Rhode Island’s Pending Legal Cannabis Program Expects to Gain Profitability by Next Summer

New York Senate Advances Bill to Provide Insurance Coverage for Medical Cannabis

June 3, 2022

Cannabis Conference Abuzz with Anticipation for New York’s Adult-Use Market

June 7, 2022The buzz:

After passing legislation late last month, Rhode Island’s got new expectations for revenues from its forthcoming legal adult-use market: By beginning sales on December 1, the state expects to pass its break-even mark next summer.

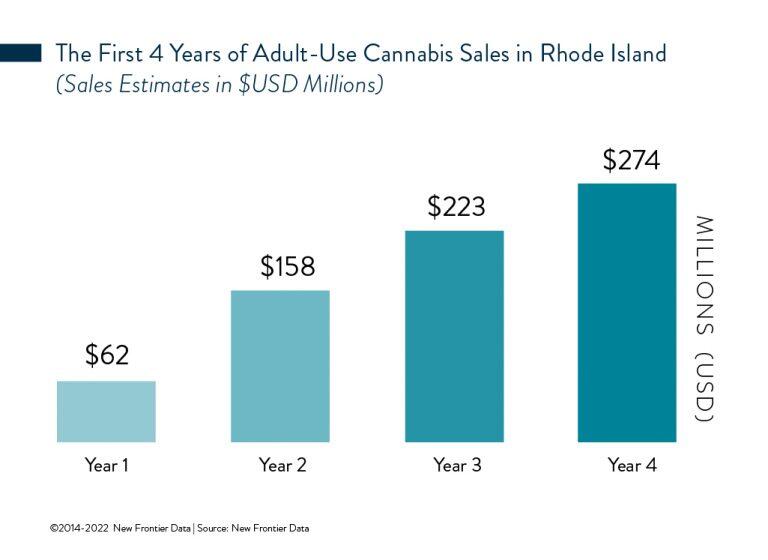

Before Rhode Island legally adopted its recreational program late last month, New Frontier Data had it on our short list of states likely to legalize adult-use cannabis before 2025. Though the timing came faster than predicted, the state’s own expected sales and tax revenue dollars are roughly in line with NFD’s previous projections for Rhode Island’s adult-use market.

Rhode Island’s State Department of Administration estimates about $41 million in sales through the first seven months of legalization. Projections previously released by New Frontier Data estimate $62 million in sales over the first 12 months of sales, breaking down to $37 million expected in the first seven months as compared to the state’s estimate.

The takeaway:

When all is said and done, the state expects its adult-use market to pass the break-even point and become profitable by the end of Q2-2023, gaining nearly $2.9 million in sales tax revenue before July 1, 2023. Participating jurisdictions are expected to receive another $1.2 million in revenue from a 3% local tax.

“Our market projections for adult-use sales incorporate an internal model for tourism spending, which is heavily reliant upon the timing and location of the new market activation,” explains Kacey Morrissey, New Frontier Data’s Senior Director of Industry Analytics. “Historical sales and tax data collected by NFD provide the supporting evidence to show that states which choose to legalize adult-use sales while bordering an illicit (or medical-only) cannabis state experience much higher rates of tourism spending than do those states that share their border with other legal adult-use markets. With legal adult-use cannabis already being sold in both of Rhode Island’s bordering neighbors (Massachusetts and Connecticut), tourism spending (usually a catalyst for revenue growth for legalized adult-use sales in geographic regions of complete prohibition) will likely be comparatively muted in Rhode Island.”