Proficiency Testing Is Vital for Public Confidence, Political Acceptance

Consumer Safety and Quality Standards Emerge as a Critical Factor in Cannabis Industry Growth

February 9, 2021

What to Do About Water? Getting the Cannabis Industry Out in Front for Wise Usage

February 22, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

As the U.S. legal cannabis market continues to mature, the establishment and adoption of standards and practices are becoming increasingly vital to better facilitate manufacturing, measurement, communication, and commerce. Particularly amid disruptions and reverberations from the COVID-19 pandemic, a premium is being placed on proficiency testing for cannabis. Demand for quality and transparency in legal markets will only increase as legalization spreads nationwide — and as legitimate products will be able to prove, differentiate, and eventually best leverage themselves to potential business partners, customers, and international markets alike on the demonstrated strengths of their testing.

Establishing nationwide standards from a patchwork of state programs is not unique. As the beverage alcohol industry discovered after the repeal of Prohibition nearly nine decades ago, among the fundamental responsibilities in producing and marketing a product for interstate distribution to new markets is dealing with the federal Alcohol and Tobacco Tax and Trade Bureau and each of the 50 respective state governments.

Unfortunately, bad actors exist in the unregulated cannabis testing space, providing false reports whether by choice or in lacking the competency to generate accurate results. While not rampant, some unscrupulous retailers advertise results without ever testing the material. There is also a problem of cultivators’ and product manufacturers’ lab-shopping to simply rubber-stamp their questionable goods tainted by substandard additives or disguised shortcuts.

Accordingly, understanding the current testing environment, addressing gaps and challenges, and anticipating future opportunities have become imminently important to make better investment, operative, and regulatory decisions in support of a healthy, transparent, and effective legal cannabis industry in the U.S. and abroad. Pending federal reform, the U.S. legal cannabis industry has no federal regulatory body to guide it, but with some form of legalization (i.e., medicinal or adult-use) already in play among more than 40 states, cannabis has been establishing itself as a major consumer packaged goods investment allocation. As consumers look to be reassured about their product choices, accreditation bodies have attempted to codify customers’ requirements as regulations are becoming increasingly stringent. The convergence of such market forces and political sensitivities are creating an immediate need for correspondingly more sensitive proficiency testing.

Toward that end, New Frontier Data and our partners from Emerald Scientific have rolled out Cannabis Proficiency Testing: The New Industry Imperative for Quality and Consumer Safety. The study analyzes quality and safety testing across the cannabis industry, concluding that proficiency testing — as the bulwark for compliance and quality assurance in the legal cannabis industry — will represent a top priority and major share of the global cannabis testing service industry as the legal market is projected to surpass $41 billion by 2025.

