Growing the Market: Plants Under Cultivation Underscore Legal Cannabis’ Promise

Colorado’s Legal Cannabis Market at 7: Amid a Rocky Product Landscape, Flower’s Popularity Endures

November 1, 2021

Between A Prized Patent and Hot Air: The Search for a Cannabis Breathalyzer Device Continues

November 15, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

Average Plants Under Cultivation Highlight Cannabis’ Growing Opportunities.

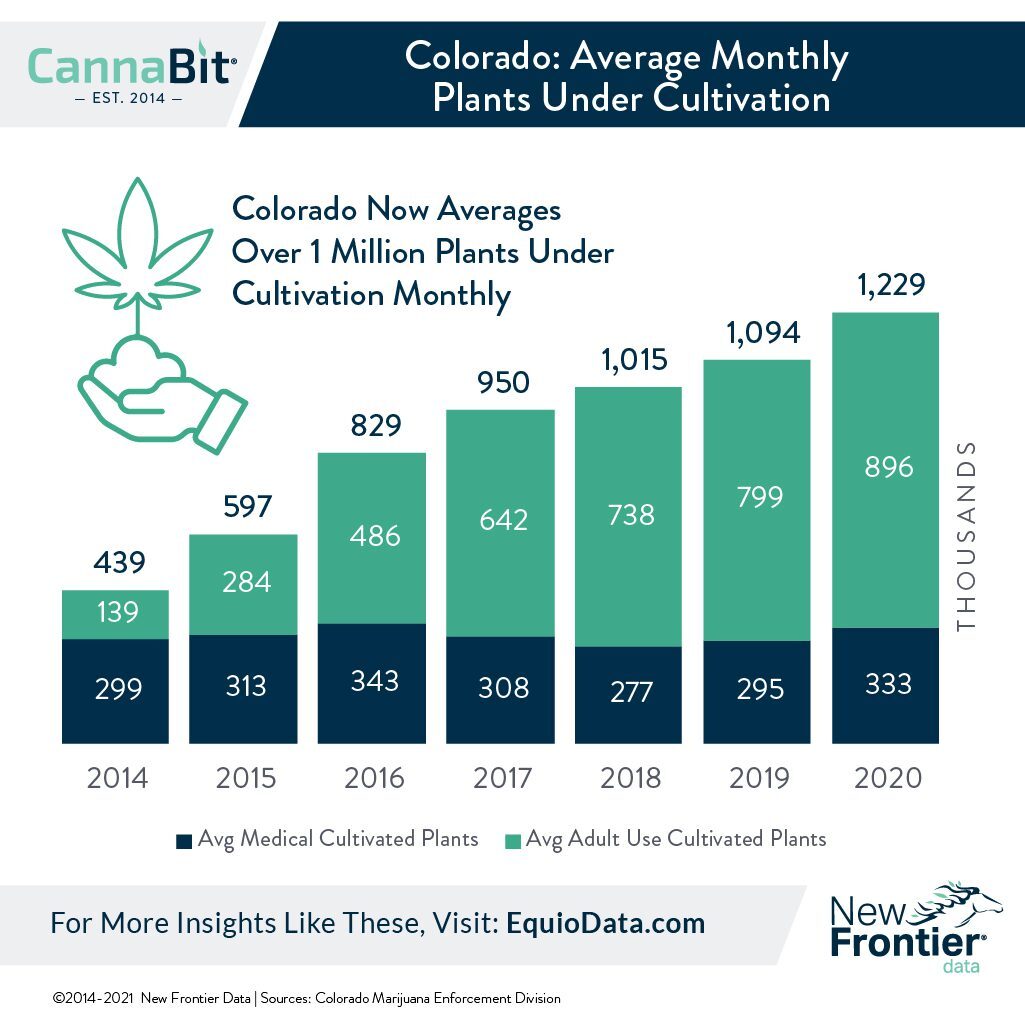

In Colorado, the average number of plants being grown each month has increased nearly fivefold since adult-use sales began in 2014: from 219,000 in January 2014, to nearly 1.3 million plants in December 2020. The sustained gains in plants under cultivation offer some important signals about the future of legal cannabis markets.

