How Millennials Are Embracing Cannabis

How Millennials Have Come of Age With Cannabis

June 21, 2022

83% of U.S. Cannabis Consumers Use Flower Even as Exclusive Flower Use Declines

June 30, 2022By Amanda Reiman, Ph.D., MSW, VP of Public Policy Research, New Frontier Data

“Talking ‘bout my generation…”

Culture, politics, and current events all shape how a generation is defined. Boomers, GenX, and the like are generally commonly defined as groups of people approximately the same ages who have been socialized by similarly lived experiences. Generational cutoff points aren’t an exact science, but Millennials are commonly defined as those having been born between 1981 and 1996. With the first among them having passed age 40, they entered adulthood before today’s youngest adults were born. Numbering more than 80 million, they now represent the largest social cohort in the U.S.

Age, as well as one’s stage in life, are highly correlated with many cannabis behaviors (e.g., medical use, use frequency, method of ingestion, and interest in pairing for effect). This underscores the utility in identifying and understanding the differences or commonalities between generational demographics.

For Millennials demographically, one main characteristic stands out: 57% of Millennials have children under the age of 18, compared to each 24% of Gen Z, 39% of Gen X, and 8% of Boomers. That reality impacts many cannabis consumption behaviors — including products used, cannabis sources, conditions treated, motivations for use, and locations of consumption.

Millennials’ Collective Identities

Being the first generation to fully take advantage of a regulated cannabis market, Millennials also demonstrate degrees of knowledge, sophistication, and intention of consumption beyond other generations. Not only are they far less likely to alcohol than previous generations (26% of Millennials report drinking a few times per week, while 13% abstain entirely), but they are most likely among the cohorts described in New Frontier Data’s report, Millennials as Cannabis Consumers: Attitudes & Behaviors of America’s Largest Generation (available on the Equio® cannabis business intelligence platform), to care about both the strain and minor cannabinoid or terpene contents of their flower, and to spend more than $200 per purchase.

More so than other generations, Millennials are using various forms of cannabis depending on the activity they are engaging in, the time of day, and where they are.