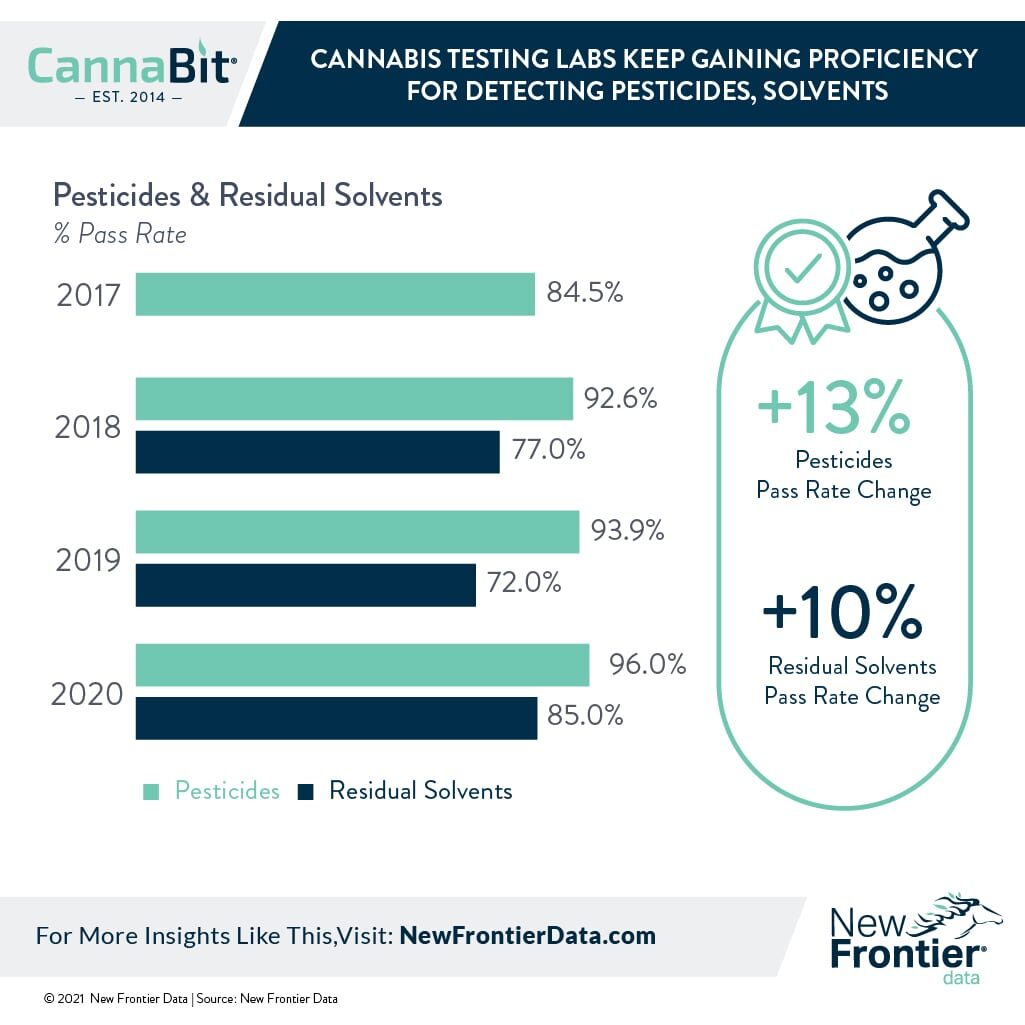

Beyond compliance obligations, cannabis brands and product manufacturers place premiums on testing because their consumers increasingly and deeply care about quality metrics. In surveys, cannabis users specifically cite “testing results” and “what ingredients are in my cannabis” as top influences when making THC and CBD purchasing decisions. Assuaging consumer safety concerns with verified test results makes strategic sense for many consumer brands. The prioritization of consumer safety tests for pesticides, mold, salmonella, and E. coli — alongside traditional potency tests like THC and cannabinoid content — has forced labs to employ more sophisticated means of analysis and record-keeping. As seen among other industries’ testing facilities, cannabis labs are implementing standard operating procedures (SOPs) and best practices to pass muster with regulators and consumers.

Pending federal reform, the U.S. legal cannabis industry for now lacks a centralized regulatory body to guide it, but with some form (i.e., medicinal or adult-use) of legalization already in play among more than 40 states, cannabis has establishing itself as a major consumer packaged goods investment allocation. And consumers want to feel good about it. Thus, as accreditation bodies have (if in sometimes haphazard fashion) codified their requirements, sensitivities have become increasingly stringent, creating a need for correspondingly more sensitive proficiency testing. As the market matures, standards and practices will likewise become more demanding to best facilitate manufacturing, measurement, communication, and commerce for its trusting and demanding consumers.

There are approximately 250 licensed laboratories operating in the U.S. to fulfill state testing requirements regulating high-THC cannabis supply. Testing for potency and contaminants is essentially important for hemp cultivators and CBD producers navigating dynamic legalities, and it affords manufacturers and retailers some opportunity to elevate their brands and credibility, particularly in terms of consumer safety. Testing is now common for residual solvents, molds, heavy metals, pesticides, terpenes and microbials. That various matrices including gummies, beverages, and hard candy are also available for testing speaks to the sophistication and capabilities of the science and analysis which have entered the cannabis industry.

Emerald Scientific’s proprietary Emerald Test™ is the cannabis industry’s most widely used ILC/PT. During last fall’s period for the Emerald Test, 123 cannabis and/or hemp testing facilities from 30 states and 9 countries were enrolled: The Fall 2020 Emerald Test™ comprising 25 PTs tested for 183 different analytes. The results illustrated how labs are performing with increased sophistication and accuracy, indicating that cannabis testing facilities are performing increasingly accurate work. More than 4,000 data fields were analyzed for the Fall 2020 test, which found a combined pass rate of 90%+.

Testing quality and consistency will continue to influence not only domestic production, but also international trade. Producers who can meet quality thresholds (e.g., European Union Good Manufacturing Practices) will have more options when it comes to exporting their products, and could accordingly garner competitive advantages as the international cannabis market matures.

For more comprehensive discussion about proficiency testing and its advantages to stakeholders, please visit the report’s webpage.