Proposed Federal Cannabis Tax Model Could Create Significant Disruptions, Drive Higher Costs for the Industry

Proposed U.S. Legislation Raises Urgent Questions on Federal Cannabis Regulation

August 26, 2021

Social Equity and the Proposed Cannabis Administration and Opportunity Act

September 7, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

The discussion draft of the Cannabis Administration and Opportunity Act now before the U.S. Senate is the most comprehensive effort for reforming federal cannabis policy ever introduced by the majority party in Congress. The bill’s key provisions, which New Frontier Data explores in the newly released report, Up in Smoke? A Review of The Cannabis Administration and Opportunity Act, include descheduling cannabis by removing it from the Controlled Substances Act, permitting both interstate cannabis commerce and foreign cannabis imports, expunging the criminal records of low-level cannabis offenders, and stimulating cannabis business opportunities among those communities most impacted by the historically inequitable enforcement of cannabis prohibition.

Notably, by descheduling cannabis, plant-touching businesses would no longer be exposed to U.S. Code § 280E, the tax provision which prevents cannabis businesses from deducting many of their standard operating expenses due to the plant’s federal illegality. 280E has resulted in the collective legal cannabis industry paying significantly higher taxes than other businesses in the economy. On aggregate, plant-touching businesses are paying approximately 60% in taxes compared to the standard business tax rate of 21%.

