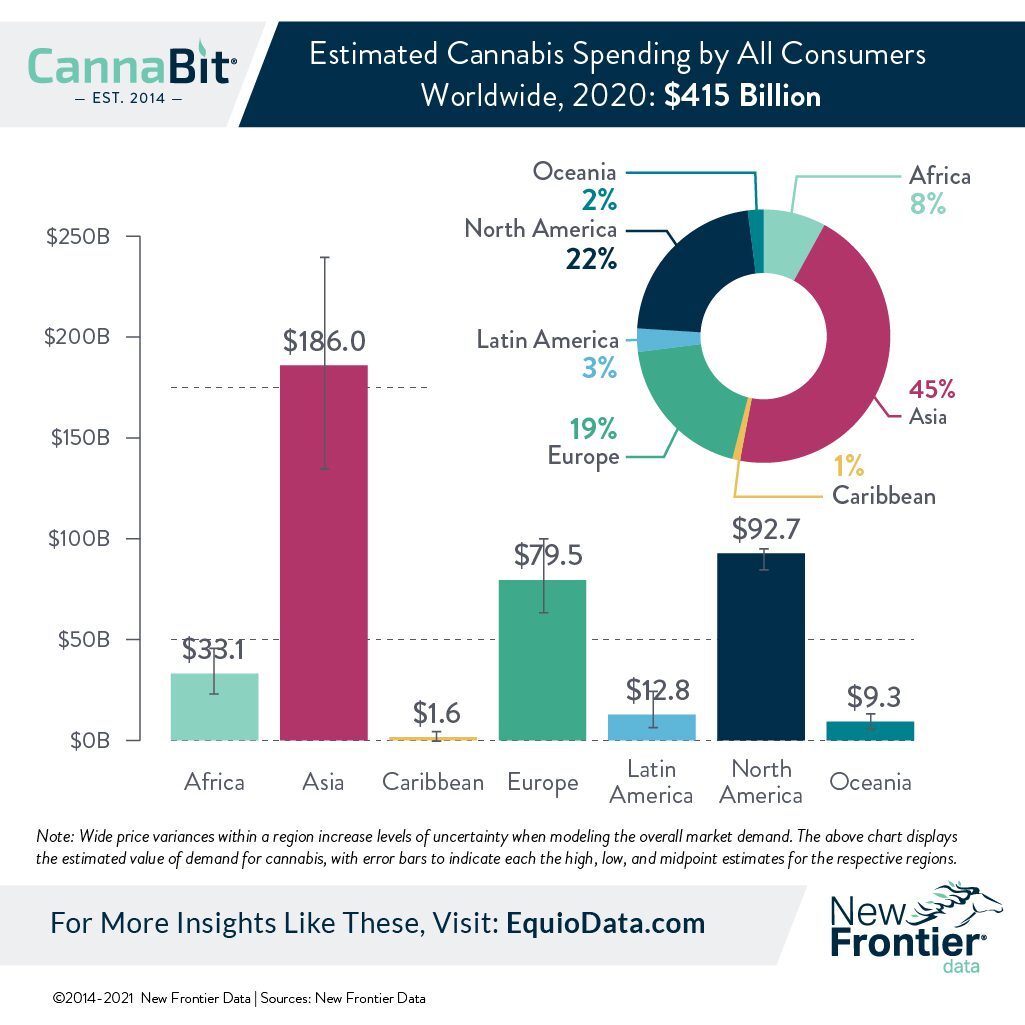

Toward that end, New Frontier Data presents its latest report, The Global Cannabis Report: Growth & Trends Through 2025, a first-of-its-kind analysis of the global market for high-THC cannabis and the drivers, trends and opportunities represented by the industry’s growth worldwide. Globally, total consumer spending on legal and illicit high-THC cannabis is projected to grow from $415 billion last year to $496 billion by 2025 (a compound annual growth rate of 3.6%), driven by expansion of legal country markets and increasing social acceptance of the plant’s therapeutic value.

Based on custom-built, predictive models for 23 regulated medical cannabis markets and six adult-use markets spanning 24 countries, the analysis incorporates unique regulatory and consumer data from each country to produce refined five-year forecasts for domestic, legal, high-THC sales to patients and adults. The report also provides analysis of total annual global cannabis demand by synthesizing factors including usage rate, pricing, and consumer spending data sourced from both legal and illicit markets across all 217 countries considered in the analysis. There are 70 countries around the world which have legalized some form of cannabis for medical use, with 26 (37%) of those countries providing medical patients with legal access to high-THC cannabis. Worldwide, 10 countries have legalized cannabis for adult-use, with six adopting a system for regulated distribution.

Cannabis regulations vary throughout the different regions across the world, with some countries developing fully regulated markets, complete with a taxed and regulated system for retail distribution of a variety of cannabis products for all adults, (e.g., Canada and in U.S. legal adult-use states), and others approaching instead choosing decriminalization with allowances for home cultivation and possession but with no framework for legal sales, like Georgia and South Africa. A few countries – e.g., Spain and the Netherlands – have legalized their cannabis markets through businesses that permit social consumption on site. Most countries to legalize access to high-THC cannabis have done so, however, by adopting a framework to allow access only for qualified medical patients.

Globally speaking, medical cannabis has been the main driver of legalization, but national medical programs have varied widely in their implementation practices. Some restrict possession and use, granting only a small number of patients with access to a tightly controlled list of imported cannabis products, while others openly allow broad patient access by approving expansive lists of qualifying medical conditions and establishing licensing for domestic production.

In Europe, many countries have taken a pharmaceutical approach to regulation (i.e., issuing products through pharmacies), with some covering the costs of medical cannabis under national health insurance systems. In Latin America, those countries that have best managed to get legal medical sales off the ground have done so via the expansion of private clinics with on-site physicians available to prescribe cannabis.

The estimated $415 billion in total sales during 2020 reflects the floor, not the ceiling, for cannabis’ long-term market opportunity. Beyond the transition of current spending from illicit to legal markets, there will be additional market growth as scientific research establishes new therapeutic applications for cannabis-derived compounds. Innovation and commercialization will introduce product forms to improve each the product quality, convenience, dosing, and consumer experience for customers. Advancements in industrial applications for cannabis biomass will create new revenue potential among non-ingestible applications for the plant. While much of the global demand would be traditionally classified as recreational, expansion and adoption of medical and industrial applications will expand the total market opportunity well beyond its current reach.

With more than 268 million cannabis consumers globally, further social acceptance and normalization of cannabis use will draw a massive consumer group with corresponding buying potential. As New Frontier Data’s cannabis consumer research has shown, consumption use spans the spectrum of demographic and socioeconomic strata. Far from being monolithic, cannabis consumers represent a highly diverse and richly varied cross-section of society. The emergence of cannabis consumers as a stand-alone market segment, combined with deepening understanding about where each consumer fits within the broader economy, will be key to building products, brands, and experiences aligned with the consequential but often misunderstood consumer group.

The emergence of cannabis consumers from the shadows will not happen uniformly, but rather begin first in the world’s most progressive markets before slowly progressing within more restrictive markets. However, in a digitally connected age where information about cannabis can seamlessly slip across (most) borders, the advancement of legalization will elevate global awareness and discussion about cannabis even as access to legal markets remains limited to small subsets of the global consumer population.

To download the report or to register for New Frontier Data’s next industry briefing via webinar (on Thursday, Sep. 23 at 3 p.m. EDT), please visit the Global Cannabis Resource Center.