Legal Cannabis Cultivation’s Footprint Sinks Common Assumptions About Comparative Water Use

Cannabis Growers Consider Broader Options to Improve Facility Water Efficiency

March 1, 2021

Virginia’s Adult-Use Legalization May Open Up More Mid-Atlantic Markets

March 15, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

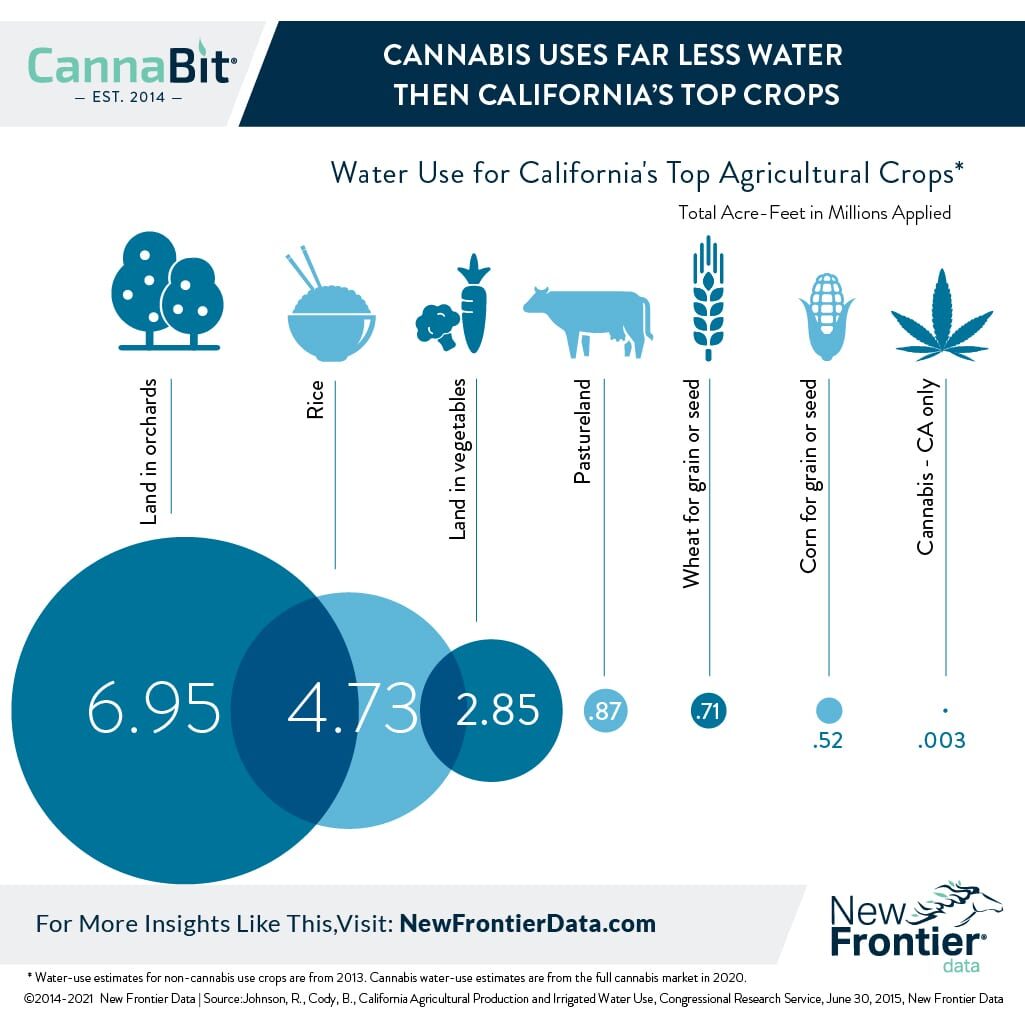

Surging growth within the legal cannabis industry has made it a convenient target for those in drought-stricken regions to blame for acute water shortages. Conventional wisdom surmises that if cannabis is California’s most lucrative cash crop, rivaling wine vineyards and the state’s fabled fruit and nut orchards, then surely the cannabis sector must be using at least as much water as the thirsty crops that lead the state’s agricultural economy.

However, the relative value of cannabis when compared to grapes, corn, or rice highlights how the cannabis economy does not equate with other large-scale crops in California. Whereas wholesale pounds of cotton, rice, and table grapes sell for approximately $0.60, $0.71, and $0.78, respectively, a wholesale pound of smokable cannabis bud can fetch $1,500 – $3,000 or more, depending on the quality. Consequently, the market value of the cannabis industry increases dramatically with only incremental increases in production.

Consequently, while the state produced over 7.1 million tons of grapes valued at $6.3 billion dollars, and nearly 2.3 million tons of almonds valued at $5.5 billion dollars, the state produced less than 10,000 tons of smokable cannabis flower (for the legal and illicit markets combined), but for a total value of nearly $25 billion dollars. That comparative scale in yield to market value is a key reason why, despite longstanding conventional wisdom, cannabis comparatively uses so much less water per dollar gained than California’s other leading crops.

As explained in Cannabis H20: Water Use and Sustainability in Cultivation, New Frontier Data’s latest report (in partnership with Resource Innovation Institute and the University of California, Berkeley), our estimates found that while the state’s orchards use nearly 7 million acre-feet of water, and rice fields use nearly 5 million acre-feet, the state’s lucrative cannabis industry only uses 3,000 acre-feet, making it the most water-economical crop among the state’s top revenue crops.

The industry’s parsimonious use of water relative to other crops has two important implications. The first is that regulators should not adopt punitive policies related to water use, as there are far greater gains to be had through water conservation in other agricultural sectors. Regulators should instead incentivize water efficiency by encouraging data-reporting among producers, collecting and sharing best practices, and offering rewards to companies which invest in water-saving technologies.

Additionally, while the industry water-use footprint may be small relative to other sectors, within the industry itself there are significant operational cost savings to be gained through reducing a facility’s water use. Recognizing that, there is obvious incentive for any operator to increase their water efficiency amid the increasingly competitive legal market.

With the U.S. legal cannabis industry poised to double in size among those states where it is currently legal, and an additional dozen or more states poised to legalize cannabis over the next two or three years, the cannabis industry resides in a particular position to make major investments in resource-efficient solutions while the sector is in its infancy. Through greater industrywide collaboration and operational benchmarking, the industry can potentially provide the large number of operators that will be establishing operations over the next decade with the ability to make cannabis not only one of the country’s most lucrative cash crops, but also one its most sustainably grown.