Five-Year Outlook for U.S. Legal Cannabis Industry Swells After Election Day, Revised California Receipts

New State Markets, California Numbers Boost Outlook for Legal Cannabis

December 7, 2020

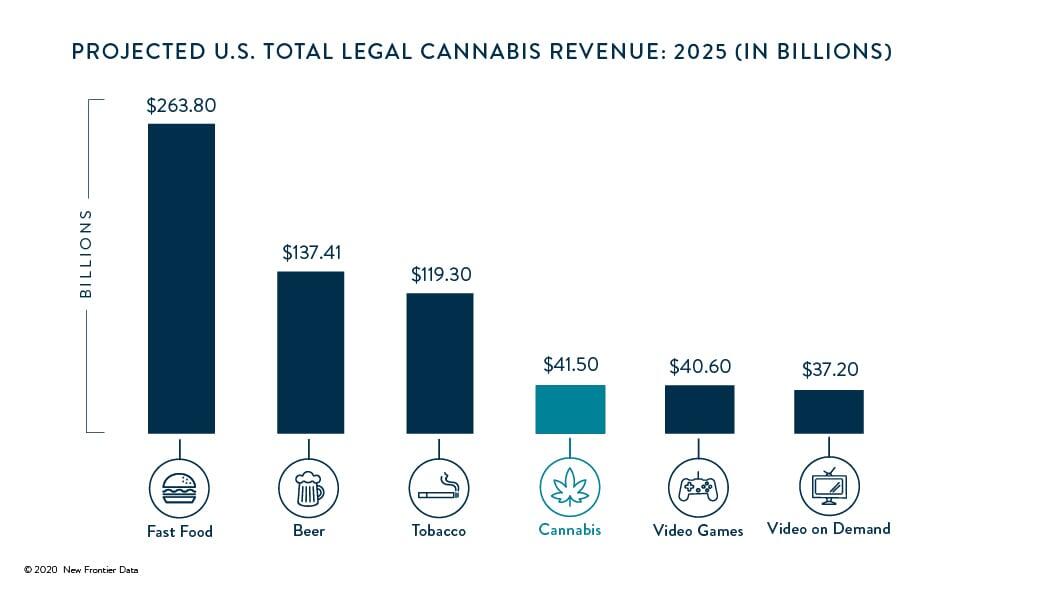

U.S. Legal Cannabis Market Projected to Double to $41.5B by 2025

December 9, 2020By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

While an historically engaging U.S. presidential election proved to be contentious throughout the past month, a clear electoral mandate was struck for America’s legal cannabis industry, and its bodes promisingly for the burgeoning industry.

In a revised forecast for the new release Cannabis in America 2021 & Beyond: A New Normal in Consumption & Demand, New Frontier Data estimates that total 2020 U.S. legal cannabis sales will exceed $20 billion, with post-election expansion and existing state markets to combine for a projected compound annual growth rate (CAGR) of 21%, to reach $41.5 billion by 2025. Annual U.S. sales of legalized medical cannabis are projected to grow at a 19% CAGR through 2025, from $5.9 billion in 2019 to an estimated $16.3 billion by 2025. During the same period, regulated adult-use sales are projected to grow at 23% CAGR, from $7.4 billion to $25.1 billion.

On Election Day, five U.S. states passed a total of six ballot initiatives to legalize cannabis: four (Arizona, Montana, New Jersey, and South Dakota) adopted adult-use measures, while both Mississippi and South Dakota approved medical cannabis programs (South Dakotans made history by simultaneously mandating both an adult-use and a medical program for the Mount Rushmore State).

As a result, as those markets come online approximately 234 million Americans — about 70% of the populace — will respectively live in a state with access to legal cannabis either for medical or adult use. Meantime, public support for legalized cannabis has reportedly reached a record high.

Those factors, combined with the election of a Democratic president who has committed to federal cannabis reforms, the sustained increases in cannabis sales due to the pandemic, and the number of additional states (i.e., Florida, New York, Pennsylvania, and Virginia) which intend to legalize adult use in the next two years, collectively position the U.S. industry for unprecedented expansion and growth into 2021 and beyond. As a result, the U.S. looks primed be the most dynamic, and opportunity-rich cannabis market in the world over the medium term.

Since U.S. pandemic-related lockdowns began last March, legal cannabis sales nationwide have skyrocketed, with sustained sales growth through Q3-2020 defining a new normal for cannabis spending and consumption. With increasing consumer access to cannabis (particularly in the new adult-use markets of New Jersey and Arizona) the newly legal markets are estimated to generate $1.2 billion in annual revenue by 2022.

Additionally, the revised forecast reflects California’s newly released, retroactive updates to tax revenue figures, improving the overall outlook for the speed at which the Golden State is successfully converting illicit sales to legal sales, and thus increasing the 5-year revenue forecast for the state.

Notably, California’s revised tax projections also suggest that consumer demand has been far stronger than anticipated, even despite the state’s highest-in-the-nation cannabis tax rates. That Californians are turning to the legal market at faster rates than expected is a positive development for the world’s largest cannabis market following years of regulatory hurdles and operational bottlenecks. It suggests that falling prices, combined with greater convenience, have made the legal market increasingly competitive against its illicit rivals.

While California will assuredly remain the largest cannabis market through 2025 (followed in order by Illinois, Florida, and Michigan), New Jersey’s adult-use legalization will be catalytic for expansion and normalization of legal cannabis throughout the Northeast and East Coast, with regional neighbors New York, Pennsylvania, and Virginia each committed to legalize adult use within the next two years.

The historic tailwinds driving the industry beyond 2020 will attract new capital into the market, spur accelerated innovation across the supply chain, entrench the normalization of legal cannabis in America, and draw heightened interest from other international markets seeking to pass their own reforms. And with last week’s UN vote to reschedule cannabis affirming changing attitudes on a global basis, the U.S. will not only be the most exciting cannabis market in 2021, but also the world’s most influential one.