From Martha Stewart to NY’s Southern Tier, A Cannabis-Do Attitude

What’s the Latest on Legalization in New Jersey?

February 17, 2019

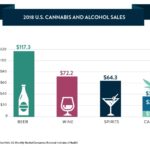

US Cannabis and Alcohol Sales

March 17, 2019By J.J. McCoy, Senior Managing Editor, New Frontier Data

With major investment announcements already made this year about industrial hemp facilities in New York State’s Southern Tier, Broome County is staking an early claim to establish itself as the equivalent of Silicon Valley for industrial hemp.

After the recent purchase of a 97,000-square-foot facility which formerly housed a $50 million Gannett newspaper printing plant, Southern Tier Hemp is poised to open its renovated, vertically integrated agricultural facility plant near Binghamton, N.Y., in time for the 2019 hemp harvest.

In a separate, unrelated announcement last month, U.S. Senate Minority Leader Chuck Schumer (D-NY) was on hand to promote the birth of a new hemp hub in town, with announcement that Ontario, Canada-based Canopy Growth will be investing $100 million to $150 million for an industrial hemp facility at a yet-undisclosed location in the county.

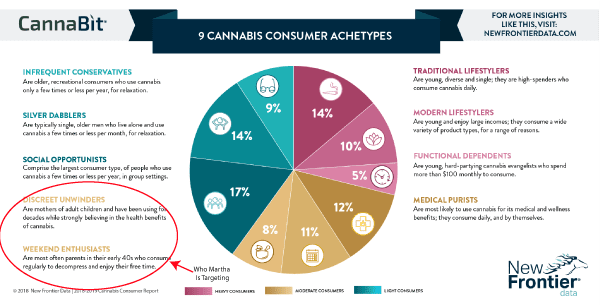

Last week, Canopy Growth added that lifestyle maven Martha Stewart was signing on to develop CBD products both for pets and human consumers. As New Frontier Data details in its groundbreaking report, 2018-2019 Cannabis Consumer Report: Archetypes, Preferences & Trends, the fastest-growing segment of cannabis consumers is represented by older females with grown children, a demographic which wants trustworthy products in attractive packaging.

“She is nailing it,” explained New Frontier Data CEO Giadha Aguirre de Carcer. “This is her audience. This is an underserved demographic that is growing very fast and is willing to pay.”

For its part, Southern Tier Hemp expects to employ about 120 employees within 36 months of opening, with the state already has earmarked $650,000 in grants to assist in the enterprise. Southern Tier Hemp already has established connections in town, through a working agreement with the Binghamton University School of Pharmacy and Pharmaceutical Sciences which will be given a research laboratory in the new facility.

Unlike Canopy Growth, Southern Tier Hemp is a private company primarily financed by investors betting on industrial hemp for a financial windfall. Canopy Growth last year drew headlines for a $4 billion strategic investment made by Constellation Brands, a New York-based beverage alcohol leader and Fortune 500 company.

Industrial hemp cultivation has been legal in New York since 2015 when it was introduced through a research pilot program through Cornell University and the State University of New York (SUNY) at Morrisville. In 2017, the state eliminated its cap on the number of sites authorized to grow and research hemp and expanded the program to include farmers and businesses. For those who had seen the state’s traditional dairy industry in steady decline throughout the past two decades, hemp has popped up as a viable economic solution.

In 2016, a total of 30 acres statewide were cultivated for hemp in New York, jumping to 2,000 acres in 2017, and 2,240 in 2018 after Governor Andrew Cuomo introduced and signed legislation to establish industrial hemp as an agricultural commodity under the state’s Agricultural and Markets Law.

The U.S. hemp Industry surpassed $1 billion in sales last year, and with the passage of the 2018 Farm Bill into law, it is expected to reach $1.8 billion in 2020 and $2.6 billion by 2022. Industrial hemp is the same genus and species as marijuana (Cannabis sativa L.), but the plant varieties used for industrial hemp purposes have a delta-9 tetra-hydrocannabinol (THC) level of less than 0.3%.

For now, the state awaits the USDA’s new guidance per specific parameters established under the new farm bill. Until then, hemp growers will follow regulations established under the previous federal farm bill passed in 2014, when former President Barack Obama defined industrial hemp as a distinct crop apart from marijuana. One vital change, however, is already taking effect insofar as hemp is now considered a commodity crop, meaning that farmers can apply for crop insurance and some degree of security in trying to cultivate something which had been deemed illegal for most of the previous 80 years.

For more insights and details on cannabis consumers and the only cannabis consumer archetypes study: 2018-2019 Cannabis Consumer Report: Archetypes, Preferences & Trends,