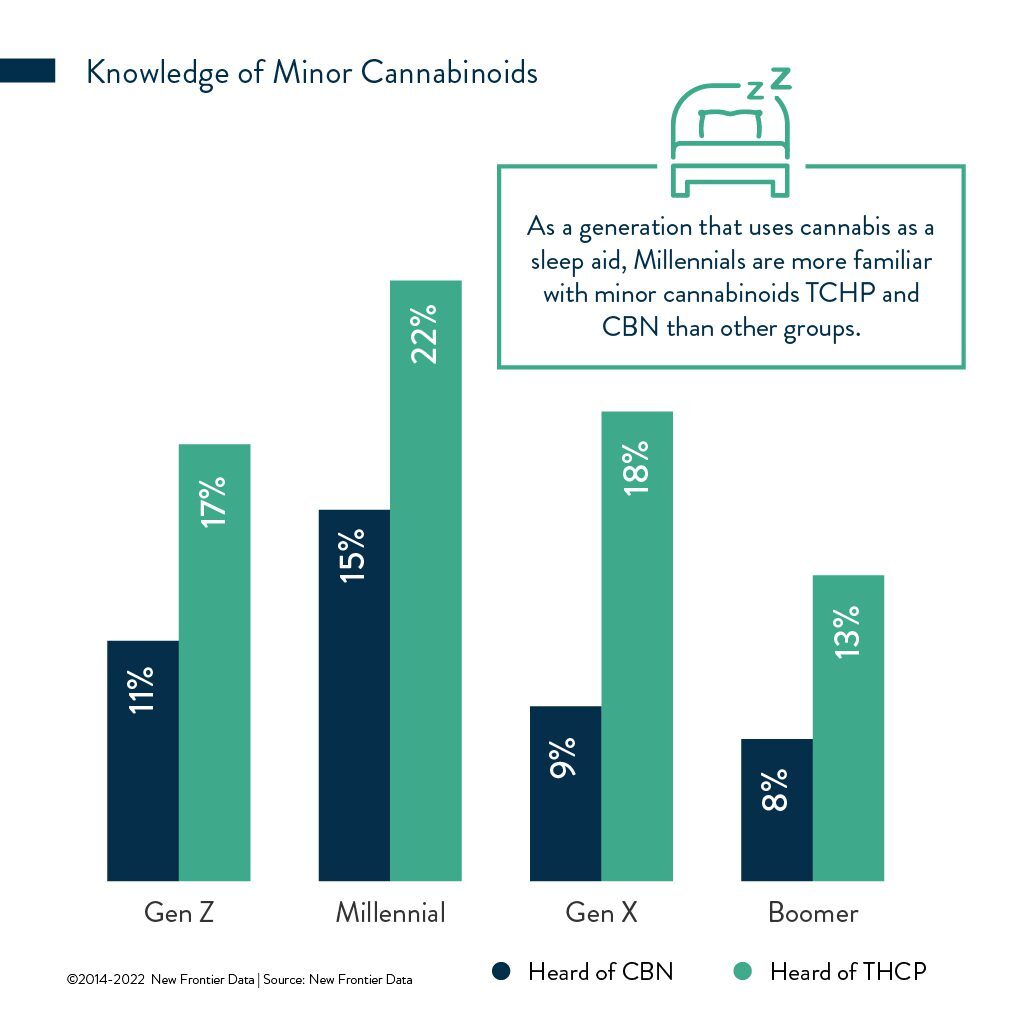

About two-thirds (66%) of Millennials identify strain as very important in influencing their purchasing decisions, more than 20% higher than the next group (Gen X), at 44%. Nearly one-third (30%) reported that minor cannabinoid and terpene profiles are likewise very important to their purchase decisions, the highest rate among all generational groups. Millennials also were the least likely to say that they did not know what either a minor cannabinoid or terpene was, or that they did not have access to them. Those tendencies speak to their general knowledge of cannabis, and sophistication as consumers.

Their identities — whether as employees or as parents — may be influencing those patterns as busy Millennials look for effective and efficient ways to obtain benefits from cannabis. They also feel comfortable adopting it as part of their lifestyles, though more often prefer to consume away from the home.

Change Is a Constant

Being immersed in a technological boom, Millennials are accustomed and savvy about social networks and other digital tools, and characteristically open to discover and adopt new concepts, products, and trends. They tend to communicate and assimilate quickly, making them more flexible and welcoming to changes than are older generations.

In comparison to other generations, Millennials are well-educated professionals open to new behavioral patterns. Rather than sticking to traditional social routines, they are likelier to act independently, and to reconsider if not reject established and/or obsolete values and practices.

For example, last year, a study by YPulse found 58% of Millennials working from home either full or part-time, and being less likely than older generations to return to work onsite in person, embracing the pandemic-related shift in workplace culture.

Have Cannabis, Will Travel

Especially as restrictions loosen after COVID-19 protocols, travel is a burgeoning segment catering to Millennials as upscale vacationers — those being as likely female as male, skewing toward Millennials or younger (63%), with a college degree (59%), job (82%), and average household income of $87,000, according to a report from the Cannabis Travel Association International (CTAI) [full disclosure: I am a board member].

CTAI projects Millennials to make up 50% of U.S. travelers by 2025, when it likewise expects their cannabis consumption to be extremely normalized compared to any other previous time of their or older generations’ lives.

Millennials came of age in a time of rapid change for cannabis laws and cultural norms. What was a prohibited and demonized behavior in their youth has blossomed into a commercial industry right before their eyes. While the impact of cannabis stigma felt by Boomers and GenX was not as strong for Millennials, they understand cannabis as more than just a consumer packaged good, and approach its use with intention and mindfulness that set them apart.