Hurricane Irma Wreaks Havoc: Florida’s Failsafe Measures Proved Sound

September 17, 2017Flower As Percent of Total California On-Demand Sales

September 24, 2017

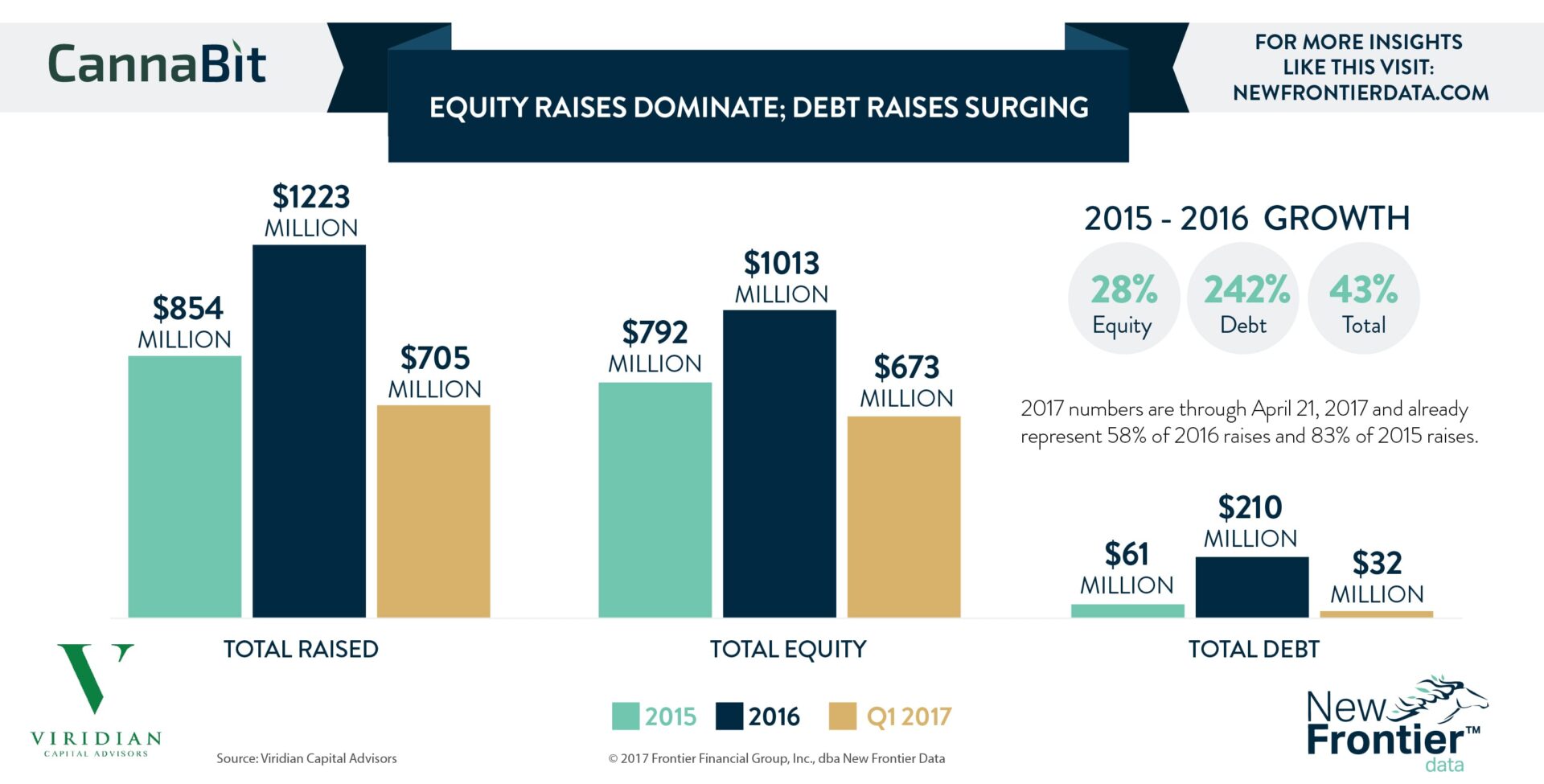

- A recent New Frontier Data report, Investing in the Cannabis Industry, produced in collaboration with Viridian Capital Advisors, includes reviews of 439 private capital deals collectively worth $1.9 billion.

- Among those, the vast majority (83%) were equity deals, through which investors receive a stake in each company they fund.

- Debt deals, though a small portion of all deals closed, grew dramatically between 2015 and 2016, jumping 242%. Comparatively, the number of equity deals increased by 28%.

- The growth in debt financing signals both a maturation of the market, and a shift in where capital is flowing, with significant increases in financing for businesses like cultivation operations where debt financing is often better suited than equity deals.

- For more information, see Investing in the Cannabis Industry, available here.