Opportunities Outweigh Any Barriers to Cannabis Homegrowing

Home Is Where the Flower Is: Cannabis Homegrowers on the Rise

August 16, 2022

New Report Details Challenges and Solutions for Federal Cannabis Regulation

August 25, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

Over the past few weeks we’ve planted some proverbial seeds that homegrown cannabis is an expanding sector of the market populated by engaged consumers and projected to expand.

Among the key drivers fueling that expansion in the United States is the increasing access to legal cannabis. Consumers in adult-use markets are more likely (7%) to engage in homegrowing than are their counterparts residing in medical (5%) or illicit (4%) state markets. As the stigma surrounding home cultivation — and cannabis writ large — diminishes, it becomes increasingly important to understand how both current cannabis consumers and nonconsumers feel about the prospect of home cultivation.

Interest Is There

Cannabis consumers are generally far more open to the idea of growing their own cannabis than are nonconsumers. More than half (53%) of current cannabis consumers report interest in growing cannabis at home, compared to just 1 in 10 (10%) of nonconsumers. Cannabis consumers are also more likely (78%) to report comfort about people growing their own cannabis for personal use than were nonconsumers (30%).

Another striking consideration is how consumers engage in other green-thumbed activities. Homegrowers claim being twice as likely to have outdoor fruit and vegetable gardens than nongrowers, and significantly more are likely to grow plants inside their homes. The orientation to gardening and pleasure derived from tending to plants should be incorporated in the focused messaging to promote nongrowing consumers’ interest in homegrowing. Nevertheless, given that producing high-quality cannabis can often be more challenging than cultivating common fruits and vegetables, prospective homegrowers should be educated about how growing cannabis differs from caring for other plants.

Review Local Regulations

Education concerning regulations is also important. Cannabis consumers in illicit markets are more confident that they understand the laws around growing cannabis than are their adult-use and medical-only counterparts. Even in markets where consumption has been legalized, homegrowing can remain an illicit activity. Where it is allowed, rules limiting the number of plants allowed for an individual or household to grow vary by state and are significantly more complicated than the blanket illegality found in illicit markets. To check the rules and relative market opportunities of each state, consult the U.S. Cannabis Dashboard on New Frontier Data’s business platform, Equio.

Among recent developments, Florida activists are reportedly planning a 2024 homegrowing ballot initiative to run alongside a filed cannabis sales measure already supported by the industry. Trulieve has said that it’s open to supporting both measures, but made no specific comment.

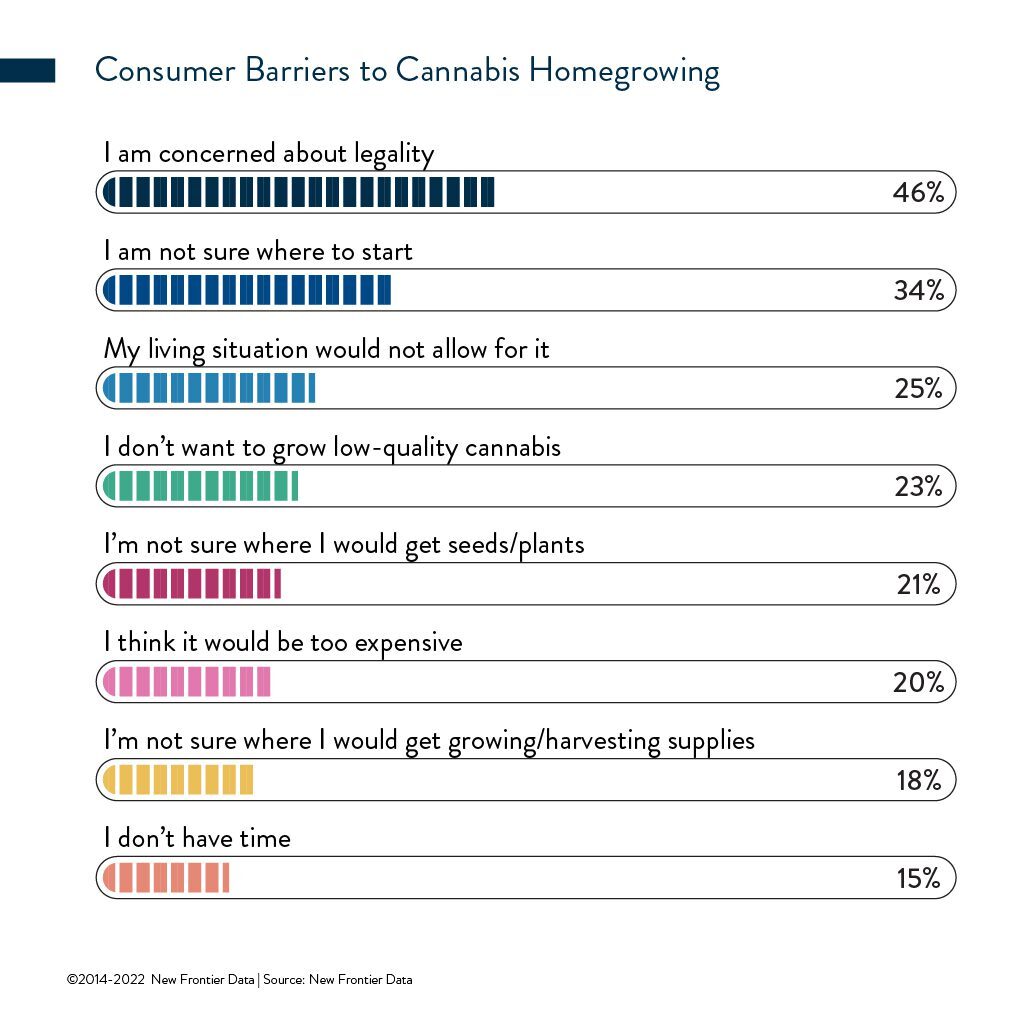

When asked what has kept or discouraged cannabis consumers from homegrowing, their primary concerns involve legality and practicality: 4 in 10 consumers in adult-use markets reported uncertainty about how to start.

Commitment Phobia Is Unfounded

Compared to those over age 55, younger consumers are more likely to express confidence about homegrowing. Older consumers and those living in illicit markets were most concerned with legality, while younger consumers were likelier to cite concerns about getting started, growing quality flower, their current living situations, and time commitments.

Some of those concerns may be unfounded: More than half (54%) of consumers expected homegrowing to require more than six hours a week, while only 34% of homegrowers reported actually spending that much time. Other challenges cited by growers included challenges growing quality flower (reported by 29%), though a notable 7 in 10 growers conversely reported resolving issues which they’d experienced with their grows.

The perceived hurdles reinforce an imperative to educate consumers about homegrowing. Given how many growers report being self-taught, providing resources to ease the transition from purchasing consumers to homegrowers could lower barriers to entry and — for brands that can position themselves as sources of information and education — provide a great deal of engagement with some of the most intentional consumers available.

For more information about homegrowing and homegrowers, download a copy of New Frontier Data’s latest report: The U.S. Cannabis Homegrow Market: Motivations, Processes, and Outcomes.