From Curiosity to Conversion: How NXTeck Data Reveals the Cannabis Shopper’s Holiday Mindset

From Curiosity to Consistency: What the Data Reveals About the Next Era of Cannabis Retail Behavior

October 19, 2025

The Era of Efficiency: How Cannabis Shoppers Have Changed — and Why NXTeck Is the Key to Winning New Customers

November 9, 2025Insights derived from 14,000 dispensary locations and 22 million verified device interactions show a clear shift in consumer behavior: cannabis shoppers have evolved from curiosity-driven exploration to confident, intentional purchasing.

As the industry enters its most competitive season, NXTeck data proves one thing:

Cannabis consumers aren’t slowing down — they’re becoming more deliberate.

Understanding that shift at the data level is what separates good campaigns from great ones.

The Data Story: From Exploration to Efficiency

After analyzing retail activity across every legal U.S. market, NXTeck’s first-party data shows three defining behavioral trends heading into Q4:

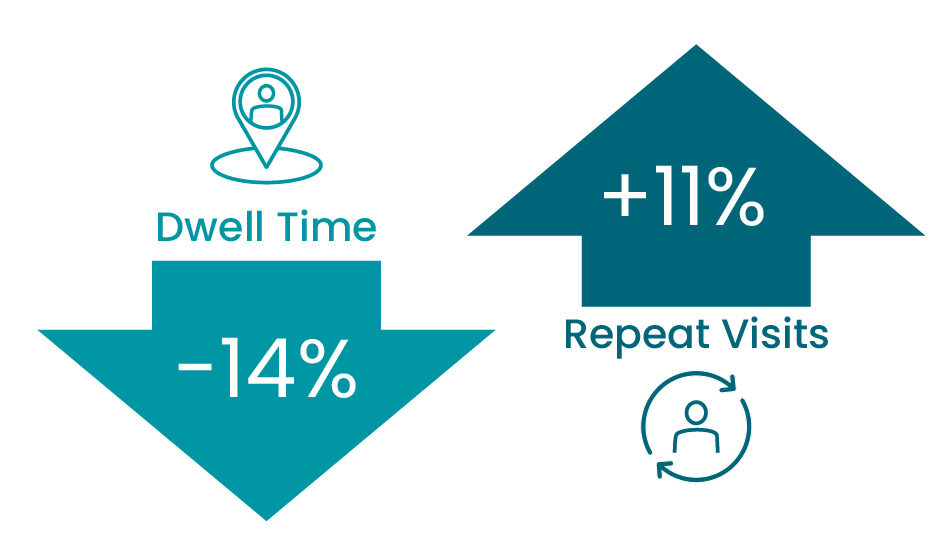

- Visits are steady, but dwell time is shrinking.

Average visit volume is flat quarter-over-quarter, while average dwell time declined 14%, signaling faster, more purposeful shopping. Consumers are heading straight to their preferred products instead of browsing. - Cross-shopping is declining.

Even in competitive states like Oklahoma and Oregon, repeat visitation rose 11%, proving that loyalty is strengthening. Shoppers are consolidating purchases with fewer retailers and showing stronger brand commitment. - Frequency remains strong.

The average cannabis consumer visits a dispensary 2-3 times per month, consistent with Q3 trends. Demand is steady — it’s the buying journey that’s evolved.

In short: marketers aren’t battling fatigue; they’re competing for focus.

Market by Market: What NXTeck Data Shows

Mature Markets (CA, CO, MI, OR, WA)

Behavior: Habitual shoppers making quick, value-driven trips.

Trendline: Steady frequency, shorter dwell (-12%), lower cross-shopping.

Opportunity: Winners already emphasize speed, value, and convenience. Pair these with retargeting within 72 hours of exposure — NXTeck’s proven attribution window in these markets.

Discovery Markets (NY, MA, NJ)

Behavior: Consumers exploring premium options and seeking education.

Trendline: Long dwell times (12–15 minutes) and higher first-time shopper ratios.

Opportunity: Content-led campaigns and in-store storytelling drive conversions. Education turns curiosity into purchase.

Tourism Markets (NV, FL, HI)

Behavior: Transient shoppers entering the funnel at high volume.

Trendline: Foot traffic up 18% month-over-month as travel season peaks.

Opportunity: Deploy geo-conquesting around hotels, airports, and events, then retarget post-trip using MAID-level attribution to maintain brand recall.

Emerging Markets (MS, WV, TX, UT)

Behavior: New buyers seeking trust and clarity.

Trendline: Dwell times up 21% as shoppers research more carefully.

Opportunity: Lead with education-based holiday campaigns that reinforce brand credibility and compliance.

What This Means for CMOs and Marketing Leaders

The cannabis retail environment isn’t softening — it’s sharpening.

Consumers are decisive, data-proven, and less forgiving of wasted impressions. CMOs who act on real-world behavior, not assumptions, are winning:

Smarter Segmentation

NXTeck identifies loyalty-driven versus exploratory markets, allowing creative localization by behavior, not just geography.

Attribution Clarity

AdEQ ties ad impressions to verified in-store visits and purchases using MAID-level precision and seven-day attribution.

Holiday Optimization

NXTeck data proves attribution windows are compressing — from five days in early Q3 to just three days in Q4. Retarget faster to convert intent before it fades.

ROI Validation

Across recent cannabis pilots, average CAC payback was under 30 days with 6:1 ROI on AdEQ-optimized campaigns.

How NXTeck Powers Data-Driven Holiday Campaigns

CMOs need actionable data, not lagging indicators. NXTeck delivers it through a unified intelligence suite:

- ShopEQ Insights – Pinpoint markets with the highest frequency, loyalty, and conversion potential.

- AdEQ Attribution – Prove ROI with MAID-level precision and seven-day attribution.

- MarketEQ Benchmarking – Compare campaign results to state and DMA-level benchmarks across dwell time, visit lift, and repeat rate.

- Audience Intelligence – Build privacy-compliant audiences based on observed behavior, not modeled assumptions.

NXTeck transforms cannabis campaign planning from guesswork to precision.

The Bottom Line

This holiday season won’t be defined by who spends the most — it’ll be defined by who spends the smartest.

NXTeck data shows:

- Consumers are moving faster.

- Loyalty is strengthening.

- Decision cycles are shorter.

Success now depends on timing, targeting, and proof of performance — and NXTeck delivers all three.

Because in a market where attention is shrinking but opportunity is growing, data is the ultimate competitive advantage.

Ready to Turn Data into ROI?

Schedule a 15-minute ROI demo to see how your campaigns compare to NXTeck benchmarks and uncover where your next conversions are hiding.