Despite Bumps, CBD Market Growing Toward Convenience Store Shelves

The Home Grow Market Could Grow Quickly as Adult Use Expands

September 16, 2018

Navigating the Maze of the Cannabis Market After the Daze of Summer

September 22, 2018By William Sumner, Hemp Business Journal Contributor

The potential both practical and profitable for cannabidiol (CBD) has been gaining an increasing amount of national attention. From alleviating intractable seizures to soothing anxiety, CBD’s health benefits have (anecdotally) become well known, which has translated to millions of dollars’ worth of investment from entrepreneurs and investors, and the attention of suitors including Coca-Cola.

The trend has particularly become pronounced in recent years as convenience store shelves have become stacked with a veritable cornucopia of hemp-derived CBD products including CBD gummies, beverages, vape-able oils, extracts, and supplements.

Unfortunately, some such CBD products often misrepresent themselves as a “legal high,” with images of cannabis leaves or smoking joints or a Jamaican flag emblazoned on their packaging.

Other companies will try to blur the line between hemp-based CBD and its higher-THC cousin cannabis by giving their products the name of cannabis strains such as Pure CBD Vapors (which sells vaping liquids with loaded names such as Purple Haze and Wowi Maui).

Because of increased relative interest in both hemp-based CBD and the deceptive practices of a handful of companies, the U.S. Food and Drug Administration (FDA) has been adamant about sending warning letters to CBD companies deemed to have crossed the line with their advertising. . Nevertheless, FDA warning letters have done little to limit such practices or quell the public’s interest in CBD products.

Late last year, headlines were ablaze with news that Target had begun to sell online CBD products from leading hemp brand CW Hemp. That news proved to be short-lived as the national retail giant quickly reversed its decision.

Similarly, news broke earlier this year that the convenience store chain 7-Eleven would partner with Denver-based producer Phoenix Tears to sell hemp-based CBD items by the end of 2018. Shortly after Phoenix Tears issued a press release announcing the partnership, 7-Eleven’s corporate offices issued a statement denying any relationship.

Despite the false starts, CBD is making its inroads to mass-market retail. Independent grocery chains such as Lucky’s Market have begun to stock CBD products, and stores like Alfalfa’s Market have even started selling their own brand of CBD oil. While shying away from specifically offering CBD products, the Florida-based grocery chain Publix has begun selling hemp oil marketed as an “organic superfood.”

Outside of grocery stores and retail chains, some CBD oil producers have started to make inroads in convenience stores. For example, Marijuana Company of America recently launched Convenient Hemp Mart, a hemp-CBD brand specifically designed for those outlets.

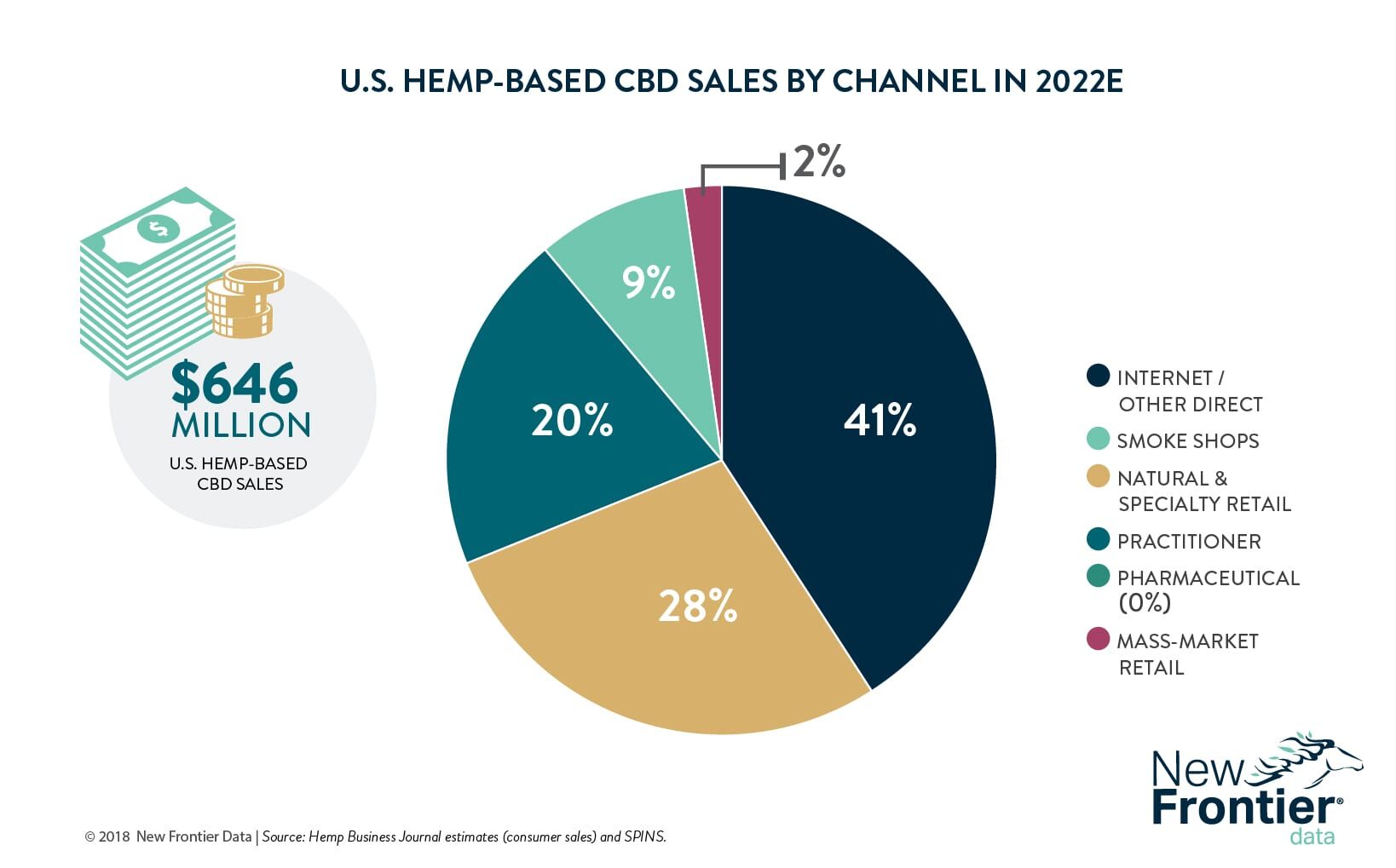

Regardless of sales channel, the hemp-CBD market is poised to become big business. Hemp Business Journal (a division of New Frontier Data) estimates that by 2022 hemp-based CBD sales will reach $646 million. As the market matures, that number should climb, especially if Congress passes the 2018 Farm Bill to fully legalize commercial hemp production in the United States. Should that happen, expect to see explosive growth within both the CBD and hemp industries, and expanded offerings of hemp-derived products in mainstream retailers.

William Sumner

William Sumner is a writer for the hemp and cannabis industry. Hailing from Panama City, Florida, William covers various topics such as hemp legislation, investment, and business. William’s writing has appeared in publications such as Green Market Report, Civilized, and MJINews. You can follow William on Twitter: @W_Sumner.