How Much Do Cannabis Archetypes Differ?

Which Archetypes Define Your Customers?

October 19, 2022

Midterm Elections See Five States Voting on Adult-Use Cannabis

November 1, 2022By Dr. Molly McCann, Ed.D., Senior Director of Consumer Insights, New Frontier Data; and J.J. McCoy, Senior Managing Editor, New Frontier Data

New Frontier Data’s latest report, Cannabis Consumers in America, Part Three: Identifying Key Archetypes, examines various typologies of cannabis consumers, presenting nine key consumer archetypes. Through specific case studies and in-depth demographic tendencies, the report illustrates basic differences and overlapping priorities among people’s motives for choosing cannabis, consuming it, and coming back for more of it from particular manufacturers, brands, and retailers.

The report concludes a groundbreaking series full of newly detailed insights into the purposeful and intentional use of cannabis nationwide: New Frontier Data’s newly quantified consumer archetypes reflect the latest consumer trends, behaviors, and preferences. Informed by new survey data, New Frontier Data has updated our quantified consumer archetypes to reflect the evolving cultural landscape; updates among archetypes within the past year are discussed at the end of each analytical section.

Nine Archetypes of Cannabis Consumers

All told, nine distinct consumer archetypes offer valuable takeaways from previously overlooked or under-examined consumption groups. Beyond usage patterns, the consumer categories also differ by their procurement sources, spending habits, preferred products, reasons for use, social openness, and other key variables. Refined data authoritatively reveals distinct consumption trends and purchasing behaviors which industry stakeholders can leverage within a U.S. legal cannabis market projected to exceed $57 billion by 2030.

Presented through partnership with cannabis discovery company Jointly, this report series zeroes in on U.S. consumers and revised data about their intentions, preferences, and behaviors. Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. To date, more than 206,000 of those have been documented to detail goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects.