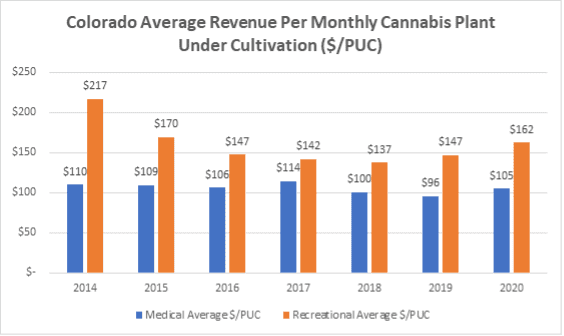

Revenue earned per plant cultivated is higher in adult-use markets than in medical ones.

In 2020, Coloradoan producers earned $104 per medical plant under cultivation versus $162 per plant in the recreational market. The cost variance, in part, is due to the economies of scale earned in the larger adult-use market. Revenues per medical plant cultivated have remained steady – ranging from a low of $96 to a high of $114 between 2014 and 2020. Over that time, average recreational revenues fell significantly – from $217 in 2014, to $167 in 2020, after hitting a low of $137 in 2018.

Even amid downward price pressure, cannabis remains an incredibly lucrative specialty crop.

If cannabis were cultivated at the same density as corn, Colorado’s 1.3 million plants under cultivation in December 2020 could have fit within 40 acres (assuming 32,000 corn seeds per acre). Furthermore, with each corn plant yielding but 2-4 ears, their average value ranged between $0.06 and $0.11 (i.e., $3.20 per bushel), exponentially lower than the $135 which Colorado’s legal cannabis plants averaged between 2014 and 2020. The high yields of cannabis per plant continue to attract new producers to the market, even as innovation and process improvements are increasing efficiency and margins. However, high start-up costs, complex regulations, and the challenge of growing high-quality cannabis continue to create high barriers to cultivators while negatively impacting profitability.

U.S. and global legal cultivation are set to surge.

Extrapolating from Colorado’s model, plants under cultivation required to meet legal U.S. demand will increase monthly from 158 million in 2020 to 325 million in 2025. Assuming were cannabis and corn planted with equal density, the area dedicated for U.S. legal cannabis cultivation will double from approximately 5,000 acres in 2020 to 10,000 acres in 2025 – a fraction of the 91.7 million acres devoted to corn in 2019. To meet global demand (i.e., both legal and illicit), monthly cannabis cultivation will need to increase from 3.8 billion plants in 2020, to nearly 4.6 billion plants per month in 2025. By itself, global legal production will monthly increase from 182 million plants in 2020 to 380 million in 2025). The vast difference between total global demand from the illicit and legal markets, respectively, highlights how much of an upside margin remains for legal cannabis cultivation.

Increases in production are driving surging investments for cultivation innovation focused on efficiency.

With only a fraction of the total market currently being served through legal channels, cultivation innovation has been a priority area for cannabis investors. According to Viridian Capital Advisers, investors in 2020 channeled approximately $2.39 billion into legal cannabis cultivation for retail sales. Such investments are being made to transform every aspect of cultivation – e.g., lighting, irrigation, fertigation, climate-monitoring systems, etc. – with the aims of reducing production costs, increasing yields, and increasing operational efficiency.

Innovation in the way cannabis is grown will be key to maintaining revenue margins as prices continue to fall. The average market rate per pound of cannabis has fallen from $2,000 in January 2015, to $1,300 in October 2021, after hitting a low of $759 in October 2018. While Colorado’s market prices have been a little more stable recently, nationally we continue to see prices fall as legal markets mature and gain efficiency. While cannabis is unlikely to be commoditized in the same way as rice or corn, cannabis growers should prepare for increasing competition even as the legal market’s expansion continues to present very significant growth opportunities.