Flush with Cash, Cannabis Companies Jockey for Prime Market Positions Amid Rush to Scale

Canada’s Unsteady Path is No Deterrent to Competition in EU Exporting

July 6, 2021

Medical Cannabis Use Rising Among U.S. Consumers with Anxiety Disorders

July 19, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

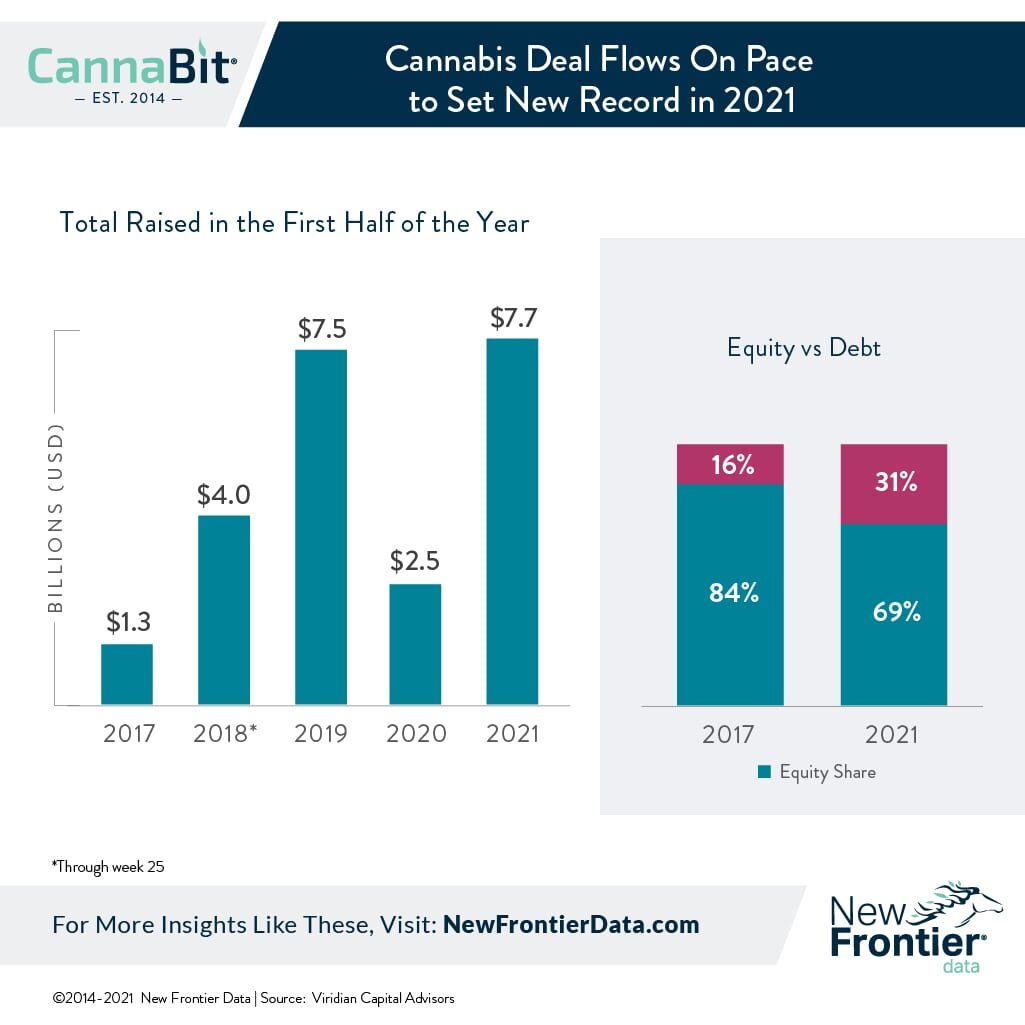

The first half of 2021 saw a record $7.9 billion in cannabis deal flow as investors — driven by the surging expansion of new legal markets — plowed new money into companies across the industry. Virtually every sector of the industry saw blockbuster investments as companies raced to enter new markets, expanded operational capacity, and acquired novel intellectual property.

The nearly $8 billion raised in the first half of 2021 was more than three times the $2.5 billion raised over the same period in 2020, and a little more than the $7.7 billion raised in the first half of 2019. More than two-thirds (69%) of the deals were equity-based, but the share of debt financing in the market has risen considerably, doubling from 16% in 2017 to 31% this year.

