CBD Archetypes Illustrate Nuances Between CBD consumers and Potential Customers

86% of Americans Know of CBD

May 19, 2020

U.S. CBD Consumer Archetypes

May 24, 2020By Molly McCann, Director, Industry Analytics, New Frontier Data

Age and gender do not tell the whole story.

In a new survey of more than 4,000 Americans demographically representative of the general population of the United States, New Frontier Data has gathered information about people’s uses, purchasing habits, beliefs, and attitudes about the cannabinoid CBD and products containing it. Survey themes include CBD use, purchasing behavior, decision influencers, product preferences, and expenditures, plus beliefs about CBD, and policy attitudes. The results are discussed in New Frontier Data’s U.S. CBD Consumer Report: Archetypes and Preferences, Volume 1, produced in partnership with Square.

While some significant differences were noted among genders and age cohorts, trying to fully understand consumers based on one or two dimensions of their identities is inadequate for marketers to develop an effective overarching approach for consumer engagement in the increasingly crowded, rapidly maturing market.

Just as New Frontier Data became the first to identify archetypes among higher-THC (marijuana) consumers, now we have developed archetypes to better identify and relate to both American CBD consumers and nonconsumers.

Algorithmic clustering is a technique used to automatically group respondents by the degree to which they are alike or dissimilar from others. A resulting group is a collection of consumers who are like others in their group, but unlike those in other cohorts. Crucially, similarities and differences span not only one variable (e.g., age or gender), but dozens of dimensions among respondents’ behaviors, beliefs, attitudes, and respective e exposure to CBD.

Clustering allows inherent similarities and differences among groups to emerge, as opposed to predefining (or guessing) the qualities of each group.

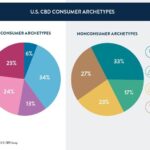

Through such methods, New Frontier Data has identified nine unique archetypes — five groups of CBD consumers and four groups of nonconsumers — and the key behaviors and beliefs which importantly distinguish each group.

CONSUMER ARCHETYPES

Key variables differentiating consumers include their frequency of CBD use, beliefs about the benefits of CBD, and roles in promoting CBD or absorbing messages about it among their social circles. As regards CBD in particular — given its relative novelty for most consumers, and the often confusing messaging, unfamiliar advantages, and uneven social promotion about it — informative communication is fundamentally important.

Exuberant & Intense (6% of consumers) – Extremely enthusiastic, frequently consuming, high spenders.

Integrative & Consistent (34% of consumers) – CBD believers, experienced consumers, moderate spenders.

Skeptical and Limited (13% of consumers) – Treating pain, moderate spenders, skeptical of some applications.

Receptive & Reserved (24% of consumers) – Believe in CBD’s benefits, not connected to other consumers, lower spenders.

Ambivalent & Experimental (23% of consumers) – Never purchased CBD, may no longer consume, least enthusiastic.

NONCONSUMER ARCHETYPES

Among nonconsumers, some key differences include their likelihood of (and circumstances for) using CBD, level of knowledge and familiarity with it, and — vital for CBD companies to understand — what factors have prevented them from trying it.

Knowledgeable & Primed (33% of nonconsumers) – Most likely to try CBD.

Cautious & Curious (17% of nonconsumers) – Still have some lingering concerns.

Informed & Indifferent (23% of nonconsumers) – Have decided CBD is not for them.

Unaware & Uninterested (27% of nonconsumers) – Lack information or interest in CBD.

For an introduction to and professional appreciation of such archetypes for targeted outreach and marketing, download the report.