Investors Waking Up to Hemp as Cannabis Stocks Retrace

Official Response to Claims & Allegations: The Oceania Cannabis Report, 2018 Industry Outlook

October 29, 2018

Fresh Perspectives Arising from the Pacific Rim

November 3, 2018By Sean Murphy, Director of Hemp Analytics, New Frontier Data

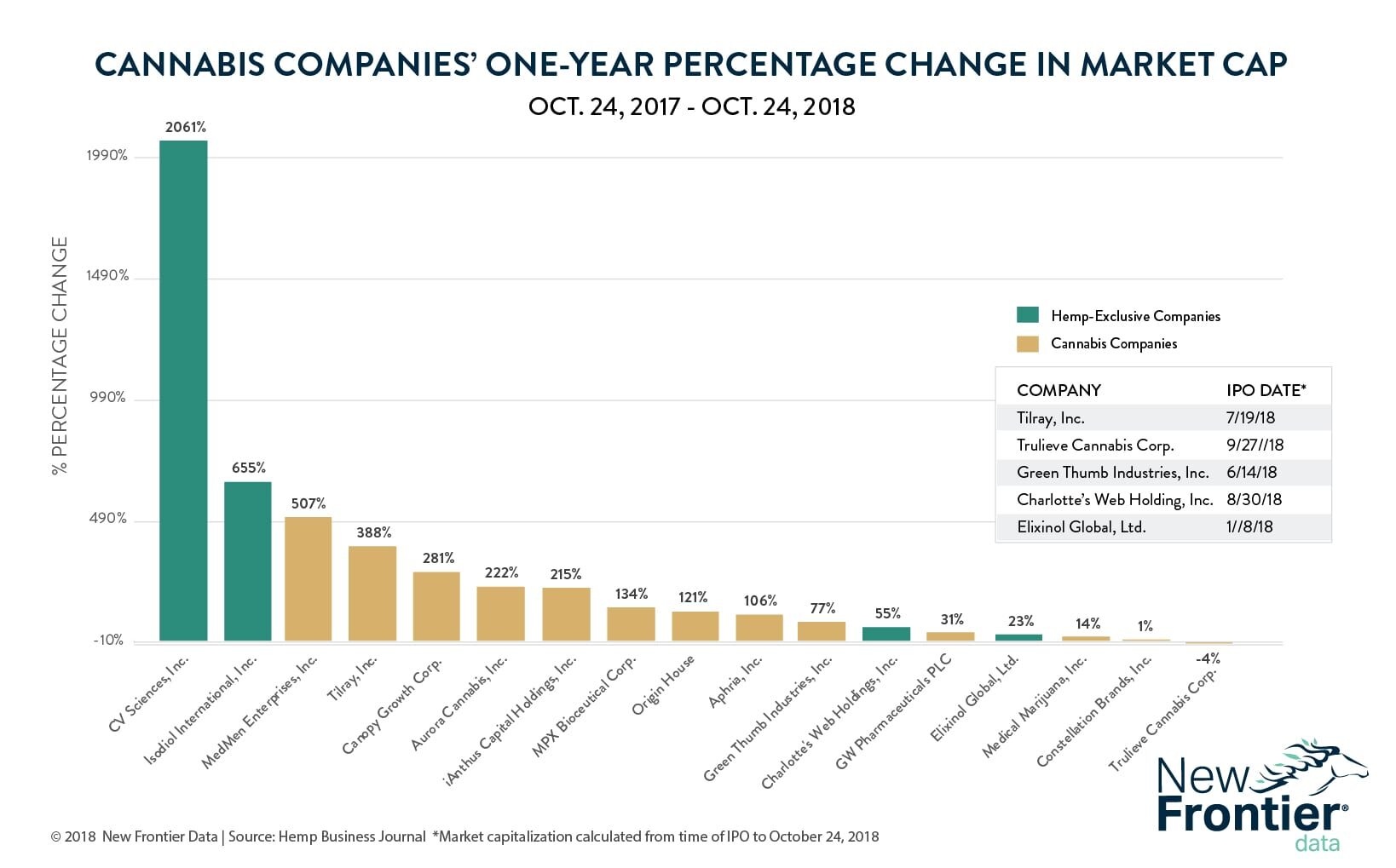

Investors are waking up to the hemp industry. Hemp is proving its opportunity for financial returns, and potential for social and environmental impact.

