Law Enforcement’s Ill-Gotten Gain: Civil Asset Forfeiture Laws v. Cannabis

Guilty Until Proven Innocent

June 29, 2020

Civil Protests Give Urgency to Cannabis Industry’s Social Equity Programs

July 5, 2020By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

Civil Forfeiture Overview

Civil forfeiture laws allow police to seize property—cash, cars, and houses, guns, and other assets—suspected of being connected to criminal activity independently of whether criminal charges are ever filed. While the original intent of civil asset forfeiture was to disrupt large-scale organized drug trafficking and fight the “War on Drugs”, overwhelming evidence shows that the programs exercised at the state and local levels offer too few protections for innocent property owners while simultaneously offering perverse profit incentives for police and prosecutors.

Additionally, many states do not require reporting on key details, such as whether any criminal charges were ever filed in relation to the seizure of cash or property, or what type of criminal activity was alleged (e.g., cannabis), and if a state has no requirements to aggregate those reports or publish them online, there is very little incentive to be honest and transparent about either the circumstances under which the money and property were seized, or the ways how assets were allocated and spent.

Burdon of Proof

People having the financial means to go to court to fight for forfeited assets often face another major obstacle: low standard of proof required to seize property under most civil forfeiture laws. Under civil asset forfeiture, the property itself is charged with the crime, not the person, and unlike when a person is prosecuted for a crime, the property is effectively seen as guilty until proven innocent, with the burden of proof falling on the property owner.

Thirty-one states and the federal government set “preponderance of the evidence” as the standard of proof for all civil forfeitures, making it the most common standard nationally. (A preponderance of the evidence standard means that property is more likely than not connected to a crime. It is often thought of as a 51% standard, meaning that the evidence must be a bit more than 50–50 (or slightly better than a coin flip)in favor of the government, a much lower hurdle than proof beyond a reasonable doubt.)

Massachusetts and North Dakota set a lower standard still, requiring only probable cause for civil forfeiture. Probable cause is the same low evidentiary standard that police must meet in order to make an arrest, carry out a search, or seize the property or cash in question in the first place.

Perverse Incentives

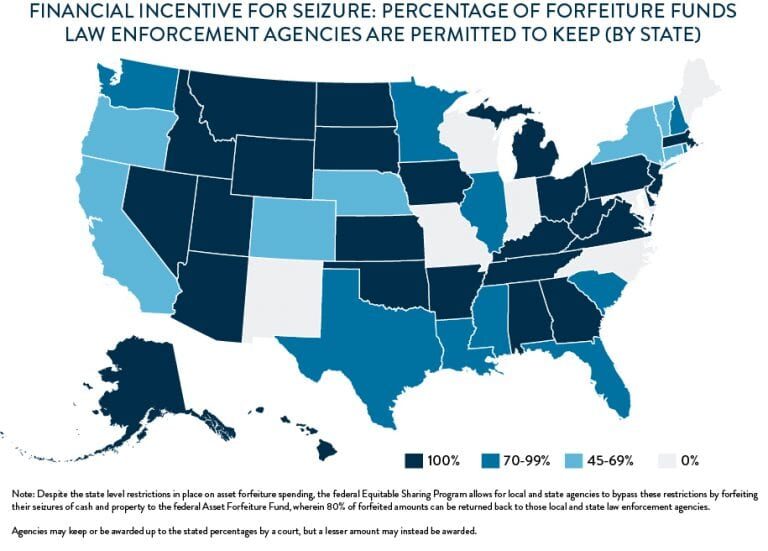

One of the incentives for program abuse lies in the absence of restrictions on spending of seized funds, with 35 states allowing law enforcement to keep over 75% of total forfeited proceeds (26 states allow law enforcement to keep 100% of the cash and property they seize). Only seven states and the District of Columbia block law enforcement from access to forfeited proceeds.

Picking on Cannabis

Drug-related crimes make up most crimes cited for seizures, and marijuana is the most commonly cited individual drug.

