In a Fragmented Product Landscape, Consumer Understanding is Critical

MSOs Establishing Themselves With Strength in Legal Cannabis Markets

February 15, 2022

Survey Says: Opposition Keeps Fading to Legalization’s Favor

March 1, 2022By Rob Kuvinka, VP, Data Science, New Frontier Data

With over 100,000 unique product SKUs now on sale in California, cannabis consumers face an increasingly dizzying array of options to choose from in a hyper-fragmented market. With so many existing choices available as new entrants jockey for competitive positions, brands must vie for shares of both minds and wallets.

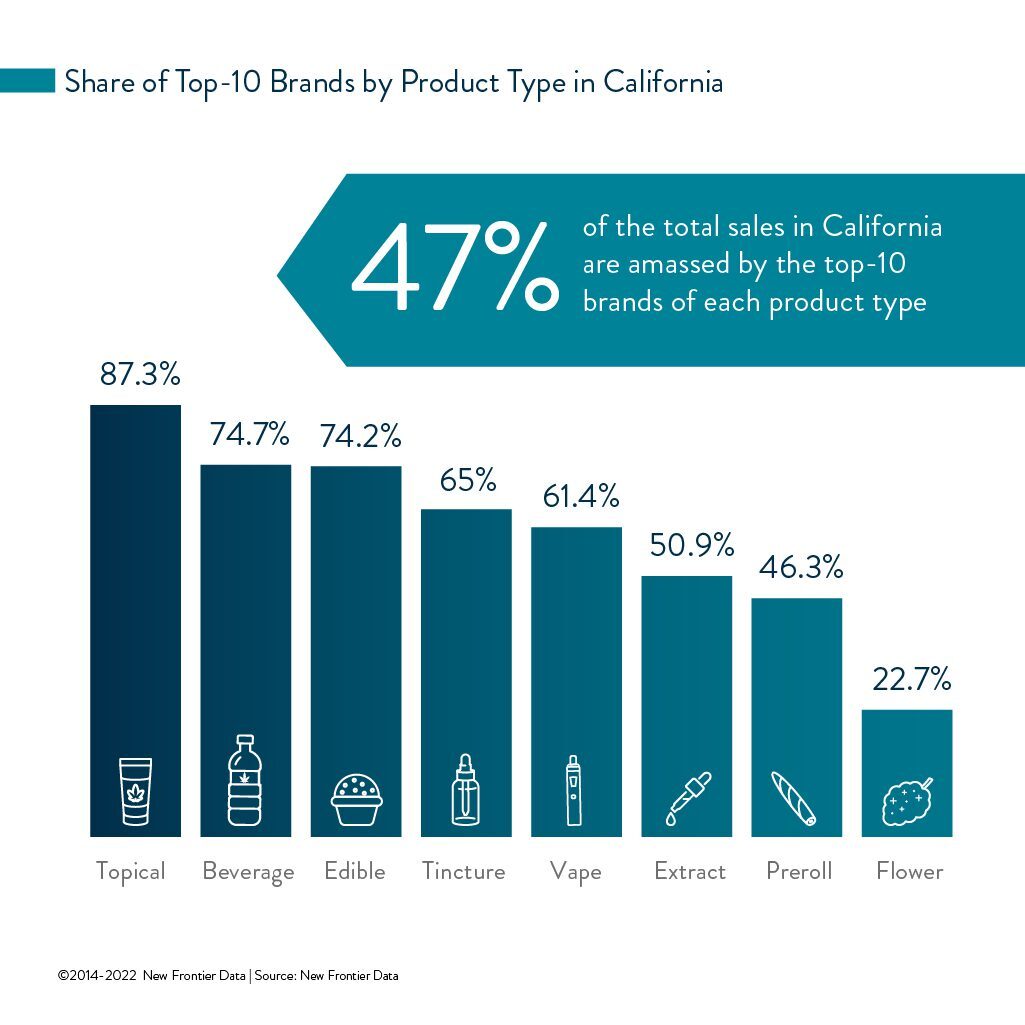

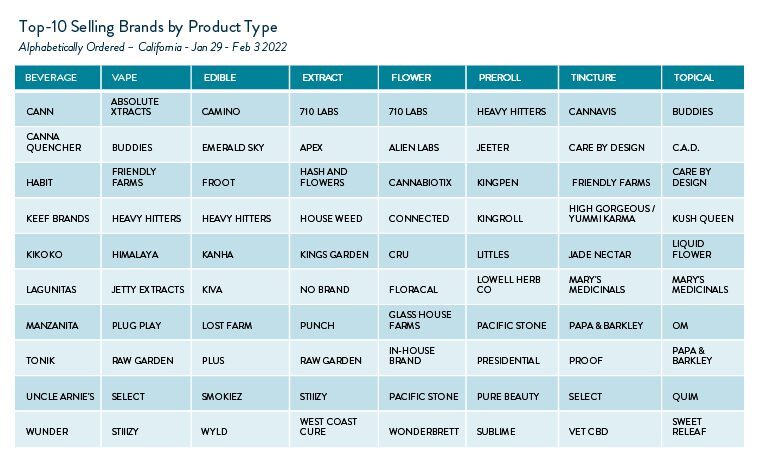

New Frontier Data’s analysis of recent data from California shows just how competitive the state’s cannabis product landscape has become. Flower products (including pre-rolls) represent the largest category in the market, accounting for nearly half (46%) of all sales and nearly $2.2 billion in revenue during 2021. The sector is crowded, however, featuring beyond 850 unique flower brands and more than 600 pre-roll labels currently sold if without any single brand commanding more than 3% of the market. The top ten brands combined account for 22% of the category. Despite that fragmentation, but given the significant degree of consumer spending on flower, even a small share of the multibillion-dollar category stands to be highly lucrative.

At the other end of the spectrum sit topicals, a smaller, far more concentrated category with a few large players vying for the lion’s share of the category. Topicals accounted for less than $30 million (below 1% of the market) in 2021. Competing with only about 60 topical brands, sales of California’s top two leaders command more than half the category’s share, and the top ten topical brands comprise 87% of the category, illustrating their domination of that segment.

The higher concentration of share among value-added categories is due to several factors: Unlike highly substitutable flower products (e.g., similar strains grown by different growers), value-added products offer greater abilities for differentiation based on the ingredients’ use and form factors. Additionally, most consumers transitioning