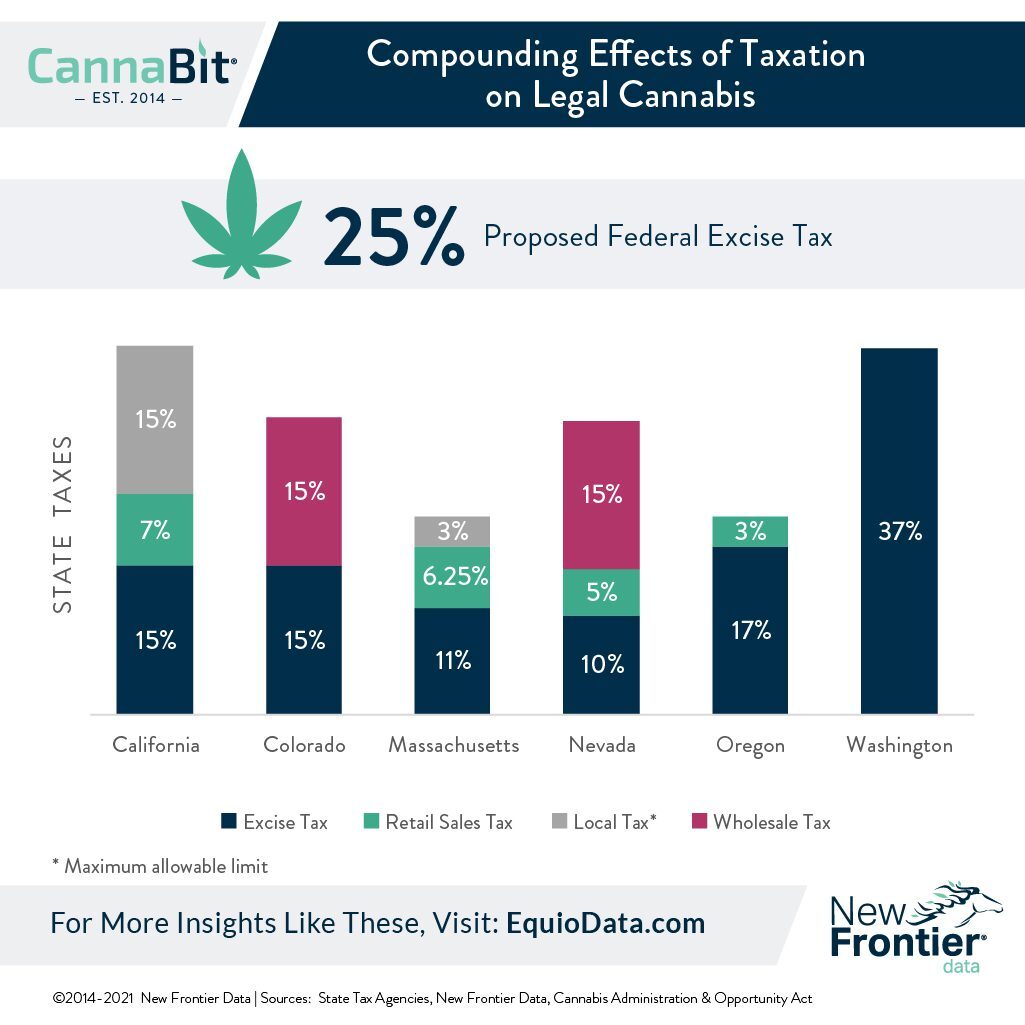

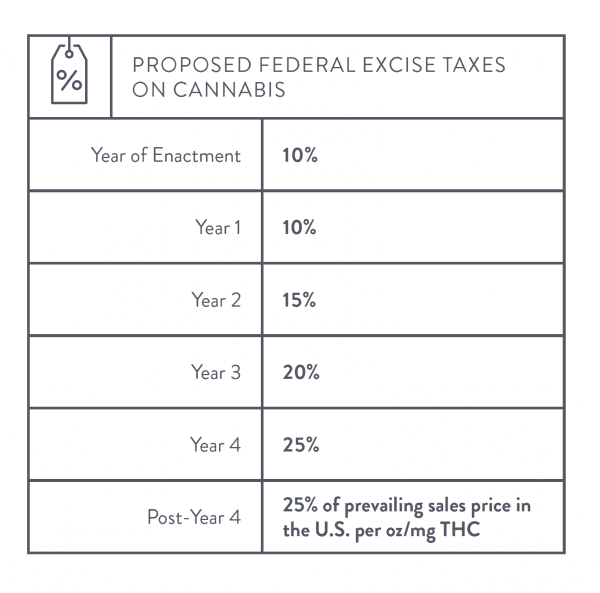

While the industry has long called for the elimination of 280E, the creation of a 25% wholesale excise tax, atop the 21% standard business tax means that both operators and consumers are unlikely to see much tax relief if the bill as proposed passes. The wholesale tax would apply to transactions between producers and processors, and producers and retailers.

Some key issues raised by the proposed tax structure include:

- The wholesale excise tax places an even higher financial burden on the industry than the current 280E model. Our analysis found that — assuming that cannabis was fully available nationally — the industry would incur a higher tax burden under the CAOA than it would under 280E by the fourth year of post-enactment (i.e., when the excise tax reaches 20%). With the compounding of 280E and high state and local taxes already acting as drags on industry growth, saddling the industry with an even greater tax burden as proposed in the CAOA would negatively impact small businesses, impede investment and innovation, and further perpetuate the illicit market, thereby undermining key objectives for federal legalization.

- The federal wholesale tax does not account for the vertically integrated nature of many companies in the industry. By requiring companies to treat the movement of goods through their operations as arms-length transactions the tax negates a key cost efficiency advantage of vertical integration. It also creates an opportunity for gaming of the system by incentivizing vertically integrated companies to reduce their tax exposure by lowering the value of the taxable goods transferred within their organization.

- For non-flower products, the tax rate would be set based on quantity sold or milligram of THC, with the rates based on prevailing price of cannabis sold in the US in the prior year.Using the prior year’s average market rate creates two issues:

- As economies of scale and market efficiencies drive down wholesale prices, taxes will be asymmetrical to the actual wholesale prices in the market. In Colorado, for example, wholesale prices are currently down 35% since the adult-use market launched in 2014, and fell by 61% between the highest and lowest average market rate over that period.

- Lower-priced products will pay higher taxes than higher-priced products. As such, lower-cost producers will carry a greater tax burden relative to the value of their goods than will higher-priced products.

- Under the proposed law, businesses with less than $20 million in sales would be eligible for a 50% tax credit, and “producers with more than $20 million in sales would be eligible for a tax credit on their first $20 million of cannabis sold annually, with sales above that amount subject to tax at the full rate.” Structuring this concession as a tax credit means that businesses will still be required to pay the full tax amount until the credit is issued, (which could be up a year after the taxes are filed). This means that small businesses will still end up carrying the significant expense of the excise tax until their credit is received, leaving them with less operating capital and putting them at a significant disadvantage against large and more financially liquid companies.

- Wholesale taxes in a multi-stage supply chain are far more onerous to calculate than retail tax rates paid at the final point of sale. In an industry already burdened by significant governance costs, the proposed tax structure will introduce an even greater compliance burden whose toll will be greatest on small businesses.

It is likely that the additional costs introduced by the proposed tax structure will be passed on to consumers via higher retail prices. That would reduce the cost-competitiveness of the legal market against the illicit market, especially in those states with the highest state and local taxes, thereby perpetuating the entrenchment of the illicit market.

The proposed tax structure in the CAOA, while modeled on the alcohol industry, fails to account for differences in the structure of the cannabis industry as it exists today. Concerns about disruptions that such a tax structure would impose upon the industry are a key point of concern for industry stakeholders, serving as one of several rallying points for opposition to the currently proposed legislation.