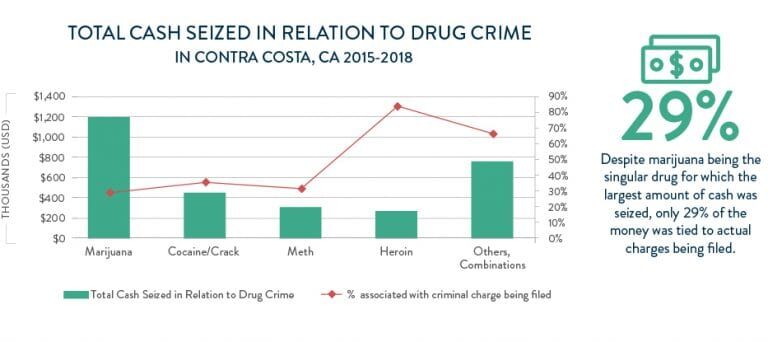

Despite the overwhelming lack of transparency about details of civil asset forfeiture programs across many states, there have been some small pockets of visibility though public records requests in states that are required to keep information about the cash and assets they are seizing. For example, in Contra Costa, Calif., a series of public records requests to the district attorney’s office revealed cash seizures totaling $1.3 million in cases where drug-related criminal charges were filed, and $529,000 in cases where a charging decision had not been made. About $1.1 million of the seizures came from cases where the district attorney’s office decided not to file criminal charges, yet still took action to keep the cash – of that $1.1 million, nearly half came from marijuana alone. Despite marijuana being the singular drug for which the largest amount of cash was seized, just 29% of the money was tied to actual charges being filed.

Source: Contra Costa County District Attorney’s Office

Federal Equitable Sharing Program as Loophole for Seizing Cannabis Assets

State civil forfeiture laws vary in terms of their incentives, but state and local law enforcement agencies have a loophole of receiving the assets through the federal government’s Equitable Sharing Program, under which state and local police agencies can collaborate with federal agencies to seize assets from individuals and then transfer those seizures to federal control. In doing so, local agencies can bypass some state-level regulations limiting forfeitures, and still receive 80% back from the federal program. The method has been sharply criticized for circumventing state laws, specifically those states requiring seized assets to go into a state’s general fund.

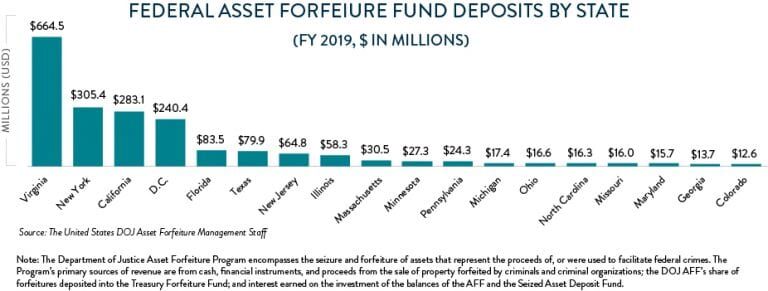

The federal Equitable Sharing Program is a tool that is being specifically used to seize assets related to cannabis both in states where it is illegal and in states which have legalized and regulated its use and sale. Once that cash or property is taken under the program, federal (and not state) forfeiture law applies—even if state law prohibits or limits law enforcement access to forfeiture funds. Such an instance occurred in California, where cannabis is legal. Not only does federal law allow forfeiture proceeds to be spent by law enforcement, but equitable sharing rules indeed mandate that funds go to law enforcement. It is for that reason that agencies in states with stricter or less generous civil forfeiture laws participate more heavily in equitable sharing. Given relatively restrictive civil forfeiture laws in places like D.C. and California, the high dollar amounts flowing through the federal sharing program help underscore the circumvention risks which the entire practice poses, specifically to the evolving cannabis industry.

The DOJ Asset Forfeiture Program

Source: The United States DOJ Asset Forfeiture Management Staff

Note: The Department of Justice Asset Forfeiture Program encompasses the seizure and forfeiture of assets representing either the proceeds from, or which were used to facilitate, federal crimes. The program’s primary sources of revenue are from cash, financial instruments, and proceeds from the sale of property forfeited by criminals and criminal organizations; the DOJ AFF’s share of forfeitures deposited into the Treasury Forfeiture Fund; and interest earned on the investment of the balances of the AFF and the Seized Asset Deposit Fund.