from illicit to legal markets are well oriented to flower and concentrate products, but generally less experienced with high-quality edibles, beverages, vapes, and topicals (due to the difficulties in producing them at scale for an illicit market). Thus, consumers’ limited experiences with value-added products afford brands the ability to establish a strong affinity with those coming to them without well-established expectations. Furthermore, consumers new to legalized cannabis — especially those without previous experience smoking cannabis — are likelier to choose noncombustible products, and to become brand loyal upon finding a product to meet their needs.

Considering the continued fragmentation of the product landscape, it is incumbent upon brands to define their target consumers, and align their products (and messaging) to those specific consumer groups. With so many competitors jockeying for position in a crowded space, cannabis brands can no longer afford to be one-size-fits-all, because generically branded products will inevitably be pushed aside by those leveraging more thoughtful and nuanced approaches to target specific consumers. The imperative for refined consumer targeting is especially important in the value-added product categories, where brands have significantly greater flexibility in tailoring their products to specific use cases or experiential outcomes. A topical intended for pain relief, for example, would rely on very different branding and messaging than one intended for intimacy.

Over the coming weeks, New Frontier Data will be delving more comprehensively into evolving consumer behaviors and retail product trends. Suffice it to say, however, that while market share is a compelling metric for identifying who currently leads a market, the accelerating pace of product innovation to entice fast-evolving consumer preferences means that no company (especially not one aiming to maintain dominance of a category) should rest on its laurels. Fortunately, with the burgeoning amounts of retail and consumer data now available, brands have access to all the intelligence required to devise well-defined and highly defensible strategies amid their increasingly competitive markets.

Source: New Frontier Data 2022