Catching Up for Lost Time: Legal Cannabis Markets Project to Top $51 Billion Globally by 2025

Cannabis Reforms Worldwide Aim to Expand Legal Sales Beyond $50 Billion in 2025

September 20, 2021

Fragmented Markets and Patchwork Regulations Aside, North America Sets Global Course for Legal Cannabis Industry

October 4, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data; and J.J. McCoy, Senior Managing Editor, New Frontier Data

Nearly a century since the League of Nations signed the revised International Opium Convention of 1925, which for the first time added cannabis to the international community’s list of prohibited drugs, the modern world seems inclined to make up for lost time. As comprehensively analyzed in New Frontier Data’s new Global Cannabis Report: Growth & Trends Through 2025, since 2019 the number of countries with some form of legalized cannabis has increased from 50 to 70, with global legal sales projected to reach $51 billion by 2025, and consumers forecast to spend $430 billion across legal and illicit markets this year alone.

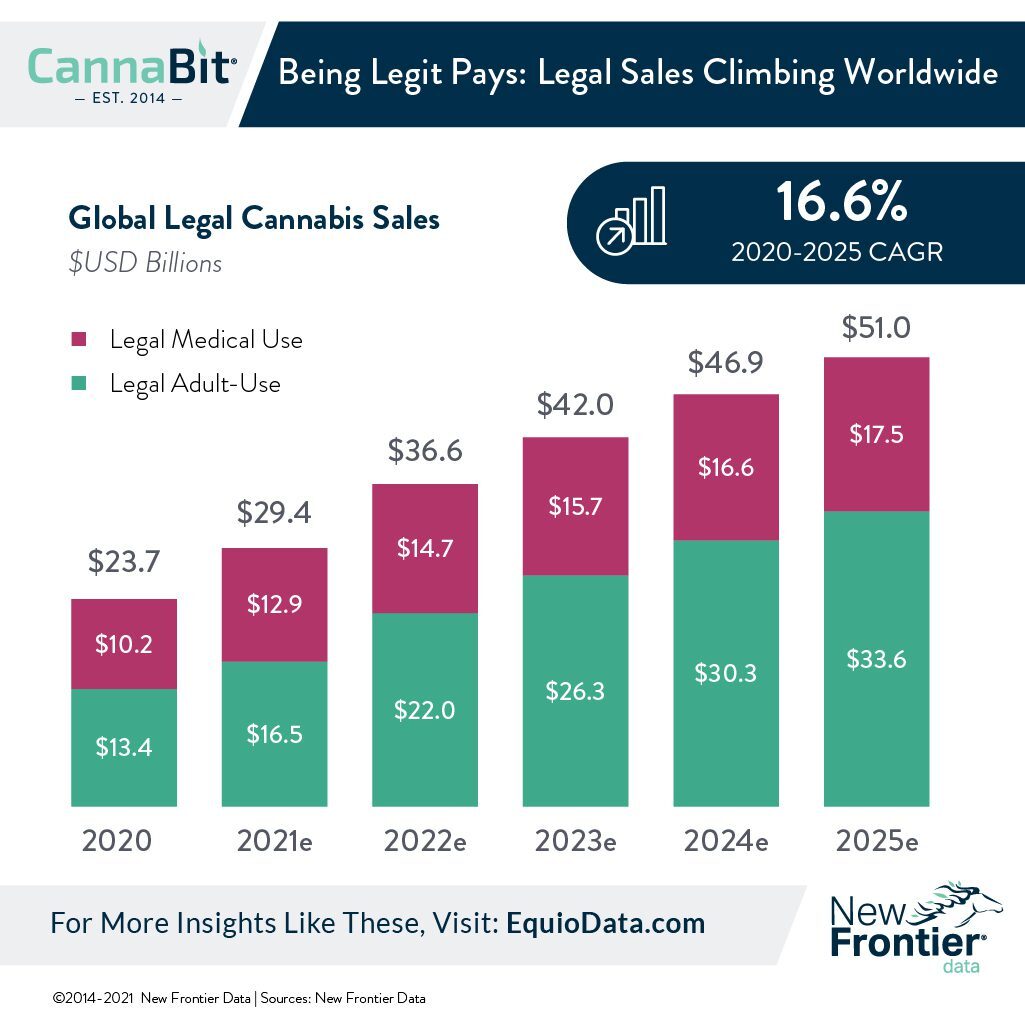

Sales of high-THC cannabis through legal regulated markets totaled $23.7 billion in 2020, with the combined legalized medical and adult-use state markets in the United States alone accounting for $20.3 billion (86%). Legal regulated markets captured 6% of total global demand for cannabis in 2020. However, strong growth in the largest and most dominant markets (i.e., U.S. and Canada) is projected to push combined legal sales to an estimated $51 billion by 2025.

Despite the lack of a national legal framework, medical and adult-use cannabis sales in legal state markets totaled $20.3 billion in 2020. That was 10x the amount of legal spending seen in any other legal market in the world. Canada, the world’s second country to federally legalize adult-use cannabis – and the first G7 nation to do so – saw over $2 billion of high-THC cannabis sold through its growing national footprint of medical and adult-use dispensaries in 2020.

Outside of North America — which has the highest rates of social acceptance for cannabis use, and the most advanced consumer markets — legal sales of high-THC cannabis were markedly smaller. Germany, which allows insurance reimbursements for medical cannabis patients, in 2020 had the largest legal medical cannabis program in Europe by a wide margin, with an estimated $206 million* in legal high-THC products sold to all patients.

(*Note: Germany’s figures include estimates for high-THC sales both by patients using insurance to reimburse products, as well as patients accessing products through private health market.)