In D.C. (where law enforcement cannot keep any funds or property which they seize) over $240 million in assets were seized and forfeited to the federal program in 2019, which under the equitable sharing program allows for up to 80% to be sent back to law enforcement agencies.

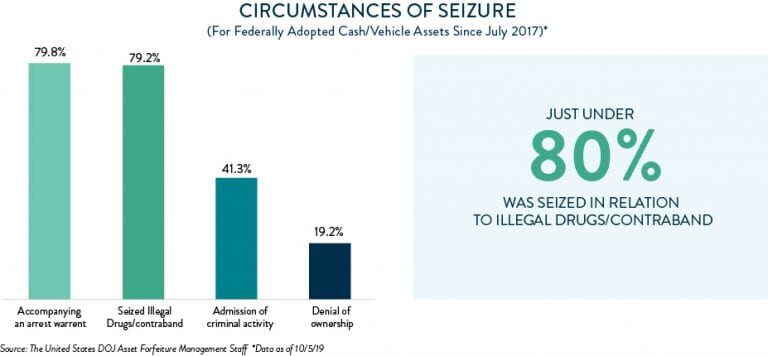

According to DOJ Asset Forfeiture Management Staff, of the cash and vehicle assets adopted since July 2017, nearly 80% was seized in relation to illegal drugs/contraband.

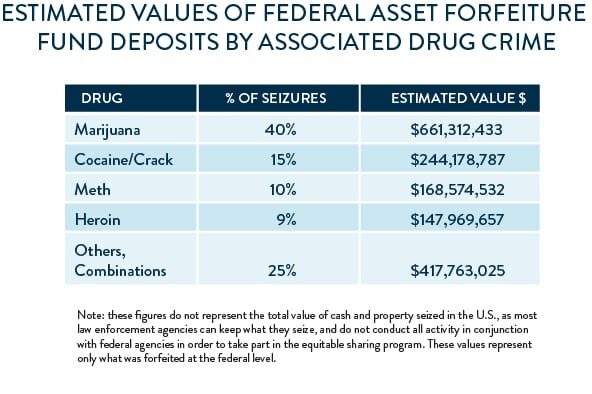

If the ratios of drug types seen in local municipalities like Contra Costa hold true at the level of the federal asset forfeiture deposits, it means that roughly $661 million would have been collected by the federal government’s asset forfeiture program from seizures related to marijuana in FY 2019.

2019 FY

Total Deposits Federal Asset Forfeiture Fund: $2.1 billion

Total Estimated From Illegal Drugs and Contraband: $1.6 billion

Note: these figures do not represent the total value of cash and property seized in the U.S., as most law enforcement agencies can keep what they seize, and do not conduct all activity in conjunction with federal agencies in order to take part in the Equitable Sharing Program. These values represent only what was forfeited at the federal level.

Major Reforms Are Still Needed

Amidst the robust national debate currently being had about reforms to policing in the aftermath of the killing of George Floyd in Minneapolis police custody last month, state and federal lawmakers are weighing a range of options to make policing more equitable, including eliminating incentives for police malpractice.

Given the significant number of people whose property is being seized under civil asset forfeiture programs but who are never charged — and particularly since cannabis has been a major driver for the forfeitures at a time when public support for legalization is at an all-time high — reforming civil asset forfeiture laws and ensuring that those whose property has been seized have proper recourse to recover their assets should be key components. Further, having police department budgets funded by property seized from the public creates perverse incentives for law enforcement agencies in budget-constrained communities to be more aggressive in the practice in order to offset budget cuts. At a minimum, having any seized assets allocated toward community programs (or other general fund allocations outside of law enforcement) can eliminate the expectation that police pay hinges on how many assets that officers seize. Additionally, the federal Equitable Sharing Program should be reformed to eliminate the bypassing of such state level restrictions on spending. Barring such changes, the civil asset forfeiture will continue to present significant opportunities for abuses of police power.