How Concerning Is Inflation for Cannabis Consumers?

Cannabis Conference Abuzz with Anticipation for New York’s Adult-Use Market

June 7, 2022

Cannabis Marketers Express Optimism About Growth Opportunities at Denver Summit

June 14, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

The buzz:

The Consumer Price Index rose 8.6% through May, the highest U.S. inflation rate since December 1981. Data released Friday shows inflation climbing as gas prices reached record highs. Worldwide, rising costs for labor, ingredients, packaging, and transportation through disrupted supply chains are stoking consumer price inflation, a trend which S&P Global expects to continue through September.

How does inflation impact the legal cannabis market? The gray market? Consumer behaviors?

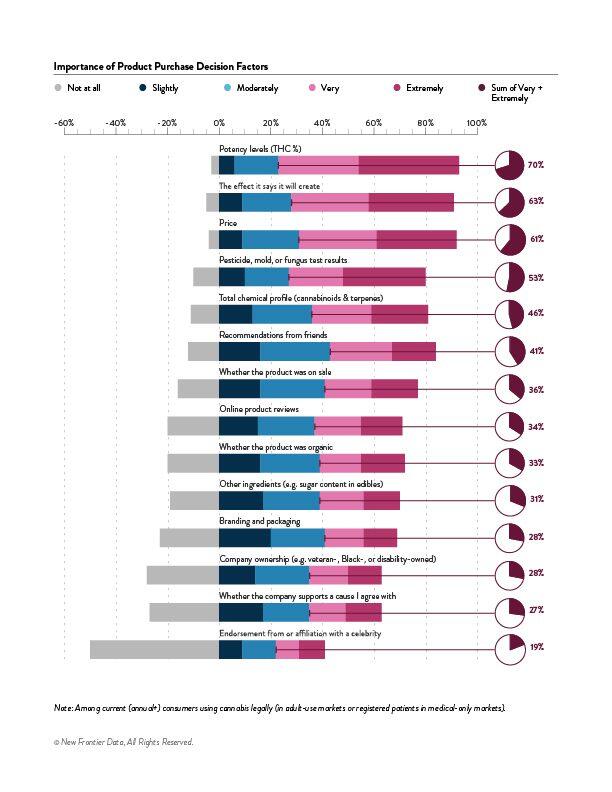

As detailed in our recent report, Cannabis Consumers in America, New Frontier Data determined that price ranked as the third-most important factor (among 61% of consumers) when making a purchase decision: “For most consumers, cannabis is a low-spend/high-frequency purchase. Nearly half (45%) of current consumers acquire cannabis at least once per week, with most (67%) among them spending less than $100 per purchase. The high-frequency nature of those purchases, coupled with high levels of expressed interest in new products, creates significant opportunities at each touchpoint for retailers and brands to engage and educate consumers.”

Shrinkflation or downswitching

Call it reverse inflation. In mainstream consumer marketing, it happens all over, in stealthy ways that you don’t notice, but then that’s the plan. To offset inflation without raising prices (at least not too much) which would turn off consumers, manufacturers just find ways to give them less. In January, Domino’s announced that it would drop its serving size of chicken wings from 10 to 8 to maintain its advertised $7.99 carryout deal.

Others are less upfront about it. From coffee and corn chips to tea bags and toilet paper, manufacturers have quietly been shrinking contents and package sizes without lowering prices. It’s called “shrinkflation,” or “downswitching,” and it goes on worldwide.

It’s also not new. In the 1980s, Andy Rooney of “60 Minutes” decried how the traditional pound of coffee was no longer a pound: Cans on grocery shelves were the same size as always, but careful shoppers noted how the labels revealed that what for so long held the standard 16 ounces had come to contain something less than that, maybe 13 or 14 ounces. Today, a box of Kleenex may include 60 tissues rather than 65, for a 7.7% decrease to offset the general spike.

Of course, in the legal cannabis industry, size matters. Vitally. An 8th of an ounce of flower, say, is 1/8th of an ounce however it’s packaged, and legal markets almost universally require a set level of THC in any given package. Those standard requirements leave very little leeway for subtle deception. For instance, track-and-trace programs like METRC in California require the weight of cannabis to be carefully monitored as it flows through the supply chain, with the amount of THC in manufactured products independently tested and verified.

In the hemp food sector, too, the tried-and-true dictates the market’s direction.

“From a food perspective, when we think about hemp grain becoming a more adopted ingredient, this is a time when brands and manufactures tend to become less exploratory and risk-adverse,” explains Eric Singular, Director of the Hemp Business Journal. “They batten down the hatches on their marquee products; with the supply-chain issues of the last two years, many are struggling to keep shelves stocked with those marquee products. With rising grocery prices, consumers also will also batten down the hatches, spending less and prioritizing the staples for themselves and their families. Higher-priced, premium, niche products tend to lose out at times like this with consumers.”

The takeaway:

“Consumers should be confident in the weight of their cannabis flower and the amount of THC in their edibles,” assured Amanda Reiman, New Frontier Data’s VP of Public Policy Research. “Still, they should be aware how other cost-saving measures might affect the quality of their purchases and experiences.”

Though packaging flower in amber jars can reduce negative impacts from UV light, using plastic childproof bags could be one cost-cutting measure. Anyone looking to protect (much less increase) sales revenue knows that even the smallest price reduction can drive higher demand. In fact, 5 of the top 10 performing brands week-over-week in Equio’s Retail Suite MVPs had discounts of over 18%. Nevertheless, manufacturers should beware not to undercut quality by sourcing cheaper, lower-quality ingredients, because doing so impacts the value and overall health proposition of the product – and by extension, the market at large.