Evolution of the Cannabis Consumer from 2018 to Now

U.S. Hemp Producers Beginning to Go with the Grain

April 5, 2021

Cannabis Consumer Group Evolves to One of the World’s Most Lucrative Demographics

April 15, 2021By Josh Adams, Ph.D., Senior Industry Analyst, New Frontier Data

The landscape of the cannabis industry in the United States has been rapidly maturing over the past decade, with a consumer evolution that has accelerated in recent years. That evolution has been spurred by each greater legal access to cannabis, a broader range of available products, and a diminishing stigma associated with cannabis use. New Frontier Data has been tracking cannabis consumers to better understand their motivations, their changing tastes and behaviors, and their roles and influences in responding to seismic shifts in the industry.

New Frontier Data’s newest report, the 2021 U.S. Cannabis Consumer Evolution: Archetypes, Preferences, and Behaviors, continues to refine cutting-edge research about cannabis consumers’ preferences and behaviors. Building upon previous analysis of the cannabis consumer, the report not only captures consumer preferences and behavior in the current marketplace, but also follows how such behaviors have shifted since 2018. To that end, the report provides an in-depth understanding of contemporary cannabis consumers.

Drawing on a nationally representative survey of cannabis consumers from across the U.S., New Frontier Data aims to capture key trends and transitions which have occurred over the past three years. With the expansion of legal, regulated cannabis markets, the American consumer experience has increasingly started to resemble that of those adopting other consumer goods. Specifically, consumers’ purchasing cannabis from private dealers has fallen 8% since 2018, while those acquiring cannabis from friends have decreased doing so by 6%. There has been a corresponding increase in cannabis purchasing from businesses, with brick-and-mortar storefronts experiencing a 13% increase, while online delivery services have increased by 7%.

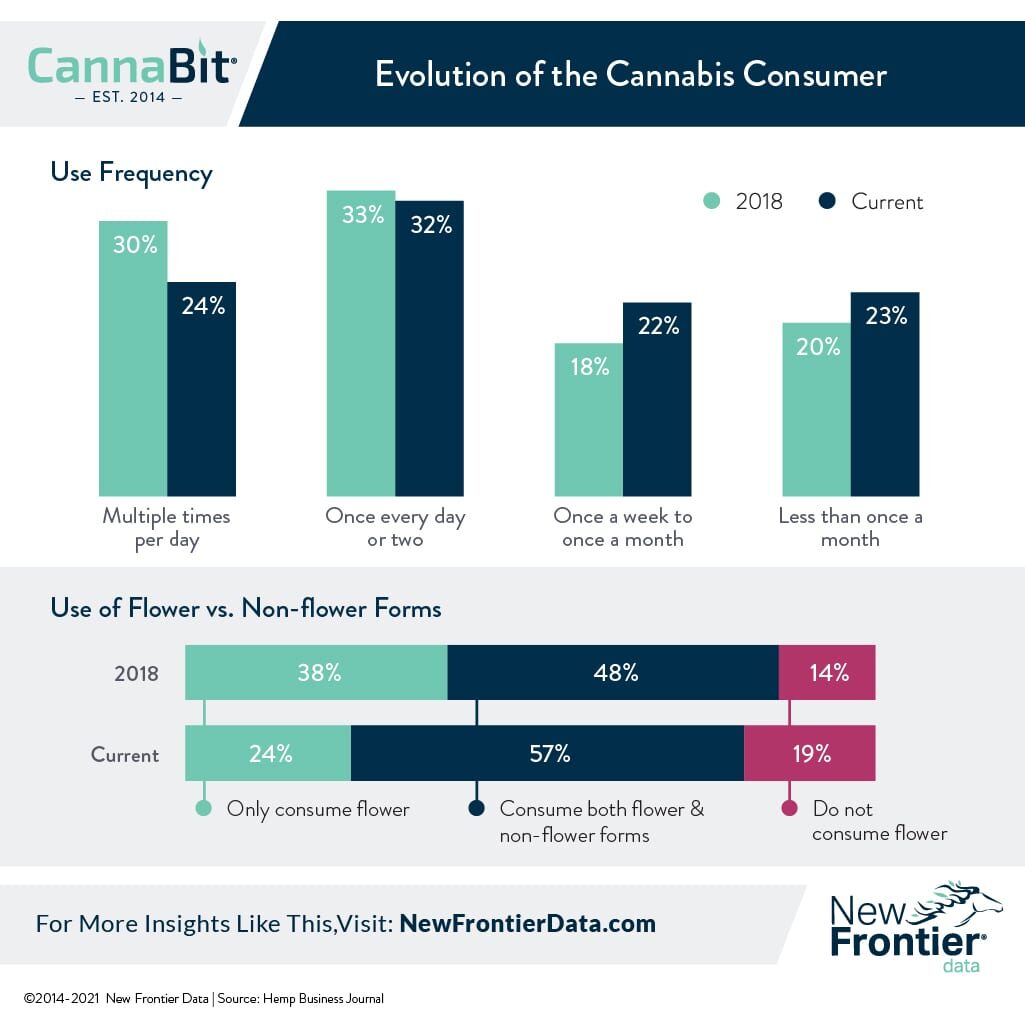

As cannabis availability grows, there are identifiable changes reflected in overall use rates. The percentage of consumers who report consuming cannabis multiple times a day has fallen roughly 6% since 2018. However, those who consume either once a week (+7) or less than once a month (+3) have both increased. In part, those shifts in consumption can be attributed to newer consumers who often are exploring cannabis and incorporating it into their lifestyles as an occasional indulgence.

With the greater availability of a diverse product forms, there has been discernable movement regarding the types of cannabis which consumers are purchasing. Since 2018, there has been a 14% decrease among consumers who use flower exclusively, while those who only consume non-flower products have increased 5%.

Even though flower remains the dominant choice of product form (while slipping about 5% from 2018 to present), other forms have seen significant increases. Consumers reporting that they have used edibles increased 19%, while those sampling topicals and tinctures each grew by 8%. Notably, in 2018 one-third of cannabis consumers reported having used a CBD-only product; by 2021, more than half (54%) have been reporting having consumed a CBD-only product. The increase is likely a reflection of the increased availability of CBD products both among cannabis-specific outlets and other retailers.

The U.S. cannabis consumer survey is a continuation of New Frontier Data’s series of ongoing consumer research and analyst reports examining the cannabis marketplace in the U.S. and globally to glean, interpret, and provide in-depth insights into the expansive consumer segments of the international legal cannabis industry.