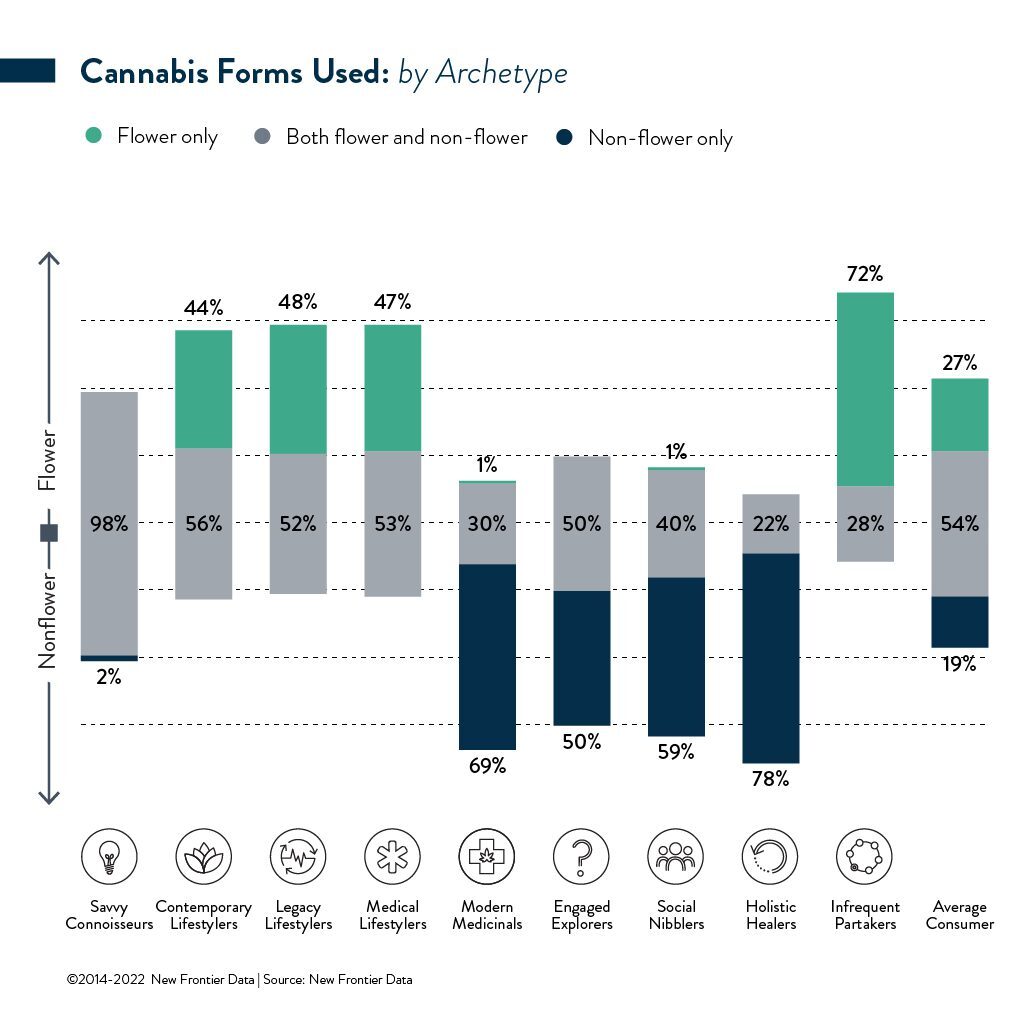

Through specific case studies and overarching demographic cohorts, the report illustrates primary differences and overlapping priorities among consumers’ motives for choosing and consuming cannabis. The particular proclivities and preferences – and market shares – represented by each Savvy Connoisseurs (18%), Legacy Lifestylers (16%), Contemporary Lifestylers (14%), Medical Lifestylers (12%), Modern Medicinals (9%), Engaged Explorers (7%), Social Nibblers (7%), Holistic Healers (6%), and even Infrequent Partakers (11%) offer key insights. Once that essential consumer differences are addressed, similarities can then be shared: Which goals are most popular, and which product forms are considered the most reliable for achieving success?

Preferences for Product Use

A popular shift towards dual use of flower and non-flower products (as opposed to the exclusive use of flower) still differs by archetype. For Savvy Connoisseurs in 2021, 27% were using flower exclusively, though in 2022 none were doing so. However, for Contemporary Lifestylers, another high-consuming group, the exclusive use of flower rose, from 27% in 2021 to 44% in 2022.

Contemporary and Legacy Lifestylers are both overrepresented in the flower consumption group, while underrepresented in the other consumption groups: However, Contemporary Lifestylers are so by choice (since they live in legal markets), and Legacy Lifestylers are such by necessity (due to lack of access in an illicit market). The impact of evolving markets can also be seen with the Modern Medicinals: In 2021, 34% lived in an adult-use state, while 54% were doing so in 2022. At the same time, use of exclusively non-flower products in that group rose from 48% to 69%. Conversely, those consumers’ reliance on a dealer for their cannabis dropped from 13% in 2021, to 4% in 2022. We see a similar pattern with Engaged Explorers.

Newer consumers in a market (e.g., those Engaged Explorers) tend to prefer products that are easy to consume in a wide variety of places, like edibles and vape pens. Among that group, 74% consume edibles and 37% use vape pens, compared to the general consumer population’s preferences (55% and 28%, respectively). That group is also most likely to report vaping or dabs as their most frequently used form.

Everyone Has Their Favorites

Even those who consume infrequently express a preferred product type. Among Social Nibblers, 78% consume edibles, as compared to 55% of the general consumer population; meanwhile, 100% of Infrequent Partakers consume flower as compared to 81% of general consumers.

“Cannabis consumers are a unique and varied population,” notes Dr. Amanda Reiman, Ph.D., MSW, New Frontier Data’s chief knowledge officer. “Brands can no longer assume that generalized marketing which plays into overarching cannabis culture will attract their core consumers. Furthermore, the archetypes suggest that some consumers may start in one group and then transition as access and motivations change. This means that cannabis companies need to not only understand the consumer landscape in front of them, but anticipate opportunities for future shifts in consumer behavior.”

In a webinar available here, she and other industry experts discuss “Understanding your Customer: Cannabis Consumer Archetypes”, and how New Frontier Data identified the distinct consumer archetypes based on analysis of social and demographic data along with cannabis consumer behaviors, goals, and purchasing habits. Diane Downey, co-Founder & CEO of Rebel Spirit Cannabis Company, and Lilli Keinaenen, sustainable packaging + branding designer for Changemaker Creative, join the discussion.

Check out the complete video library on Equio®, our cannabis business intelligence platform. Download a complimentary copy of the report. Interested in also accessing Part I and Part II of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.