Securities Law Basics: Partners and Investors

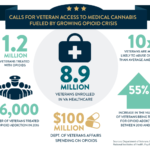

Calls for Veteran Access to Medical Cannabis Fueled by Growing Opioid Crisis

July 30, 2017

Achieving Business Diversity Differently: The Cannabis Industry Case Study

August 13, 2017By Dennis Brovarone and Peter Stavropoulos

Except for the rare circumstances of an extremely multi-talented individual with personal wealth, nearly every new business is a combination of actively involved people and passive investors.

While “general partner” has a specific legal meaning of being all-in with respect to the business liabilities, “partner” is also often a synonym for “founder,” “officer,” “director,” “manager,” etc. Those titles represent individuals and, sometimes, legal entities conducting, if not controlling, business affairs while sometimes also providing initial capital for an ownership interest. Conversely, an “investor” provides capital for a “security,” an investment contract (if in various forms) with an expectation of profit from the enterprise solely from the efforts of others, i.e., the officers, directors, and managers. Securities include shares, LLC interests and promissory notes. An investor is passive and does not participate in management of the business.

The distinction is critical because while business entities such as a corporation or limited liability company shield officers, directors, and managers from the ordinary debts of the business, those same officers, directors, and managers can be personally liable to an investor for what is disclosed and what is not disclosed to the investor.

State and federal law and regulations control the offer and sale of securities in arcane detail — what is being offered by whom, to whom, and where, etc. Various nuances can range greatly on a case-by-case basis, but for the purposes of this article we simply include some broad, basic guidance about offering and selling investment or entering into a securities agreement.

Get it in Writing. Any purchase of securities should be documented in an agreement. The agreement should not only state the terms of the investment, but should include representations from the investor about their investment experience, acknowledgement of risk, and description of their financial ability to bear such risk. The purchase agreement should also describe what disclosures have been provided, and affirmatively state that only identified disclosures are those to be relied upon.

Good Disclosure is Good Protection. Specific disclosure requirements exist for registered public offerings and Regulation D offerings that are most relevant to sophisticated offers to multiple (often institutional) investors, in different jurisdictions, and using broker-dealers to conduct the offering. Such disclosure and investment documentation can run into tens of thousands of dollars. Start-ups are most often offering the investment to a small number of previously known potential investors. At the very least, a disclosure package or memorandum should include the following:

The Type of Entity, with copies of the LLC Operating Agreement or Articles of Incorporation and Bylaws.

A Business Plan describing how the business is operating or intends to operate and how the business is generating or intends to generate revenue.

The Management and Principal Ownership, their business experience and any related party transactions.

The Current and Projected Financial Condition as every business should have financial statements, even if generated by off-the-shelf accounting software. Such pro forma financial statements should have sufficiently detailed assumptions stated, so that the readers can judge for themselves.

Good Professionals & Finding Investors: Competent legal counsel can assist with disclosure documents and subscription agreements and qualified accountants can help with preparing proper financial statement. However, no matter how good the presentation, the most difficult part of an offering is finding potential investors to take a look. Most entrepreneurs first go to “family and friends,” people who personally know, or know someone else who personally knows the entrepreneur.

Beyond F&F investors are venture capital firms who invest their own funds, and broker-dealers who act as sales agents. The good ones always have more deals to consider than they can handle, so getting noticed is a huge challenge. Reputable broker-dealers are licensed by the Securities and Exchange Commission and are members of FINRA (the Financial Industry Regulatory Authority). Both have online tools for due diligence on members.

Companies need to be very careful when dealing with unlicensed consultants or investment bankers who claim to have access to investors. Often, they will charge upfront fees, or take a sizeable equity position for services that never materialize. Due diligence is critical; if such consultants claim a track record of success, it should be independently verified. If engaged for business, there should be a written agreement prepared or reviewed by competent legal counsel.

Equity vs. Debt: When a business is first being formed, investment is being made into systems, plant, equipment and people. This investment can be capital-intensive. The business owner or manager can raise capital in one of two basic ways: They can raise equity, or they can raise debt (or a combination of the two). When a business owner raises equity, they simply sell a percentage of equity in the company to a third party. Usually the company will issue shares to a third party, effectively diluting the ownership interest of the original owners. For example, if the owner (Mr. O) owns 1,000 shares at $100/share in company X Inc., and he wants the company to sell 1,000 shares at $100/share to the investor (Mr. I), then Mr. O will own only half the shares of the company after the transaction. The company will have raised $100,000 as a result. If Mr. O eventually owns less than 50% of the shares, then he will not have effective control of the company.

If Mr. O wants to raise $100,000 but he doesn’t want to issue any shares, he could have the company borrow $100,000 from Mr. I in the form of a loan, comprising a note. Now, Mr. I would probably want some security attached to his money, so he would want a security interest in an asset of the company, such as the plant or equipment. Such would be a secured financing.

There are alternatives that are combinations of debt and equity; one is called convertible debt, and another is called preferred equity. Convertible debt is debt that converts into equity at a predetermined price. Preferred equity is like equity, but it only gets a preferred return from profits left over after all operating expenses, but is paid and calculated before the regular equity owners are paid.

Conclusion: Raising capital through investors can be a long and difficult process. Careful preparation and due diligence increase the odds of completing an offering, and (if the offering is successful) provides the best legal protection possible if the investment doesn’t work out as first envisioned.

Be on the lookout for more original New Frontier Data analysis of critical Cannabis Daily In Sight stories, soon available exclusively via our Equio free online portal!

Not yet an Equio user? All the essential, real-time cannabis intel you need at your fingertips! FREE SIGN-UP HERE

Dennis Brovarone, Senior Attorney

Dennis Brovarone is a Senior Attorney for Hoban Law Group. Peter Stavropoulos is Counsel for Hoban Law Group.

Founder and managing partner Robert Hoban of Hoban Law Group serves as an advisor to New Frontier Data.