COVID-19 and the Purchasing Practices of Cannabis Consumers

California Cannabis Sales Gather Momentum

March 22, 2020

The Impact of COVID-19 on the Purchasing Practices of Cannabis Consumers

March 29, 2020By Josh Adams, Senior Industry Analyst, New Frontier Data

Since the outbreak of the worldwide COVID-19 pandemic, social distancing measures have been gradually implemented across the United States. For many municipalities, measures include closing or limiting access to retail establishments, disruption of the supply chain, and consumers’ stockpiling goods. While cannabis operations have been declared essential businesses in many of the states where legal and regulated, consumers remain concerned about both their access to, and the availability of, cannabis in an uncertain environment.

New Frontier Data recently conducted a survey to gauge how cannabis consumers were responding to the uncertainty. A majority (60%) of them reported having purchased cannabis or cannabis products in the previous two weeks as a direct response to the COVID-19 outbreak. Medical cannabis patients were more likely to have stockpiled products in the past two weeks than were recreational consumers (65% vs. 47%, respectively).

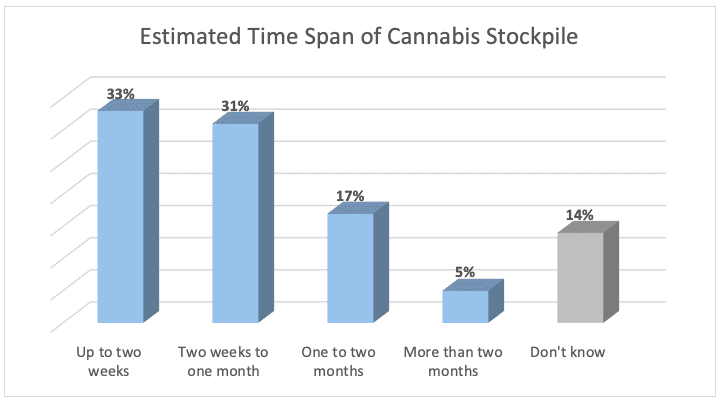

While 33% of consumers reported extending their supply for up to two weeks, more than half (53%) stockpiled beyond two weeks’ supply. Roughly a fifth (17%) of consumers indicated that they had extended their supply for up to two months. Again, when segmented by user type, medical users were more likely to have extended their supplies by up to a month than were recreational consumers (22% vs. 13%).

Given the uncertainties across retail markets and the continued availability of cannabis products, New Frontier Data asked consumers who were stockpiling where they were sourcing their cannabis. More than one-third (35%) of consumers purchased from brick-and-mortar stores, with slightly lower numbers relying on private dealers (31%) or friends and family (30%). A reported 16% of consumers used delivery services, which are expected to become more popular as consumers continue to self-isolate, and since local governments which initially rejected delivery services have permitted them in order to ensure consumer access and promote public health.

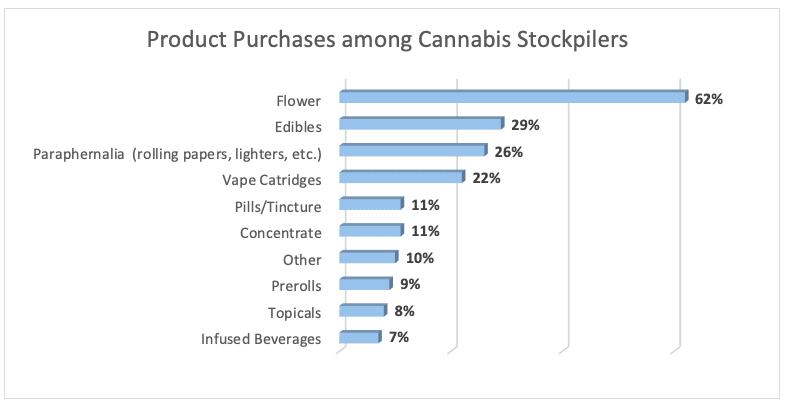

Flower has long been the most popular product form, and it remains so among stockpiling consumers with 62% buying flower, followed by 29% choosing edibles, and 22% opting for vape cartridges. More than a quarter (26%) of consumers also reported stocking up on paraphernalia (e.g., rolling papers, lighters, etc.).

Consumers were asked whether their personal consumption of cannabis had changed as a result of the COVID-19 outbreak. Almost half (49%) responded that there was no change in their cannabis consumption, while 29% noted an increase and 20% a decrease. Among medical cannabis consumers, 39% reported consuming more often whereas 21% had decreased their usage. Among recreational consumers, 23% reported an increase compared to 19% seeing a decrease in their cannabis use.

Among those who reported an increase in cannabis consumption, stress and anxiety stemming from COVID-19 were often cited as core motivations. One respondent described “more anxiety and stress due to COVID19. My immunocompromised mother lives with me and I also don’t have insurance.” Another similarly related “more anxiety [as] my parents are old and live with me, and my youngest son has asthma. So, I smoke more to help me be still.”

Boredom and increased downtime at home were also reasons cited by consumers for using more cannabis. They included innovative strategies for socializing, as one respondent wrote that they had “more downtime and [being] at home more than out socializing. Will video chat with friends and have a ‘sesh’.” As another respondent summarized, “home more, can do it more, not driving, not going to work.” Cannabis becomes a means to occupy empty hours.

New Frontier Data will continue to analyze how consumers and the cannabis industry respond to the COVID-19 outbreak and the resultantly shifting economic environment. Those and related topics shall be discussed in greater detail during an April 2 online event, Global Cannabis Town Hall: New Economic Realities.