How Millennials Have Come of Age With Cannabis

39% of Millennial Cannabis Users Report Consuming Multiple Times a Day

June 15, 2022

How Millennials Are Embracing Cannabis

June 28, 2022By Amanda Reiman, Vice President of Public Policy Research

Beyond the seminal historical events of 9/11 and the longest U.S. war, or sociopolitical influences ranging between the adoption of gay marriage and a rise in gun violence at schools, Millennials have also been raised with the internet, and come of age throughout a veritable sea change in cannabis-related social attitudes and policies.

As a demographic cohort, Millennials represent those born between 1981-1996, numbering about 72 million in the United States. Sandwiched between Gen X (which recalls life before the internet) and Gen Z (which does not), Millennials grew up while consumer technology around them was changing at a rapid pace, maturing hand-in-hand with modern mobile devices and products (i.e., iPhones, smartwatches, Alexa/Echo smart speakers, and virtual reality).

As young adults they watched the cannabis markets in which they lived transition from prohibition to legal, regulated markets, and they have collectively played a leading role in the emergence of the legal cannabis economy, both as consumers and as champions for change.

Older Millennials were young adolescents in 1996 when California passed the first state medical cannabis law, Proposition 215, and younger Millennials may not even remember a time when medical cannabis was not available somewhere in the U.S. For this age group, cannabis prohibition was a paradigm disintegrating in front of their eyes.

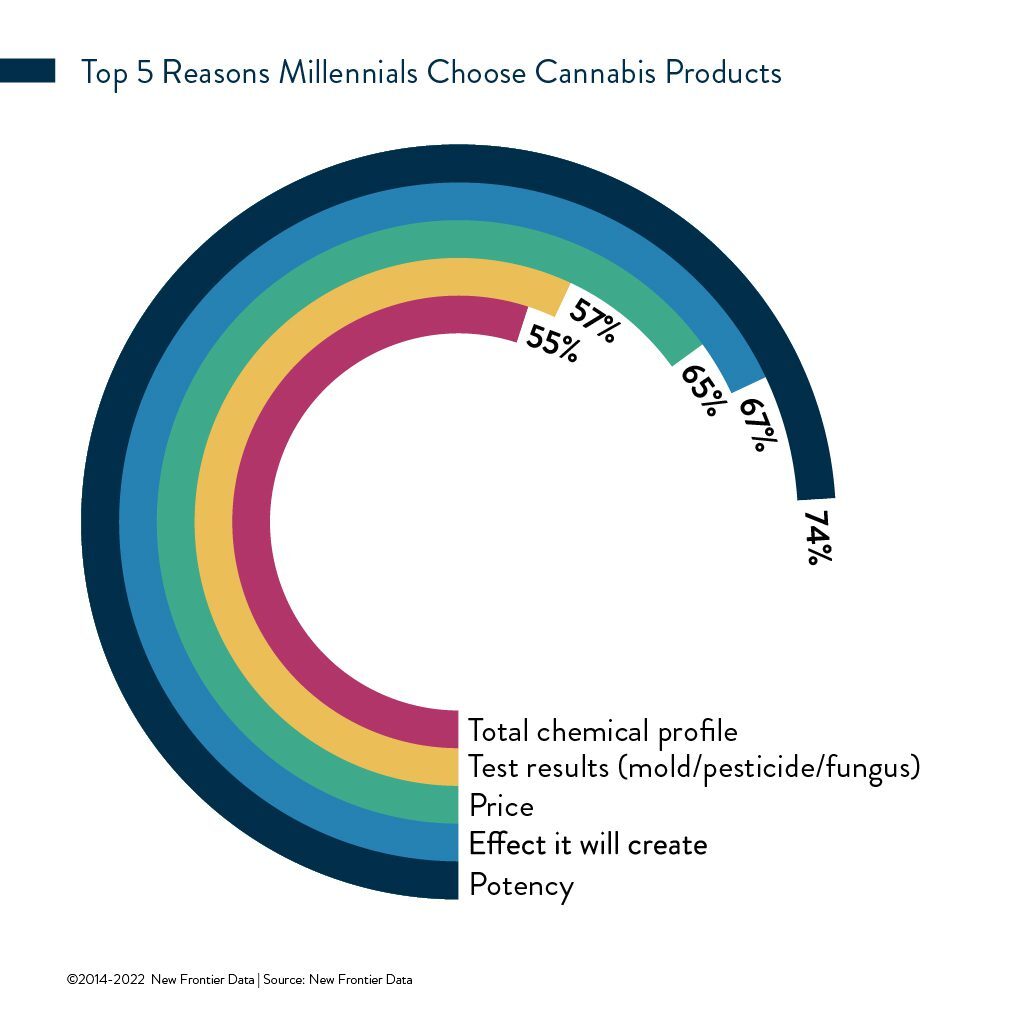

As consumers, Millennials report views in line with the other generations, with some notable differentiation. Across all generations, relaxation was the most common effect sought by consumers (with ¾ of each group citing it), but focus is an effect most sought out by Millennials, with 32% identifying that as a goal, compared to 29% among Gen Z, 21% of Gen X, and 14% of Boomers. As among other age groups, potency is the biggest driver for product choices among Millennials, followed by effect.

Millennials also were the least likely to say that they didn’t know what a minor cannabinoid or terpene was, or that they did not have access to them. Those tendencies (plus the importance placed on strains) speak to their general knowledge of cannabis, and sophistication as consumers.

Millennials’ Sophistication About Cannabis

Indeed, Millennials typically have a broader understanding of cannabis than do other generations. They are more aware of the minor cannabinoids used for sleep, and they use cannabis to replace OTC sleep aids more than do other groups. They are also more likely than other age groups to care about the strain and minor cannabinoid and terpene content of their flower, and to spend more than $200 per purchase.

Almost half (49%) of Millennial consumers spend between $50 and $200 per purchase. For context, the national average spend per transaction across all age groups ranges from $57 (topicals) to $93 (flower), according to the Retail Dashboard in Equio, New Frontier Data’s business intelligence platform.

Millennials Rely on Brick-and-Mortar Shops More than Family or Friends

The normalized legitimacy of a brick-and-mortar store, combined with a variety of products and more extensive, commonly available product information likely drive Millennials’ increased tendency to prefer brick-and-mortar outlets to sourcing from family or friends.

Effect is the most powerful purchase influencer among all age groups, but details that impact effect like terpenes and minor cannabinoids are more important to Millennials. About 2/3 (66%) of them identify strain as very important in influencing their purchasing decisions, more than 20% higher than the next group (Gen X), at 44%, another factor that could be influencing the use of brick-and-mortar stores, as referenced in New Frontier Data’s recent report, Millennials As Cannabis Consumers: Attitudes & Behaviors of America’s Largest Generation.

Millennials also engage in effect pairing, using various forms of cannabis depending on the activity they are engaging in, the time of day, and where they are. They also report doing so in greater numbers than do other generations. Their identities as parents/full-time employees might influence those patterns. More than other generations, Millennials are interested in choosing the right product for the right situation. This, along with an increased interest in the components of the plant beyond THC shows the sophistication of this generation of consumers.