Fragmented Markets and Patchwork Regulations Aside, North America Sets Global Course for Legal Cannabis Industry

Catching Up for Lost Time: Legal Cannabis Markets Project to Top $51 Billion Globally by 2025

September 27, 2021

Making Last Call? How Cannabis Preferences Are Displacing Alcohol

October 12, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

Home to the world’s largest federally legal adult-use cannabis program in Canada, and a patchwork of legalized U.S. states, North America is laying the foundation for a global industry. With total cannabis demand valued at $93 billion in 2020, the demand for cannabis in North America is second only to Asia’s ($186 billion), and is 20% larger than in the European market. Both the United States and Canada have been at the forefront of the legal cannabis movement, influencing how governments and legislative bodies across the world are approaching potential legalization of cannabis in their own countries.

As comprehensively analyzed in New Frontier Data’s new Global Cannabis Report: Growth & Trends Through 2025 , since 2019 the number of countries with some form of legalized cannabis has increased from 50 to 70, with global legal sales projected to reach $51 billion by 2025, and consumers forecast to spend $430 billion across legal and illicit markets this year alone.

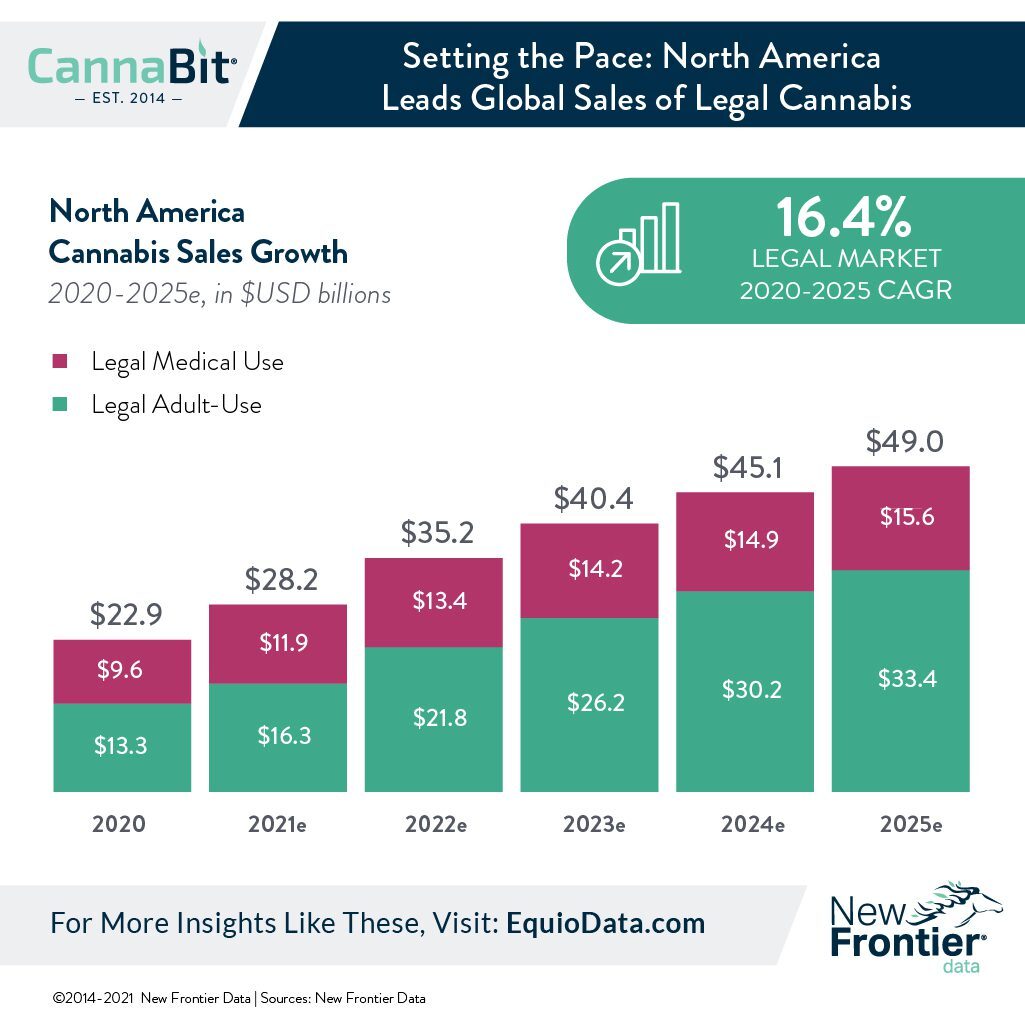

Sales of high-THC cannabis through legal regulated markets totaled $23.7 billion in 2020, with the combined legalized medical and adult-use state markets in the United States alone accounting for $20.3 billion (86%). Legal regulated markets captured 6% of total global demand for cannabis in 2020. However, strong growth in the largest and most dominant markets (i.e., U.S. and Canada) is projected to push combined legal sales to an estimated $51 billion by 2025.