It is important to note that while Spain does not have a federally regulated program for legal cannabis access, its autonomous provinces have permitted private spaces, which serve as club where members can buy and consume cannabis. There is no single authority or cannabis-licensing agency for the country, and without formal regulations the popularity of cannabis clubs exploded over the past 10 years, particularly near Barcelona in Catalonia, where clubs have capitalized on legal loopholes to allow tourists to purchase and consume cannabis. The existing system is under review after a court ruling this year, and thus Spain is not included in the New Frontier Data Global Legal Market Projections. However, sales through clubs in Spain totaled an estimated $431 million in 2019 (the year prior to COVID-19 closures and shutdowns), which would mark it as the third-largest national market behind the U.S. and Canada should it become fully legalized and regulated.

During a Sep. 23 webinar, “Exploring The Global Cannabis Economy: Trends, Projections & Opportunities”, New Frontier Data’s Chief Knowledge Officer John Kagia noted that while “over $8 billion of capital is invested in this market” already, “That rate of investment is only expected to grow.” While it will necessarily be incumbent on cannabis companies to understand and adapt to each particular region, and address the respective local needs and demand, such demand will be forthcoming. Kagia expects medical use to drive participation, with consumers’ desire to address various conditions of chronic pain being a “really critical element.”

Tim O’Neill, international VP of international markets for SōRSE Technology, said that while as a practical consideration, navigating the regulations in one’s various targeted markets may be the most immediate concern – “either you can sell there, or you cannot” – it is fundamental to understand the consumer demand.

After 12 years in the industry and some 30 issued patents for LED lighting solutions, Mikhail Sagal understands how navigating a particular country’s regulatory framework is what will drive success in that space. The founder and president of TSRgrow cautions that while ultimately international standards will need to be established, for the foreseeable future agility is imperative. Whether it be pharmaceuticals or food products, he said, since standards “will all have to change and become more standardized and acceptable, [a company] will have to change and be able to adapt in changing systems.”

The bottom line for one’s bottom line, suggested Lincoln Eckhardt of FTI Consulting, is to aspire for the best yet anticipate the worst. He is FTI’s co-leader for its cannabis practice, and specializes in valuation and determining economic damages throughout the legal cannabis industry. He reminds how the vaping crisis of 2020 once threatened the nascent industry before legal cannabis would be deemed essential business after the exponentially larger outbreak of the COVID-19 pandemic. Though neither of those events were anticipated, both were met head-on and addressed. “Would that have been the answer a year or 18 months ago?,” Eckhardt mused. “Look at separate medical markets – [while] Oklahoma has very few rules, when Alabama comes online, it will be incredibly restrictive,’ so stakeholders must ascertain its risk assessment and corporate investment in terms of what it decides to be worth offering.

