Panic buying and social distancing: Cannabis sales strong even in first month of corona-recession

U.S. CBD Consumer Archetypes

May 24, 2020

Frequency of Use Among U.S. CBD Consumers

May 31, 2020By: Brian Peterson and Andrew Miller, Anderson Economic Group

Multiple factors shape cannabis markets as pandemic unfolds

Chicago, IL—In a few short years, cannabis sales have transformed from a mostly illegal enterprise to an ‘essential business’ that many states have kept open during the COVID-19 epidemic, the worst the nation has seen this past century. Experts at Anderson Economic Group have been closely monitoring COVID-19’s impacts on the cannabis industry.

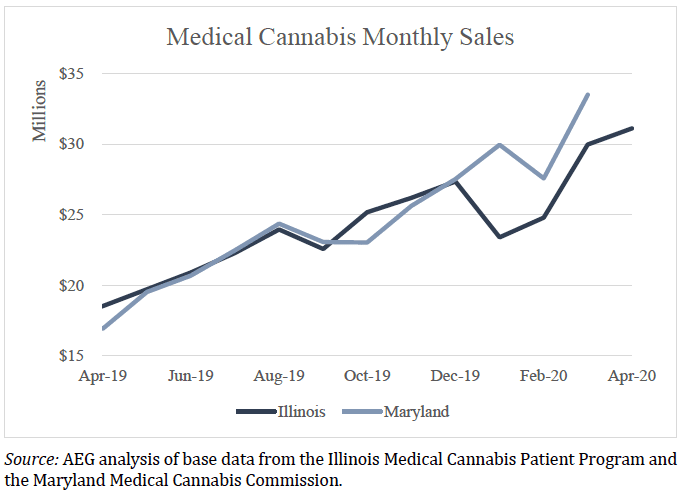

Initial data suggests demand in March was strong. Even as the COVID-19 crisis led to a 2.0% drop in national personal income and an 8.7% decrease in retail sales in March, early data indicates that cannabis demand remained steady. Andrew Miller, a senior analyst at Anderson Economic Group, predicts that medical cannabis sales will see a short-term boost as patients concerned about dispensary closures engage in panic-buying. “Illinois and Maryland both saw their medical cannabis sales increase by over 20% in March,” he noted. And in Massachusetts, where a stay at home order banned recreational sales, medical patient registrations have more than tripled as consumers seek to switch to medical cannabis. Illinois and Michigan both saw recreational sales growth in March despite stay at home orders, and Illinois’ recreational sales in April were the highest since its market opened in January.

Charting new territory. Brian Peterson, director of public policy for Anderson Economic Group, notes that this is the first time the cannabis industry has faced a significant economic downturn since states began legalizing. “We have been tracking demand for cannabis through the AndCan® Index since 2015. This is the first time the market has seen a recession,” Peterson said. “There’s a lot of uncertainty about what will happen next – we can’t look to the past to predict how consumption patterns will change in response to an economic downturn because this is the first one.”

Although initial data show increased demand, Miller cautions that we won’t have a clear picture of the epidemic’s impact until more states begin reporting sales data for April. “Unlike March,” Miller said, “sales data for April will reflect a full month of stay at home orders and provide a better look at their impact on cannabis sales.”

Cannabis markets face headwinds in the long term. Looking to the near future, there are many factors working against cannabis markets, and AEG experts expect the AndCan® Index to show at least a slight decrease in cannabis demand beginning in April. Anderson Economic Group previously estimated that that 104 million Americans would lose at least two days’ worth of income in April – a development that will undoubtedly lead some cannabis consumers to tighten their belts. Furthermore, global supply chain disruptions, combined with the cannabis industry not being eligible for federal relief, may slow or stop cultivation.

Peterson expects the extent of the epidemic’s impacts to vary from state to state. He noted that some states allow cannabis delivery and telehealth appointments for medical patient registration. “Ease of access will influence demand,” Peterson said. “Consumers concerned about virus exposure may not want to risk a trip to the dispensary or doctor’s office,” he noted. Earlier this year, AEG CEO Patrick L. Anderson wrote about the impacts of state policy on cannabis consumption in his award-winning paper, “Blue smoke and seers.”

Another concern for the cannabis market is the impact of a downturn in tourism-reliant markets. In Illinois, where out-of-state consumers regularly account for one-quarter of recreational sales, out-of-state sales decreased by 15% in April. If stay at home orders remain in place and consumers choose not to travel, states like Illinois, Colorado, and Nevada could lose out on a large portion of sales.

This analysis was prepared by Anderson Economic Group economists Brian Peterson and Andrew Miller in Chicago. For more, see Anderson Economic Group’s AndCan Index and COVID-19 press releases.

####

About Brian Peterson

Mr. Peterson is a consultant and director of public policy and economic analysis with Anderson Economic Group. His work focuses on economic and fiscal impact modeling, actuarial analysis, and environmental economics. Prior to joining AEG, Mr. Peterson worked as a policy analyst in regional economic development and transportation planning in the Chicago region.

About Andrew Miller

Mr. Miller is a senior analyst in the public policy and economic analysis practice area at Anderson Economic Group. His work focuses on economic and fiscal impact analysis and has included projects on housing policy, state economic indicators, and infrastructure funding. Prior to joining AEG, Mr. Miller worked as a project coordinator at the Council for Adult and Experiential Learning, where he worked to advance higher education and workforce development opportunities for military veterans through policy advocacy and program development.

About Anderson Economic Group

Anderson Economic Group, LLC, is a US-based research and consulting firm that specializes in economics, public policy, commercial damages, market analysis, and tax and regulatory policy. The firm, founded in 1996, is one of the most recognized boutique consulting firms in the US. AEG serves both public and private organizations including governments, corporations, nonprofit organizations, trade associations, and small businesses. For more information, see AndersonEconomicGroup.com.

Contact: Brian Peterson (bpeterson@nullandersoneconomicgroup.com) or Andrew Miller (amiller@nullandersoneconomicgroup.com)

© 2020, Anderson Economic Group, LLC

This analysis may be reproduced in its entirety, with proper attribution. See notes and disclaimers.