U.S. Hemp Producers Beginning to Go with the Grain

Cannabis Industry Big Data Pioneer New Frontier Data Accelerates International Growth, Expands Leadership Team

March 30, 2021

Evolution of the Cannabis Consumer from 2018 to Now

April 12, 2021By Trevor Yahn-Grode, Data Analyst, New Frontier Data

Hemp cultivated for seed and grain comprised approximately 10% of 2020 total U.S. acreage, approximately 14,000 acres, according to data provided by Hemp Benchmarks. By comparison, Canadian cultivators grew more than 5x that acreage, beyond 75,000 acres, the vast majority of which was exported to the United States. Despite Canada’s long-held dominance in grain – exports to the U.S. have exceeded $300 million USD since 2010 – the U.S. is quickly closing the gap as the former artificial protectionism provided by prohibition evaporates.

As detailed in New Frontier Data’s new release, U.S. Hemp Market Landscape: Cannabinoids, Grain & Fiber, growth in U.S. acreage is being fueled largely by increased consumer demand for plant-based proteins, as well as optimism that hemp legalization will broaden potential end markets for grain. Though the U.S. Food & Drug Administration (FDA) has granted hemp grain products with Generally Recognized as Safe (GRAS) certification, it has yet to approve hemp seeds for any animal-feed applications. While industry support groups are making headway on the issue, lack of access to animal-feed markets has been a major barrier to growth in the hemp grain space since the beginning of state pilot programs in 2014.

Hemp grain production in the United States is most concentrated in three states – Indiana, Montana, and North Dakota. Those states possess climates similar to the Canadian prairie, where most Canadian hemp is cultivated. Overall, U.S. demand is rising, but the industry still requires buy-in from national brands to achieve significant growth, and that has been complicated by consumer confusion about the presence of CBD in hemp seed products.

Unless manually added, CBD is not present in hemp seed products, though a lack of consumer awareness has led many potential customers to conflate the two. Beyond regulatory reform and buy-in from national brands, the hemp grain industry requires the development of stable and dependable genetics. “Running hot” – i.e., growing hemp which exceeds legal limits to organic THC in the crop – is not an acceptable risk for most farmers, and serves as a major barrier to adoption to farmers located in lower latitudes.

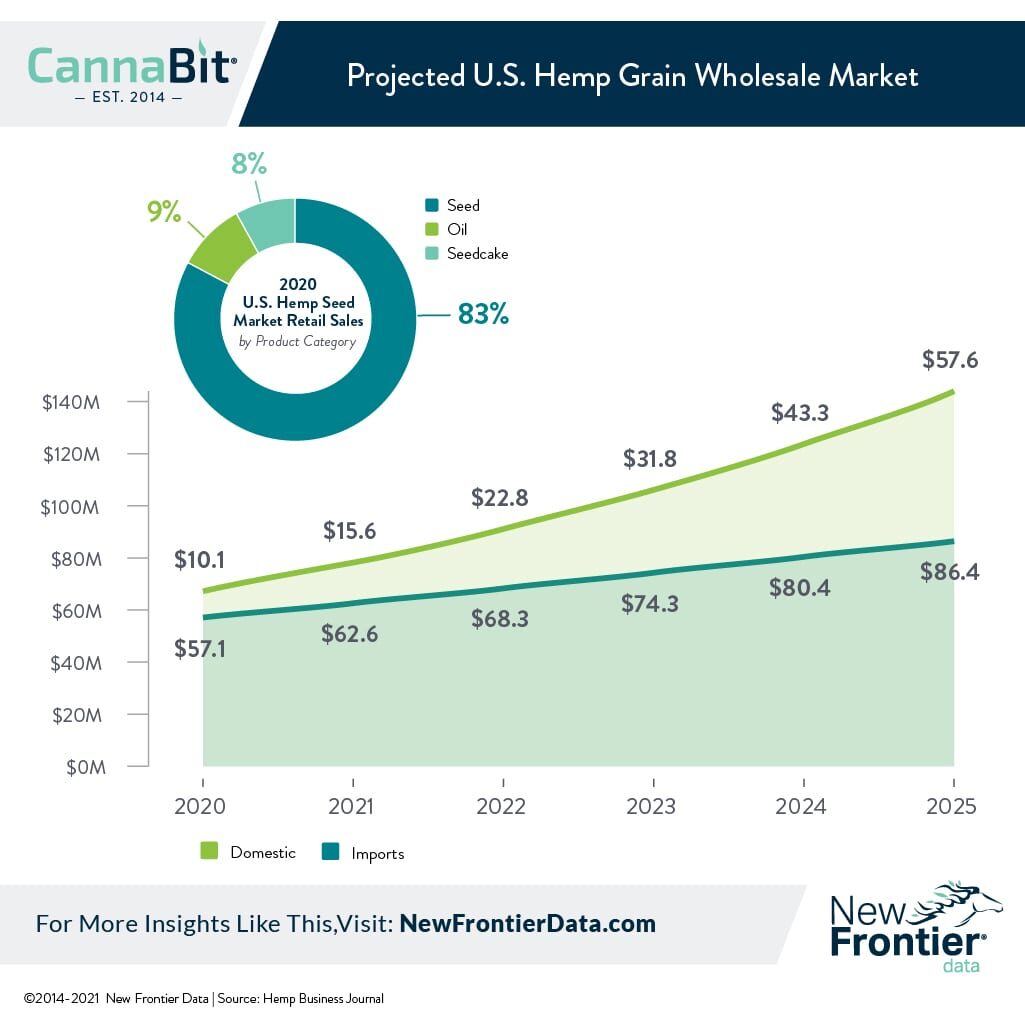

New Frontier Data projects that 2020 retail sales for hemp food products will account for $67.1 million, and grow to $144.1 million by 2025, at a compound annual growth rate (CAGR) of 16.5%. Seed-based products were the most common type of hemp food (accounting for 83% of total sales), while oil and seedcake products made up 8% and 9%, respectively. The most prominent company in the hemp foods space is Manitoba Harvest, which represented 58% of the market in 2020. Manitoba Harvest was acquired by Tilray in 2019 for $317 million USD. The fastest-growing product category of hemp seed products is protein powder, which rang up $4.7 million in total sales in 2020.