Colorado’s Legal Cannabis Market at 7: Amid a Rocky Product Landscape, Flower’s Popularity Endures

New Frontier Data to Acquire the Medical Cannabis Businesses of Skylight Health Group Inc.

October 29, 2021

Growing the Market: Plants Under Cultivation Underscore Legal Cannabis’ Promise

November 8, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

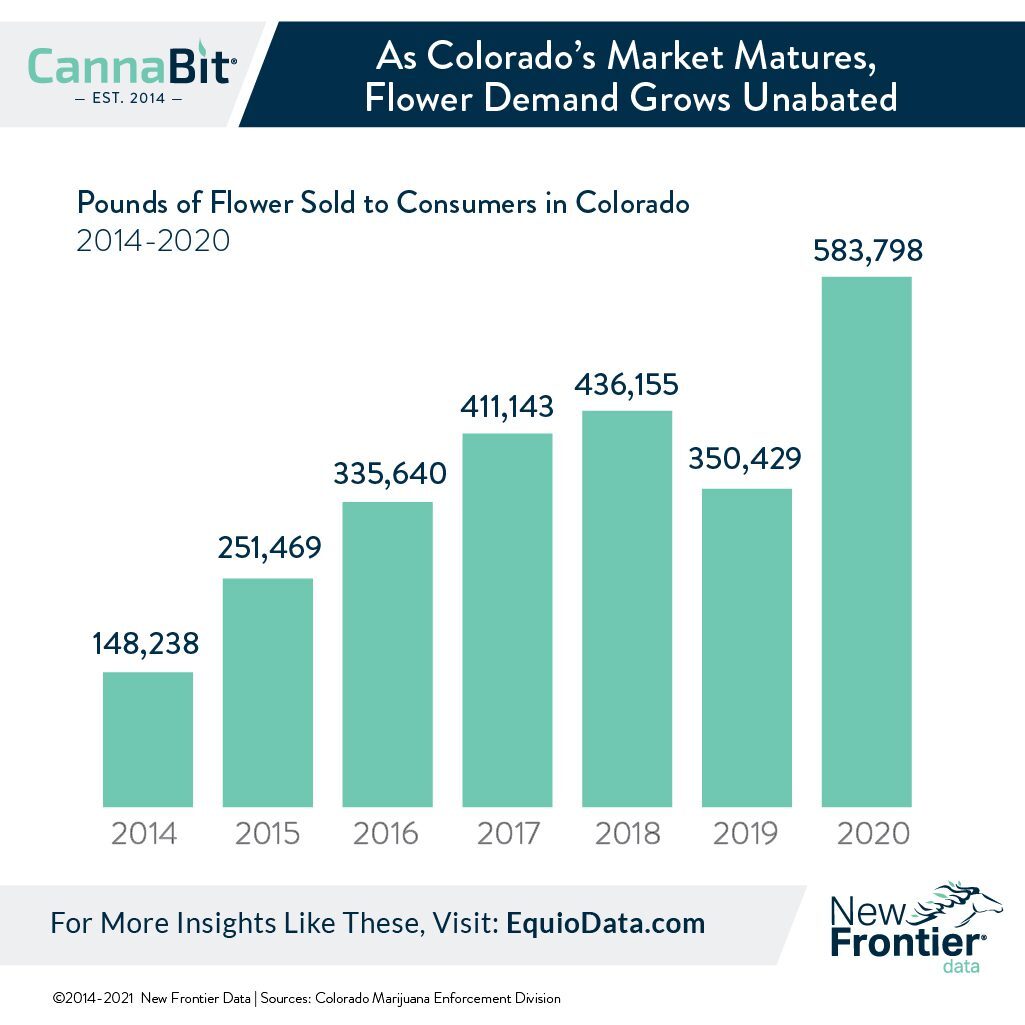

Seven years since the launch of recreational sales in Colorado, growth in demand for flower is showing no sign of abating. From 2014 to 2020, annual flower sales nearly quadrupled, increasing from 148,000 lbs. to 584,000 lbs., at a 26% compound annual growth rate. Flower sales were especially robust last year despite the COVID-19 pandemic, as demand surged to record levels in March and remained significantly above historic levels for the rest of the year.

Quantifying an average-sized joint at 1/3 of a gram, Colorado sold the equivalent of 201 million of them in 2014, rising to 795 million joints in 2020. Over those seven years, Colorado has sold the equivalent of 3.4 billion 1/3-gram joints, a number made more impressive given the state’s relatively small population of 5.7 million.

That flower sales continue to increase at such a pace seven years since the market launched suggests that smoking flower will remain a durable preference for the foreseeable future. However, the dominance of flower belies the seismic changes happening to consumer behavior, and highlights the imperative for producers and brands to understand the tides of evolving consumer preferences.

While flower continues to dominate the product landscape, consumer preferences are evolving, but not uniformly. According to New Frontier Data’s 2021 Cannabis Consumer Evolution report, more than half (57%) of consumers report consuming both flower and non-flower cannabis products, with 19% saying they do not consume flower at all. Furthermore, younger consumers were twice as likely as older consumers to report consuming both flower and non-flower products (e.g., ages 18-34 – 70%; ages 55+ – 35%), while older consumers were more than twice as likely to report that they only consume flower (e.g., ages 18-34 at –15%, versus ages 55+ at – 40%).

The most frequent cannabis consumers have proven more likely to enjoy a mix of flower and non-flower products, with the least-frequent consumers more likely only to smoke flower. Fully half (50%) of those consuming less than once a year, and 30% of who consume a few times a year, exclusively use flower, compared to 20% of those groups who report consuming cannabis at least once per month.

Women were more likely than men to eschew flower entirely – 26% of women reported not consuming flower (compared likewise to 15% of men). Similarly, 30% of self-described medical patients report not using flower (compared to 14% of recreational consumers), owing to health considerations about smoking among patients.

Flower consumption remains higher in unregulated markets. One-third (33%) of consumers living in illicit markets reported being only flower smokers, compared to 22% among those living in adult-use markets. Additionally, consumers’ preferences also appear to be influenced by their choices of outlets. Consumers who purchase from formal sources (i.e., brick-and-mortar dispensaries or delivery services) were far more likely (28% to 13%) not to consume flower than were those relying on informal sources. That dynamic reflects the regulated market’s power in introducing consumers to new, alternative product forms: Not only is the legal market far more effective in innovating new product forms than is the illicit market, but the retail experience by which consumers can speak with knowledgeable budtenders regarding their needs and preferences is hastening the adoption of value-added products in regulated markets.

While smoking shows resilience for being the primary means by which cannabis is ingested, a generational change is anticipated as more consumers either supplement flower with non-flower products or give up smoking flower altogether. The fragmentation of the product landscape is quickly reshaping the flower-dominant segment of the market; based on current trends, consumers who use flower exclusively are likely to become increasingly dominated by older, male, and less-frequent users.