MSOs Establishing Themselves With Strength in Legal Cannabis Markets

Normalization of Cannabis Yields Accuracy in Self-Reporting

February 7, 2022

In a Fragmented Product Landscape, Consumer Understanding is Critical

February 23, 2022By Rob Kuvinka, Manager, Data Science, New Frontier Data

Since California legalized cannabis five years ago, public acceptance has grown exponentially. With MSOs having gained greater market share in newer legal markets (Connecticut, Florida, Maryland, New Jersey, New York, and Pennsylvania) than established markets in the West, industry stakeholders are taking note of the differentiating characteristics that set them apart as viable investments.

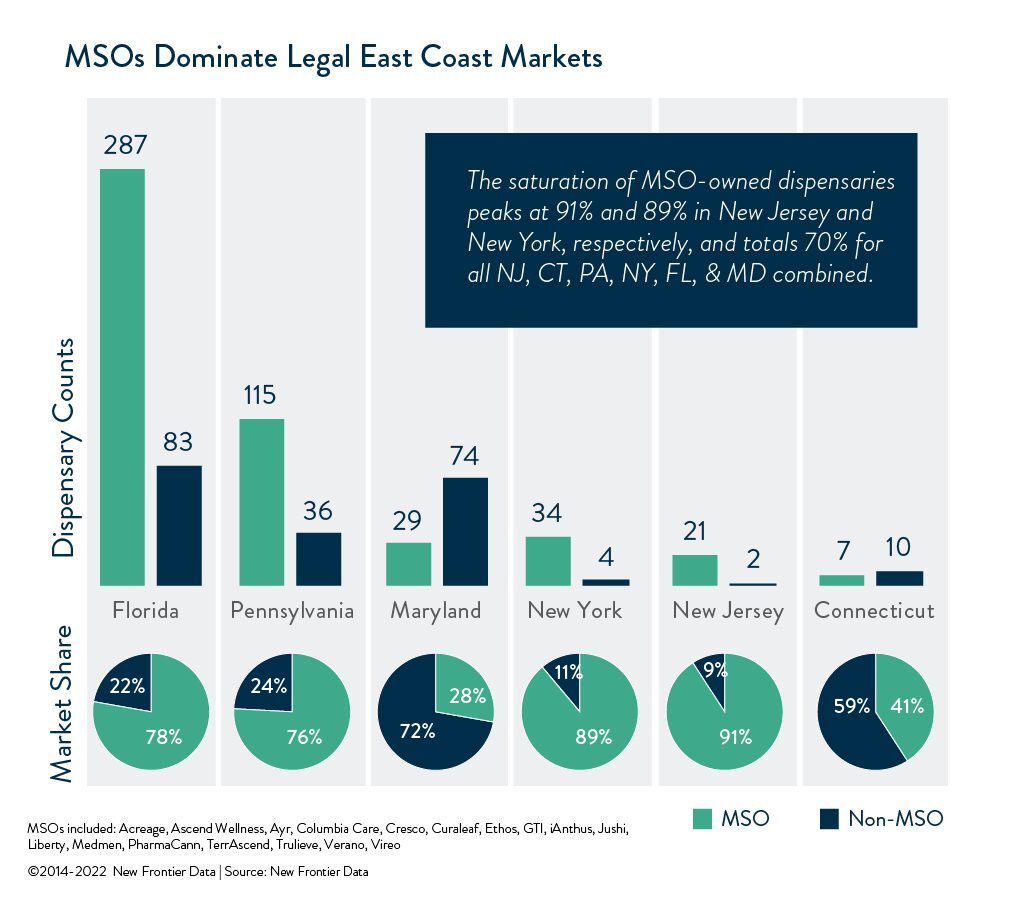

Aggressive statewide store rollouts and merger-and-acquisition (M&A) deals are allowing well-capitalized corporations to quickly dominate what New Frontier Data projects to be a combined $7.8 billion legal retail market in the newer markets this year. The saturation of MSO-owned dispensaries peaks at 91% and 89% in New Jersey and New York, respectively, and totals 70% for all six Eastern states combined. Among the deals closed in the past months impacting these markets are Trulieve/Harvest (October 2021, $2.1 billion, 149 dispensaries), Cresco/Cure Penn (September 2021, $90 million, four dispensaries), and Ayr Wellness/PA Natural Medicine (October 2021, $80 million, three dispensaries).

Throughout 2021, MSO stocks roiled, according to Dan Ahrens, managing director and chief operating officer of Maryland-based AdvisorShares. While Q2-’21 earnings were reportedly “fantastic”, the stocks flattened for the latter part of the year, if attributed for a variety of reasons unrelated to earnings. First and foremost among them has been the lack of progress toward reforms to federal prohibition.

Ahrens is also the portfolio manager of AdvisorShares Pure U.S. Cannabis ETF, the largest holdings of which include Ayr Wellness, Chicago-based Cresco Labs, Massachusetts-based Curaleaf Holdings, Illinois-based Green Thumb Industries, and Trulieve.