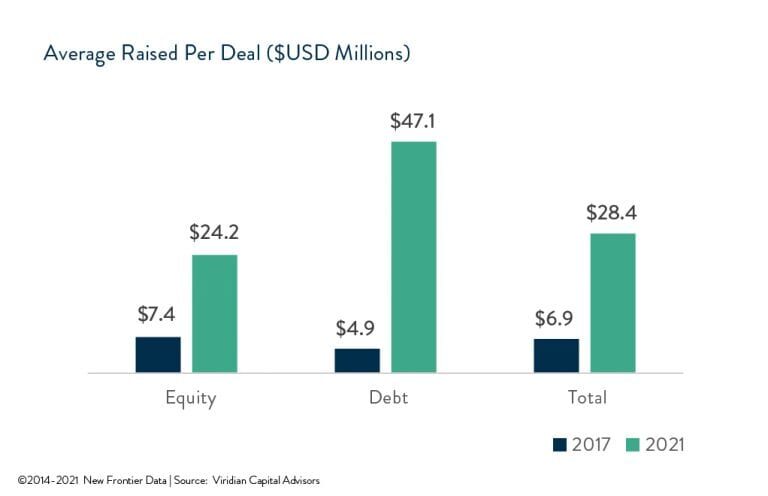

The average deal size has also increased dramatically since 2017. The average equity deal is now three times larger ($7.4 million vs. $24.2 million) while the average debt deal value has risen tenfold ($4.9 million vs. $47.1 million).

Illustrating this growth in deal size, in one of the largest U.S. MSO deals to date, Trulieve’s $2.1 billion acquisition of Harvest Health & Recreation would create one of the country’s largest cannabis businesses, with operations in 11 states, including 22 cultivation facilities and 126 medical and adult-use dispensaries. While this was, by dollar value, one of the largest publicly announced deals, other MSOs were also aggressive in their acquisition spending:

- Columbia Care spent nearly $300 million to purchase The Healing Center (CA), Medicine Man (CO), and Green Leaf (MSO);

- Cresco similarly spent $303 million to acquire Bluma Wellness (FL) and Cultivate (MA); and

- Verano Holdings spent $225 million to buy The Healing Center and Agri-Kind, both in Pennsylvania, expanding its cultivation, production, and retail footprint in the state.

The U.S. MSO buying spree was not solely domestically focused. In the first of its kind deal, Curaleaf acquired EMMAC Life Sciences, an independent European operator with a presence in the UK, Germany, Italy, Spain, and Portugal for $286 million in cash and stock. While Curaleaf may be the first, it put other American operators on notice that the race for global reach has begun.

The Canadian market was similarly frothy. The mega merger between Tilray and Aphria — two of that country’s largest licensed producers — was finally completed in May, forming Canada’s second-largest operator with a combined market cap of $7.6 billion. Canopy Growth Corporation remained slightly larger, with an $8.7 billion market cap, a position it secured with the April announcement of its $435 million acquisition of Supreme Cannabis.

HEXO, another Canadian LP, spent nearly $1.2 billion on three acquisitions, Redecan ($925 million), Zenabis ($235 million), and 48North Cannabis ($40 million), giving it expanded production capacity and retail distribution throughout the country.

Given the excess production capacity in Canada, and the slower-than-expected emergence of international export markets, there will likely be further large-scale consolidation among Canada’s LPs, even as some divest assets and shutter operations in the face of slow inventory drawdowns and intensifying competition.

One notable deal that underscored the ongoing interest in cannabis among tobacco companies was British American Tobacco’s $177 million deal to acquire 20% of Canadian licensed producer Organigram. While this was considerably smaller than the $1.8 billion rival Altria invested in Canadian LP Cronos Group in 2019, it is an important signal of the ongoing ingress of large CPG companies into Canada’s cannabis industry.

The cannabis ancillary markets have not been exempted from the rush to scale. With more cannabis businesses leasing rather than buying their properties, the real estate investment market has heated up with just three companies collectively raising nearly $600 million. Innovative Industrial Properties — one of the industry’s first real estate investment trusts — raised $300 million, while AFC Gamma raised $174 million from two public offerings, and Viridescent, a new REIT, launched with $125 million in funding.

Hydrofarm, a cannabis cultivation supplies distributor, raised $269 million in April, and invested over $360 million on three acquisitions expanding its national footprint and portfolio of own-label products. Three other cultivation-focused companies raised nearly $140 million in anticipation of the strong demand for cultivation supplies in burgeoning legal markets. Urban-Gro ($62 million), Agrify ($54 million) and GTEC ($23 million) each used public market offerings to raise the capital to fund their expansion.

Looking ahead to the second half of the year, New Frontier Data expects deal flow to increase as more capital flows into the industry and the jockeying for strategic market positioning heats up, especially in the U.S. markets. Amid the accelerating normalization of cannabis in North American society, the maturation of the industry’s operators, and the outsized opportunity presented by the continued expansion of legal markets, investors seeking a high growth, recession-proof market will have a spectrum of options by which to deploy capital into this fast-growing market.