While the first five years of the cannabis stock “green rush” was dominated by retail over-the-counter (OTC) traders, family offices and high net-worth individuals, the second phase of cannabis investing will be led by M&A deals that consolidate the cannabis industry and institutional investors speculating on companies that are disrupting major parallel industries (e.g., pharmaceutical, alcohol and tobacco).

As this second phase begins, there few value investors in the space and cannabis stocks continue to move in a volatile fashion, susceptible to swings from momentum trading, news cycles, regulatory changes, and an evolving, young market.

Many investors ”sold the news” during these last two weeks in Canada, while the cannabis market capitalizations shuttered billions of dollars. As of October 29th, the North American Marijuana Index fell 35% from its near all-time highs on October 15th, just two days before national legalization in Canada.

As sell-offs disconcerted cannabis stock investors, smart money turned its attention to hemp. The latest round of acquisitions by Canadian LPs were led by Canopy Growth’s acquisition of ebbu, LLC, a cannabinoid research and development deal valued at over $400 million.

Cannabis companies are taking different approaches to address hemp’s presence in the market. In some cases, companies are applying a M&A “buy-versus-build” approach to hemp businesses and profiting from less expensive inputs to scale supply chains and meet mass market demand for cannabinoid-based products. Other cannabis stakeholders, particularly growers, who have felt threatened by the introduction of a competitor in an already competitive space, have been charged with using local and state level bureaucracy to slow the hemp industry’s advance, primarily in California, and to some degree, in Oregon and Washington.

What matters now is the 2018 Farm Bill. The bill includes crucial hemp provisions that could establish a concrete regulatory framework for hemp companies to access major U.S. exchanges. The bill could also bring access to traditional banking, credit card processing, federal farm programs, crop insurance, and more U.S. grown hemp products to mainstream U.S. retailers.

There are several hemp companies quietly surpassing the sales of nearly all the public cannabis companies in the market, despite their comparatively modest valuations and market caps. To analyze these companies, New Frontier Data’s hemp division has initiated coverage on several hemp-specific companies including CV Sciences, Charlotte’s Web Holdings and Elixinol Global. New Frontier Data will also continue tracking other hemp CBD focused companies including Isodiol, Hemp Inc., Medical Marijuana, Inc. and other large cannabis companies, including the leading Canadian LPs that are operating divisions and subsidiaries within the hemp industry.

Investors are also discovering hemp’s applications for social and environmental impact. Hemp extracts and CBD-based products are poised to provide health benefits to millions of consumers and patients across a variety of conditions including epilepsy, pain and anxiety. Innovative hemp companies and products are tackling the challenge of reducing and replacing petrochemical pollutants (i.e. plastics) with renewable and biodegradable products. Others are developing technology to capture carbon from hemp fields to sell as credits to major polluters, in a cap and trade fashion, similar to Lyft’s recent carbon credit deal. This innovation is well-timed as the newest generation of investors, millennials, are known for their ecological and environmental priorities. Hemp is a logical pairing with this new generation of income-earners, who are eager to support naturally occurring solutions to carbon emissions and soil degradation, from a plant whose waste byproducts from manufacturing can be further utilized, recycled and connected from seed, to shelf, to earth.

To learn more about leading hemp CBD investments see The CBD Report 2018; and stay tuned for New Frontier Data’s upcoming Global State of Hemp Report.

Sean Murphy

Sean Murphy is Director of Hemp Analytics at New Frontier Data and founder of Hemp Business Journal. He is frequent speaker at hemp, cannabis and natural product industry events and source to the media on industry economics and investments, including Forbes, New York Times, The Wall Street Journal, Rolling Stone and Entrepreneur.com.