Ahrens said that shortsighted retail investors had been expecting federal reforms which have been dragged out since the 2020 U.S. elections, as publicized last fall. Adding to that uncertainty, he noted, were two other factors keeping industry share prices down: restricted access to MSO stocks and low trading volume.

Due to federal prohibition, big banks, key brokerage firms, and wire houses restricted access to MSO stocks. Since those stocks trade via over-the-counter exchanges in the U.S. without the trading volume that NASDAQ of the New York Stock Exchange-listed stocks attain, the lower market float can make any stock more vulnerable to attack by short sellers. Conversely, solid buying pressure in the short term may cause stocks to rebound sharply.

The downward trend for MSOs continued in January, though Seeking Alpha last week expressed some optimism:

“The legal cannabis industry is just getting started and 2022 could be a breakout year for publicly traded companies. The big five MSOs (i.e., Curaleaf, Trulieve, Cresco, Green Thumb, and Verano), as the largest and most well-known operators, are naturally going to get the most attention. However, investors open to investing in the industry should consider Ayr Wellness [as] it is currently flying under the radar and has significant growth potential.”

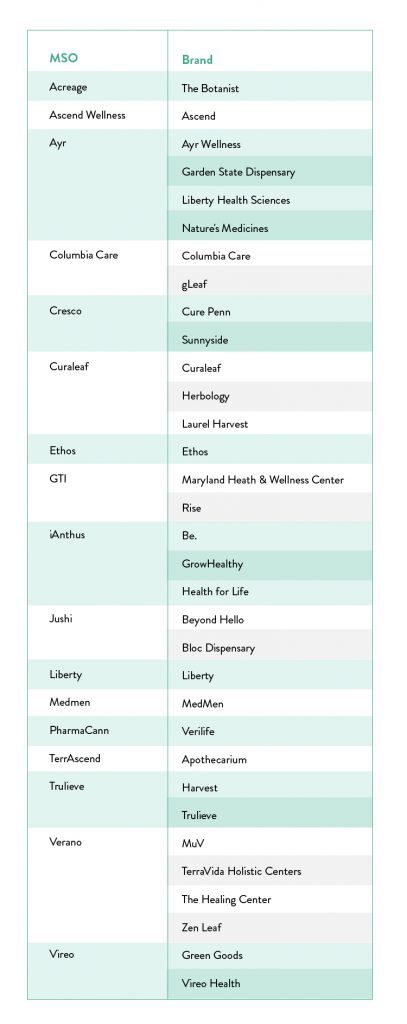

Likewise, there is a positive side for the longer term. The framework of an MSO helps a brand establish a basis for national expansion even while strictly observing federal laws on interstate commerce, which mandate that cannabis must remain for sale only in the state where grown. MSOs operate under many, interrelated dispensary brands. Those 17 MSOs found among Connecticut, Florida, Maryland, New Jersey, New York, and Pennsylvania offer 33 various brands.

The advantage of a single brand representing a coalition of operators is in its ability to promote recognition wherever sold, regardless of the original entity or its jurisdiction. That allows for the MSO to build a customer base, promote loyalty, and prepare its financial and operational footprints for when federal prohibition reform enables a national market. Meanwhile, an MSO can operate for profitability through local or state locations by offering seemingly uniform products which, in actuality, are each locally grown, processed, and distributed.

MSO dominance may also prove consequential to social-equity programs, the goals for which are jeopardized when fewer players control the retail landscape.

As Shaleen Title, distinguished cannabis policy practitioner-in-residence at The Ohio State University’s Moritz College of Law Drug Enforcement and Policy Center, wrote last month in her research paper, Fair and Square: How to Effectively Incorporate Social Equity Into Cannabis Laws and Regulation, without clear limits on how many licenses one person or entity can control, “big corporations will obtain multiple licenses, take up limited real estate, begin operating, and dominate the market before most social equity applicants even receive provisional approval”. Last fall, she shared an inside look at challenges operators are facing in Massachusetts and the ongoing push for social equity in a New Frontier Data’s Cannaweek webcast.

While challenges undeniably remain, MSOs have significant leverage in the market. Those which are well-planned and managed are prospering, both providing favorable returns and are outperforming the market. Whether through individual company stock purchases, or through the growing number of cannabis ETFs, retail investors have a growing portfolio of options to invest in the industry’s largest companies. However, with expansion and go-to-market strategies increasingly diverging, investors will need to focus on more than just size to assess the companies best positioned for growth in the industry.

Disclosure: New Frontier Data does not provide personalized investment advice, nor does it endorse any company or individual identified above. Our mission is to inform policy and commercial activity for the global legal cannabis industry. We maintain a neutral position on the merits of cannabis legalization through comprehensive and transparent data analysis and projections that shape industry trends, dynamics, demand, and opportunity drivers.