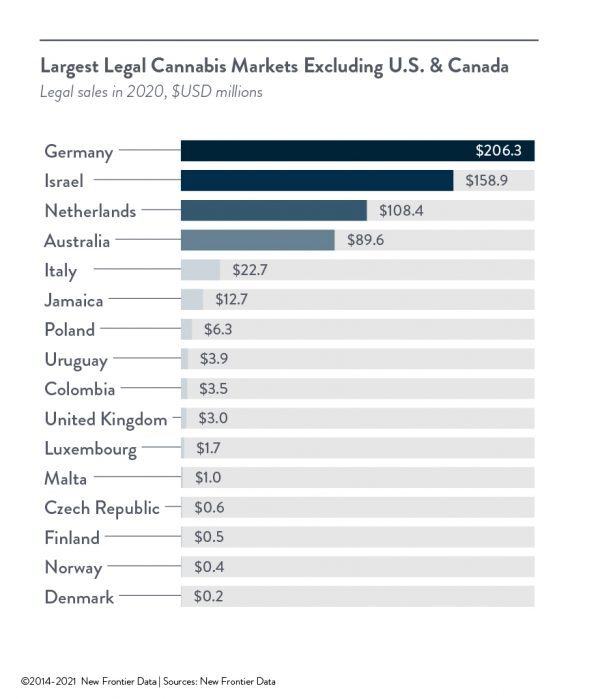

Outside of North America — which has the highest rates of social acceptance for cannabis use, and the most advanced consumer markets — legal sales of high-THC cannabis were markedly smaller. Germany, which allows insurance reimbursements for medical cannabis patients, in 2020 had the largest legal medical cannabis program in Europe by a wide margin, with an estimated $206 million in legal high-THC products sold to all patients. (Editor’s note: Germany’s figures include estimates for high-THC sales both by patients using insurance to reimburse products, as well as patients accessing products through private health market.)

Canada

Canada leads the global cannabis market: In 2018, it became the first G-7 nation to fully legalize cannabis for each medical, adult-use, and industrial purposes, acting as a catalyst in the development of the international cannabis marketplace. While still deploying its domestic markets, its licensed producers (LPs, companies authorized to grow and sell cannabis) are the world’s largest cannabis companies, with multibillion-dollar valuations. Those companies are leveraging deep financial pockets to fund supply-chain and infrastructure investments into cannabis companies worldwide as they seek to establish production in lower-cost regions and capitalize on newly legal markets. Canadian LPs have agreements for exporting to over 20 different countries, giving the country a significant head start in the emerging global cannabis market, though companies in the Netherlands and Latin America are also seeking entry to establish themselves for global cannabis exports.

Domestic sales of legal cannabis through regulated outlets totaled $2.57 billion for 2020; with recent expansion of footprints for adult-use retail outlets across the country, total legal sales from both licensed medical and adult-use retailers are projected to total $5.5 billion by 2025.

While Canada will trail the U.S. in terms of its total domestic retail sales of cannabis, Canada will remain the world’s leading cannabis exporter through 2025, with licensed agreements in place among over 20 countries worldwide.

United States

While the U.S. has not federally legalized cannabis either for medical or recreational use, 38 states have enacted laws legalizing it in some form for medical use, with 18 states having done so for adult-use programs. With a combined 141 million Americans living across those 18 adult-use states, and 239 million living across the 38 medical-use states, 43% of American adults now have access for adult use, and nearly three-quarters (72%) to legalized medical cannabis in some form.

Despite federal prohibition, cannabis legalization at the state level has been growing in momentum, and cannabis use in the U.S. is so widespread at the municipal level that it is increasingly becoming decriminalized for personal possession or use. As a result, not only do Americans hold recently liberalized views on cannabis legalization – a Gallup poll found 68% nationwide believing that it should be legal – the country has also led the world in cannabis innovation, with the creation of new genetics, cultivation techniques, derivative products, and ingestion methods, distribution methods, and consumer experiences as states develop independent markets.

While federal prohibition restricts the ability for U.S. operators to participate in global markets, American companies will have access to the world’s most lucrative cannabis market due to the large domestic population of high-spending cannabis consumers. States where cannabis is legal are generating significant revenues from legal sales. New Frontier Data estimates that in 2021 the legal U.S. state markets will generate nearly $13 billion in sales, growing to over $20 billion by 2025.

Outlook for Additional State Activation

Over the next two years, the position of the U.S. to establish itself as a global leader of cannabis consumer markets will continue to strengthen as states previously stymied in efforts for legalization amid the COVID-19 pandemic have regained momentum. There are eight additional states demonstrating strong likelihoods to legalize adult use measures in the next 48 months, and 10 states with strong likelihoods to legalize cannabis for medical use. Passage of medical-use programs in those 10 markets would for the first time bring legal medical cannabis access to an additional population of nearly 80 million Americans, among whom an estimated 8.4 million already consume cannabis on a regular basis.

Despite the lack of national legal framework, medical and adult use cannabis sales in legal state markets totaled $20.3 billion in 2020. This was 10x the amount of legal spending seen in any other legal market in the world. Canada, the world’s second country to federally legalize adult-use cannabis – and the first G7 nation to do so -, saw over $2 billion of high-THC cannabis sold through its growing national footprint of medical and adult-use dispensaries in 2020.