While confirming whether it is worth a company’s efforts to navigate the local regulations, O’Neill said that due diligence is called for. “If you are spending money on risk assessments in the European market, you must have something that they want to buy.” While he adds that there is a huge amount of confidence required for anyone to succeed, there are also ways of being imaginative and adhering to regulatory systems. Certainly, the profit motive is there. “Anyone who is not looking at the opportunities in the Chinese and Indian markets needs to take a look,” he concluded.

Legal Medical Markets

Globally speaking, medical cannabis has been the main driver of legalization, but national medical programs have varied widely in their implementation practices. Some restrict possession and use, granting only a small number of patients with access to a tightly controlled list of imported cannabis products, while others openly allow broad patient access by approving expansive lists of qualifying medical conditions and establishing licensing for domestic production.

In Europe, many countries have taken a pharmaceutical approach to regulation (i.e., issuing products through pharmacies), with some covering the costs of medical cannabis under national health insurance systems. In Latin America, those countries that have best managed to get legal medical sales off the ground have done so via the expansion of private clinics with on-site physicians available to prescribe cannabis.

In 2020, there were an estimated 4.4 million active medical cannabis patients globally who accessed legalized, high-THC products (84% of those patients being Americans registered among 38 U.S. state medical cannabis programs in operation). The number of patients in those programs is projected to grow by more than 2 million over the next five years, to a combined 6.5 million worldwide by 2025.

When ranked by density or saturation (i.e., the number of registered medical cannabis patients expressed as a percentage of a population) the U.S. territory of Puerto Rico registered the highest rate of patient participation, with 3.9% of its population enrolled as of July 31, 2021. Puerto Rico’s program is modeled after the more openly accessible medical cannabis programs in the U.S. Patients on the island can register for a range of qualifying conditions, including anxiety, depression, or chronic pain, and have access to a relatively wide variety of high-THC products at medical dispensaries. The island also operates a patient reciprocity program, allowing medical cannabis patients registered in other jurisdictions to purchase products at the island’s dispensaries. That policy has been key in driving participation among tourists visiting the island.

In countries with regulated medical cannabis sales, patient participation rates are primarily driven by the types of accepted qualifying conditions for program entry; the quality, variety, and availability of high-THC cannabis and cannabis products; and price competitiveness among legally regulated products relative to those found in the local illicit market. Some countries have enacted legal medical cannabis markets and adopted liberal regulations on patient qualifications, but failed to provide adequate varieties of products at reasonable prices, leading to high rates of patient registration but low rates of active participation via purchases from regulated sources. In those cases, cannabis consumers become medical cardholders, but continue to purchase cannabis from the illicit market at much lower prices.

Legal Adult-Use Markets

Annual global legal sales of adult-use cannabis are projected to double those of legal medical sales by 2025, despite the higher number of medical markets globally.

While 10 countries in the world have approved cannabis for adult use, only six have adopted systems for regulated distribution of high-THC cannabis products. The Netherlands and Spain have each adopted a decriminalized club/social-use model, and others (e.g., South Africa and Jamaica) have decriminalized cannabis for adult use but only through restricted access for certain demographics or religions (e.g., the Rastafarian community), or legalized adult-use programs but without frameworks for distribution to consumers.

During calendar year 2020, there were a total of four legally operating adult-use cannabis markets with regulated retail sales, dominated by the U.S. and Canada. Uruguay, the world’s first country to fully legalize and regulate adult-use cannabis, sold roughly 1,700 kg of high-THC cannabis to registered adults, while the Netherlands sold an estimated $104 million worth of high-THC cannabis through its network of retail coffee shops.

For a complimentary copy of The Global Cannabis Report: Growth & Trends Through 2025 , download the report here.